One hears such pronouncements these days… a Mr. Eric Jackson, a man of finance, it seems, has boldly declared that this ‘Bitcoin,’ a thing spoken of in hushed tones and frantic trading floors, shall, by the year of our Lord 2041, reach the astonishing sum of fifty million dollars per unit. A dizzying prospect, wouldn’t you agree? 🙄

Mr. Jackson, in conversation with a certain Mr. Rosen, a scribe of financial matters, draws a parallel – a rather audacious one, if I may say – to a company named Carvana, which, having plummeted from a respectable four hundred dollars to a paltry three and a half, experienced a… shall we say, revival. He recalls the cynical pronouncements echoing around the market: “run by criminals,” “idiots at the helm” – the usual vitriol, naturally. As if such things were uncommon in the world of commerce.

Ah, but Mr. Jackson understood something crucial: human folly. “When in the throes of despair,” he observed, “one sees only the immediate gloom.” The platform itself, he insists, was not broken; its users, in fact, professed their contentment. “Easy,” they said. “The best experience.” A curious phenomenon, isn’t it? People wanting what is convenient. It quite restores one’s faith in human nature… a little. He envisioned profitability, a mending of debts, the familiar dance of recovery. 🎭

The Vision, So to Speak

He now applies this same, long-sighted gaze upon this ‘Bitcoin’, which-despite its fluctuating price and the passionate arguments surrounding it-possesses, he contends, a hidden potential. One gets weary of hearing about the price, of course. It is the preoccupation of those lacking deeper understanding. Some proclaim it a mere scheme, others inflate its value with fantastical projections. A tiresome spectacle.

He begins with the notion of ‘digital gold’, a rather simplistic analogy. If gold holds such allure for nations and their coffers, could not ‘Bitcoin’ become its successor? A logical enough proposition, particularly considering the younger generation’s preference for the digital world and disinterest in “a hunk of rock,” as he so eloquently puts it. But this, he insists, is merely the first layer. For ‘Bitcoin’ has not yet achieved the ubiquity of, say, that rather famous pizza purchase of 2011. 🍕

The revelation, he declares, came when he began to contemplate ‘Bitcoin’ as the foundation of global finance, the very underpinnings of sovereign borrowing. Historically, this role fell to gold, then to the Eurodollar system. Now? A tangled web of sovereign debt. “All the countries borrow against this debt,” he explains, with a touch of world-weariness, “to conduct their affairs.” But, of course, there are… complications.

By 2041, in this “Vision” of his, ‘Bitcoin’ will supplant the Eurodollar, becoming the neutral asset upon which all financial structures rest. Superior, naturally, because it is digital, apolitical, and free from the whims of “whoever the latest treasury secretary happens to be.” A rather pointed remark, wouldn’t you say? It is not, he assures us, an attack on the established order, merely… an evolution. 🧐

“There’s some underlying thing that countries and financial systems borrow against.” – a comment as cryptic as it is assured.

Eric Jackson (@ericjackson) expects bitcoin to hit $50 million by 2041.

He compares his thesis to how he knew Carvana, $CVNA, would be a 100-bagger stock pick.

– Phil Rosen (@philrosenn) December 7, 2025

Looking fifteen years hence, he envisions nations abandoning debt in favor of ‘Bitcoin’, a prospect he deems “logical.” The scale of sovereign debt is “enormous,” he notes, and if ‘Bitcoin’ becomes the dominant foundation, its price must inevitably soar. Hence, the fifty million dollar prediction. Highly speculative, of course; but then, are not all matters of finance?

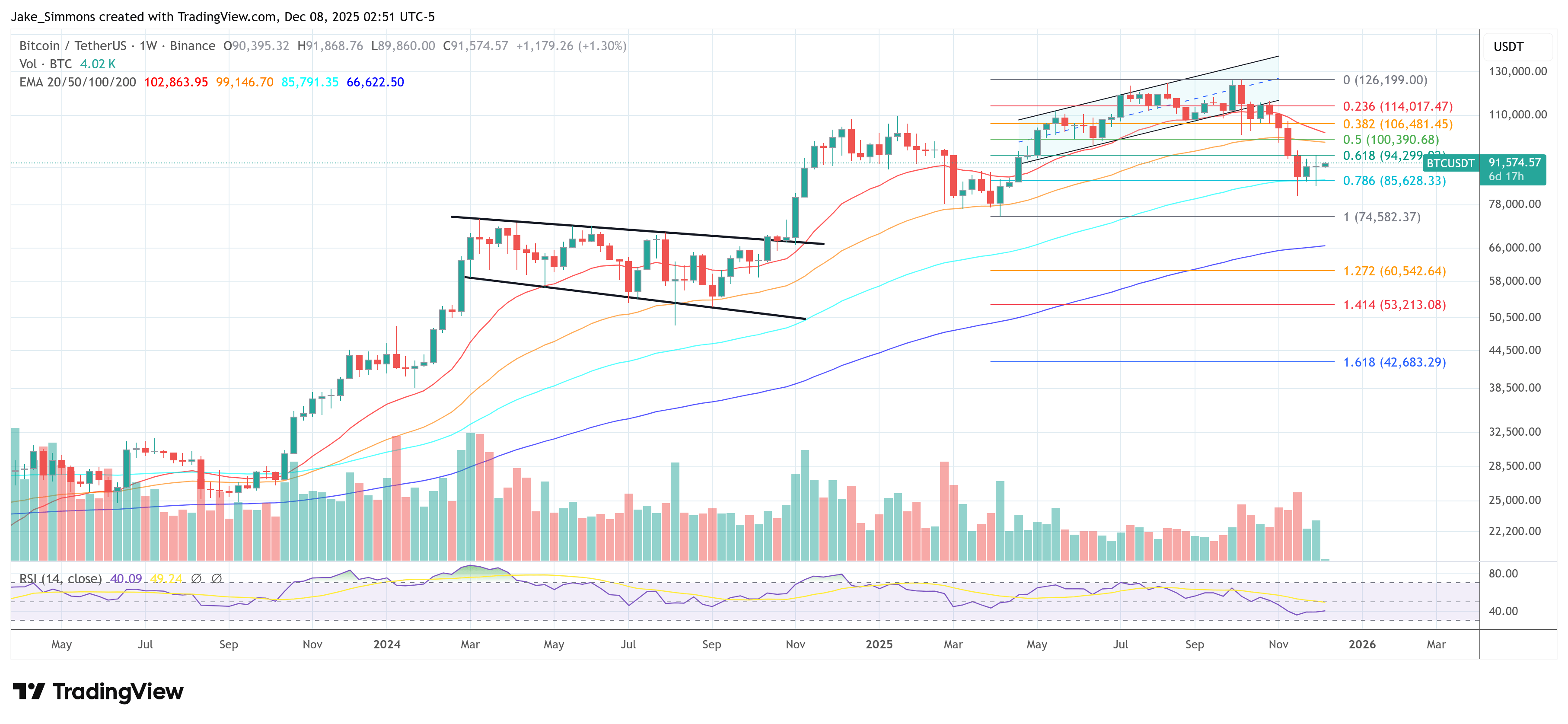

At the moment of this writing, ‘Bitcoin’ trades at ninety-one thousand, five hundred and seventy-four dollars. A sum which, to a humble observer such as myself, seems quite substantial enough.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Ireland, Spain and more countries withdraw from Eurovision Song Contest 2026

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

- Best Arena 9 Decks in Clast Royale

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- ‘The Abandons’ tries to mine new ground, but treads old western territory instead

2025-12-08 11:13