Ah, Bitcoin – the digital gold rush with the charm of a caffeinated squirrel on a rollercoaster. Today, it suddenly decided to jump more than 7%, just to remind everyone that it’s still alive and probably plotting its next unexpected stunt. It swaggered back above the $93,000 mark, as if it had just remembered it’s supposed to be valuable, especially with the Federal Reserve whispering sweet nothings about upcoming decisions next week. Meanwhile, gold is chilling above $4,200, doing its best to look unaffected, which is quite impressive considering it’s basically a chunk of shiny rock with a stubborn streak.

Speculation is running wild that Kevin Hassett, the adviser with about as much charisma as a slightly eccentric uncle, may be the next Fed Chair. This has markets whispering sweet dovish nothings, as if they’re hopeful for a gentle nudge rather than a slap in the face from economic policy.

Investors Are Holding Their Breath (and Their Coffee) for December

The spotlight brightly shines on the FOMC meeting scheduled for December 10, a two-day affair where policymakers sit around contemplating whether to raise, cut, or invent a new kind of interest rate. Expect lots of acronyms, and possibly, a hint of quantitative easing-because what’s more exciting than printing money like a Monopoly game gone rogue? Even the tiniest whisper of changing the rate or easing policy could send Bitcoin soaring higher or making it do a nervous dance, much like a cat discovering a cucumber.

Economic Data to Watch Before the Magic Happens

Before the big reveal, traders are obsessively monitoring two reports: Friday’s PCE inflation data (the Fed’s favorite measure of whether your coffee is too expensive) and Tuesday’s JOLTs job openings (because who doesn’t want to know how many more people are desperately looking for jobs?).

- Inflation: Apparently still above the Fed’s ideal 2%, which is a polite way of saying prices are creeping up faster than a gossip in a small town.

- Jobs: Strong numbers suggest the US economy is doing its best impersonation of a bouncing ball, unbothered by all the talk of recession or mild discomfort.

- Liquidity: The markets are adjusting to the end of quantitative tightening, which means there’s more money floating around than a boat party in the Caribbean.

What the Day of Reckoning Will Likely Bring

At 2:00 PM ET on December 10, the Fed will probably send out a press release-probably with a lot of jargon and a wink or two. Then, Jerome Powell (that’s the guy with a hairstyle that looks like it’s experimented with many different policies) will take the mic at 2:30 PM ET. His tone-cautious, optimistic, or secretly plotting to buy more yacht accessories-could sharply influence Bitcoin’s next stunt.

The odds, according to CME FedWatch, favor a 87% chance of a 25 basis point rate cut, dropping the target range to a pleasantly relaxing 3.50%-3.75%. Basically, the Fed is teasing us with the idea of turning the dial down a notch, like lowering the TV volume just enough to annoy your neighbors.

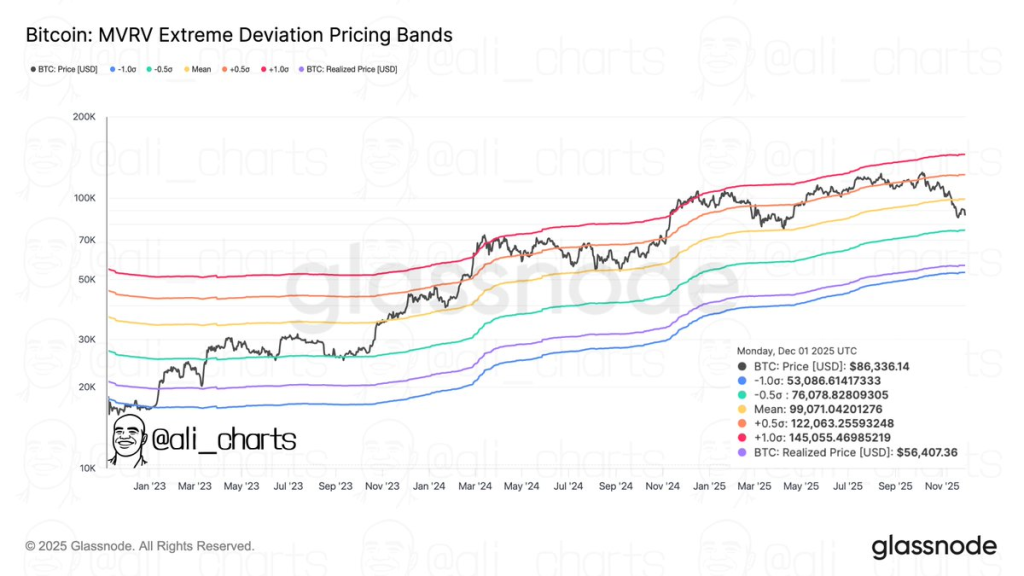

Ali Martinez, the on-chain analyst with a penchant for numbers and resistance levels, says Bitcoin needs to crack two major barriers: the big $99,070 and the even bigger $122,060. Think of these as the digital equivalent of gym trainers yelling, ‘Push harder!’

- $99,070 – the first hurdle, like the digital version of “Don’t stop now!”

- $122,060 – the summit, possibly where Bitcoin drinks champagne and yells, “We did it, Mum!”

Meanwhile, the ever-optimistic crypto trader Posty suggests Bitcoin might finally be over its ‘lower highs and lower lows’ drama, having formed a somewhat hopeful higher low around $84,000. The next step? Closing daily above roughly $94,000, a threshold that, if crossed, might just propel us toward the $100,000 mark, or at least give us a good story to tell at parties.

But-and this is important, so listen closely-he warns caution. This isn’t a guaranteed victory lap, and the bigger market remains an insistent, somewhat cranky, giant that still needs to be convinced that everything’s fine.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- December 18 Will Be A Devastating Day For Stephen Amell Arrow Fans

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Mobile Legends X SpongeBob Collab Skins: All MLBB skins, prices and availability

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- Mobile Legends December 2025 Leaks: Upcoming new skins, heroes, events and more

- Esports World Cup invests $20 million into global esports ecosystem

- BLEACH: Soul Resonance: The Complete Combat System Guide and Tips

2025-12-03 16:38