Ah, the price of Bitcoin! A riveting tale of dramatic highs and lows, akin to a Shakespearean tragedy but with a touch of sparkle! Over the past week, our dear cryptocurrency has danced around the $90,000 mark, only to trip and fall to $86,000, much like a debutante at her first ball. One can hardly look away! 🎉

But alas, the prognosis is not so bright, my friends. It seems our beloved Bitcoin is donning the somber attire of a bear market-a fate no one saw coming, or perhaps everyone did, but let’s not dwell on such trivialities!

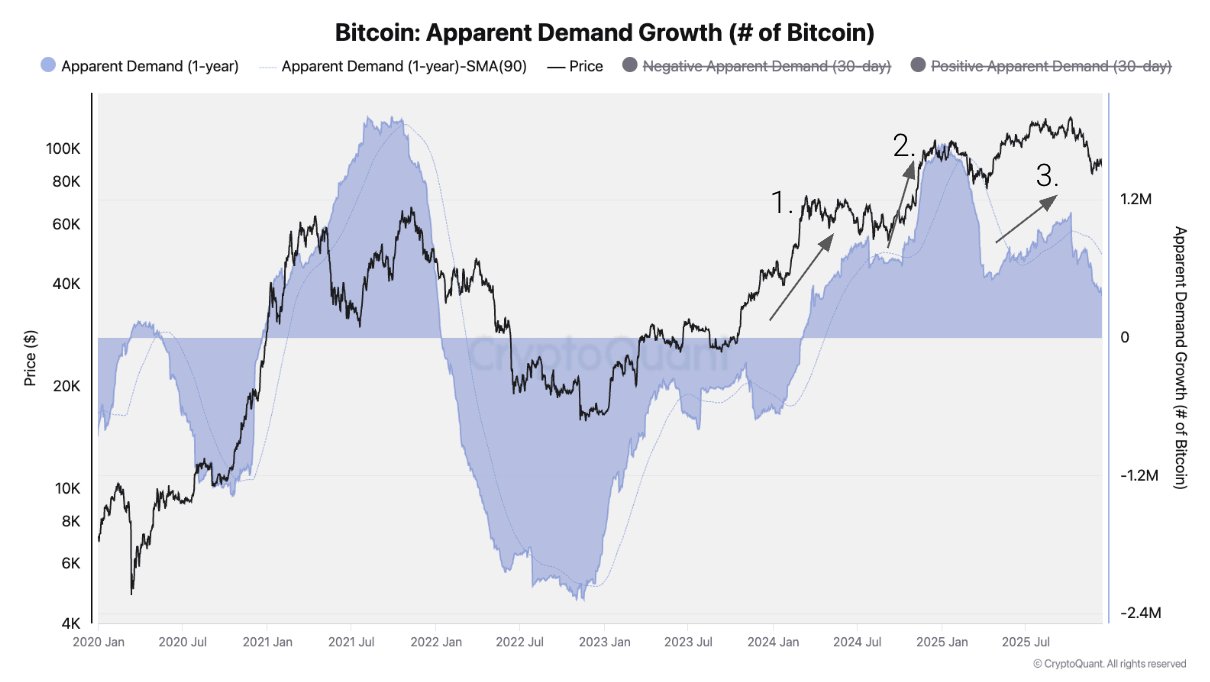

Bitcoin’s Cyclical Antics: Demand Dwindles, Drama Ensues!

According to the ever-so-astute analysts at CryptoQuant, the plummeting Bitcoin price can be attributed to a rather embarrassing decline in demand. Yes, dear readers, it appears that 2025 has not been kind to our golden child-demand growth has slowed to a snail’s pace, ushering in this bear market. 🐢

CryptoQuant has noted three grand waves of spot demand that have graced us since the exhilarating bull cycle kicked off in 2023-thanks to the US spot ETF launch, a presidential election outcome that had all of us on the edge of our seats, and the Bitcoin Treasury Companies bubble, which burst rather spectacularly. However, just as the curtains were about to rise again, demand came crashing down in early October, coinciding with what can only be described as the market’s version of a bloodbath. 💔

As if scripted by the finest playwrights, the demand from institutional investors has taken a nosedive, while US Bitcoin ETFs have turned into net sellers. Such drama! In Q4 2025, these ETFs shed a staggering 24,000 BTC, a far cry from the bustling accumulation we witnessed in the previous year. “Oh dear, what a turn of events!” one might exclaim. 🤭

Now, let’s not forget the derivatives market, which has also decided to take a little nap, showing less activity and a reduced appetite for risk-which, let’s be honest, sounds terribly dull. CryptoQuant informs us that funding rates have plummeted to levels not seen since December 2023. Traders are seemingly less inclined to maintain their long positions, a classic sign that rumblings of a bear market are upon us.

In the grand finale, CryptoQuant declares that the fate of Bitcoin does not rest solely on its halving event but rather on the ebbs and flows of demand. When the demand peaks and then falls, a bear market is inevitable-much like a well-rehearsed encore that fails to materialize. 🎭

What Lies Ahead for Our Bitcoin Star?

As per CryptoQuant’s wisdom, the Bitcoin price structure is, regretfully, on a downward spiral. It now finds itself languishing below its 365-day moving average-historically a crucial support level that delineates bullish from bearish phases. Oh, how the mighty have fallen!

However, fear not! The downside reference points suggest that while we may be entering a bear market, it may not be as dreadful as it sounds. Historically, the realized price of around $56,000 has emerged as a potential bottom, indicating a mere 55% correction from the latest all-time high-a charmingly modest drawdown for such a diva. Meanwhile, it finds some solace around the intermediate support level of $70,000.

As I pen these thoughts, Bitcoin graces us at approximately $88,170, showcasing a delightful 3% jump in the last 24 hours-what a rollercoaster! 🎢

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Witch Evolution best decks guide

2025-12-21 04:19