Bitcoin and ether ETFs flexed their financial muscles Tuesday, gobbling up $330 million in inflows while Solana and XRP joined the party like it was a mandatory team-building exercise. The U.S. crypto ETF market turned greener than a basil plant in a sauna.

The crypto ETF crowd had a full-blown midlife crisis Tuesday, Dec. 9, ditching Monday’s timid vibes for a raucous parade of green. It was the kind of market mood swing only a Wall Street broker could love: bullish, brash, and blessedly unapologetic.

Bitcoin ETFs roared back like a DeLorean on a caffeine binge, churning up $151.74 million. Fidelity’s FBTC led the charge with $198.85 million-because who needs restraint when you’re chasing digital gold? Grayscale’s Bitcoin Mini Trust added $33.79 million, and GBTC and BITB followed with enough cash to make a Scrooge McDuck jealous. Franklin’s EZBC ($8.09M), Invesco’s BTCO ($6.50M), and Ark & 21Shares’ ARKB ($5.26M) chimed in, while Blackrock’s IBIT coughed up $135.44 million. But hey, someone’s gotta balance the books, right? Total assets hit $122.10 billion, because why not?

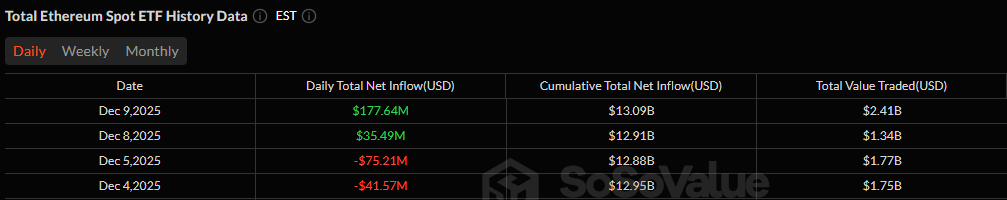

Ether ETFs outdid themselves with $177.64 million, because Ethereum clearly needed more attention. Fidelity’s FETH ($51.47M), Grayscale’s Ether Mini Trust ($45.19M), and Blackrock’s ETHA ($35.29M) threw confetti into the market. Bitwise’s ETHW ($17.91M), Vaneck’s ETHV ($14.64M), and ETHE ($11.47M) followed, while TETH added $1.66M. Trading volumes hit $2.41 billion, because why let a good crypto rally go unnoticed?

Solana ETFs tagged along with $16.54 million, including Bitwise’s BSOL ($7.78M), Grayscale’s GSOL ($5.84M), and Fidelity’s FSOL ($2.47M). Vaneck’s VSOL rounded out the group with $456,990. Assets climbed to $950.40 million, proving even a sleepy altcoin can have a moment.

XRP ETFs closed the show with $8.73 million, led by Canary’s XRPC ($6.08M), Bitwise’s XRP ($1.42M), and Grayscale’s GXRP ($1.23M). Trading hit $28.63 million, because who doesn’t love a good XRP comeback story?

Tuesday’s crypto ETF party was the rarest of beasts: everyone got invited, and no one left thirsty. Markets danced like it was the 1990s again, fueled by volume, assets, and investors who’d finally stopped Googling “what is blockchain?”

FAQ 🚀

- What triggered Tuesday’s crypto ETF explosion?

A market rebound so fierce, it made Wall Street brokers forget their own names. Investors flocked to Bitcoin, Solana, and XRP like they were discount coupons. - Which ETF category won the popularity contest?

Ether ETFs took the crown with $177 million, because Ethereum’s still the life of the crypto party. - How did Bitcoin ETFs perform?

Bitcoin products pulled in $151 million, despite IBIT’s $135 million outflow. Because balance is overrated. - Did every crypto ETF smile at the end of the day?

Yes. BTC, ETH, SOL, and XRP all turned green. The only red? Investors’ flushed faces from the win.

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-12-10 18:18