Markets

What to know:

- Tether’s stability is under scrutiny as market participants debate its asset backing and liquidity.

- Concerns focus on Tether’s limited cash reserves and its ability to handle large-scale redemptions.

- Bitcoin and Ether face pressure amid rate-hike signals from the Bank of Japan, affecting crypto markets.

Good Morning, Asia. Here’s what’s making news in the markets:

Well, well, well, look who’s back in the limelight: Tether. The world’s largest stablecoin is getting the attention it loves. And the question is: Is it really as solid as its balance sheet would have us believe?

This debate, however, is as old as time itself. Tether truthers, mostly those with a distaste for crypto, would spin elaborate conspiracy theories about the health of USDT, claiming it’s all just a house of cards ready to collapse. “Bitcoin’s going to zero, folks! And it’s all because Tether is on the brink of disaster!” they’d say.

But here’s the twist-this time, the debate is coming from actual market participants, not just the typical conspiracy-theorist crowd. Real traders, real analysts. It’s getting serious, folks.

The divide here isn’t over whether Tether is a scam, but more about how on Earth we’re supposed to assess its stability. It’s a battle of wits!

Take Arthur Hayes, the BitMEX founder. He’s got a lot to say about Tether’s exposure to Bitcoin and gold, arguing that if those assets dip, Tether’s so-called “safety net” could come apart faster than a cheap sweater in a washing machine.

But wait! Hold your horses-Joseph Ayoub, former Citi crypto research lead, isn’t buying it. He claims Hayes is working with half the story. According to Ayoub, Tether’s disclosed reserves don’t even touch the full extent of its corporate balance sheet.

Ayoub paints a picture of a much stronger Tether, one that’s not just holding cash but also equity, mining operations, corporate reserves, and one of the largest cash-generating Treasury portfolios in the world. In short, Tether’s not just playing Monopoly-it’s playing the stock market with some serious capital.

Now, here’s where things get fun-Tether’s biggest problem isn’t solvency; it’s the speed of redemption. The crypto world moves faster than a cheetah on roller skates, and Tether’s reserves aren’t exactly quick on their feet. They hold very little cash and rely on limited banking rails. So, if a massive run on Tether happens, the whole thing could be in for a bit of a bumpy ride.

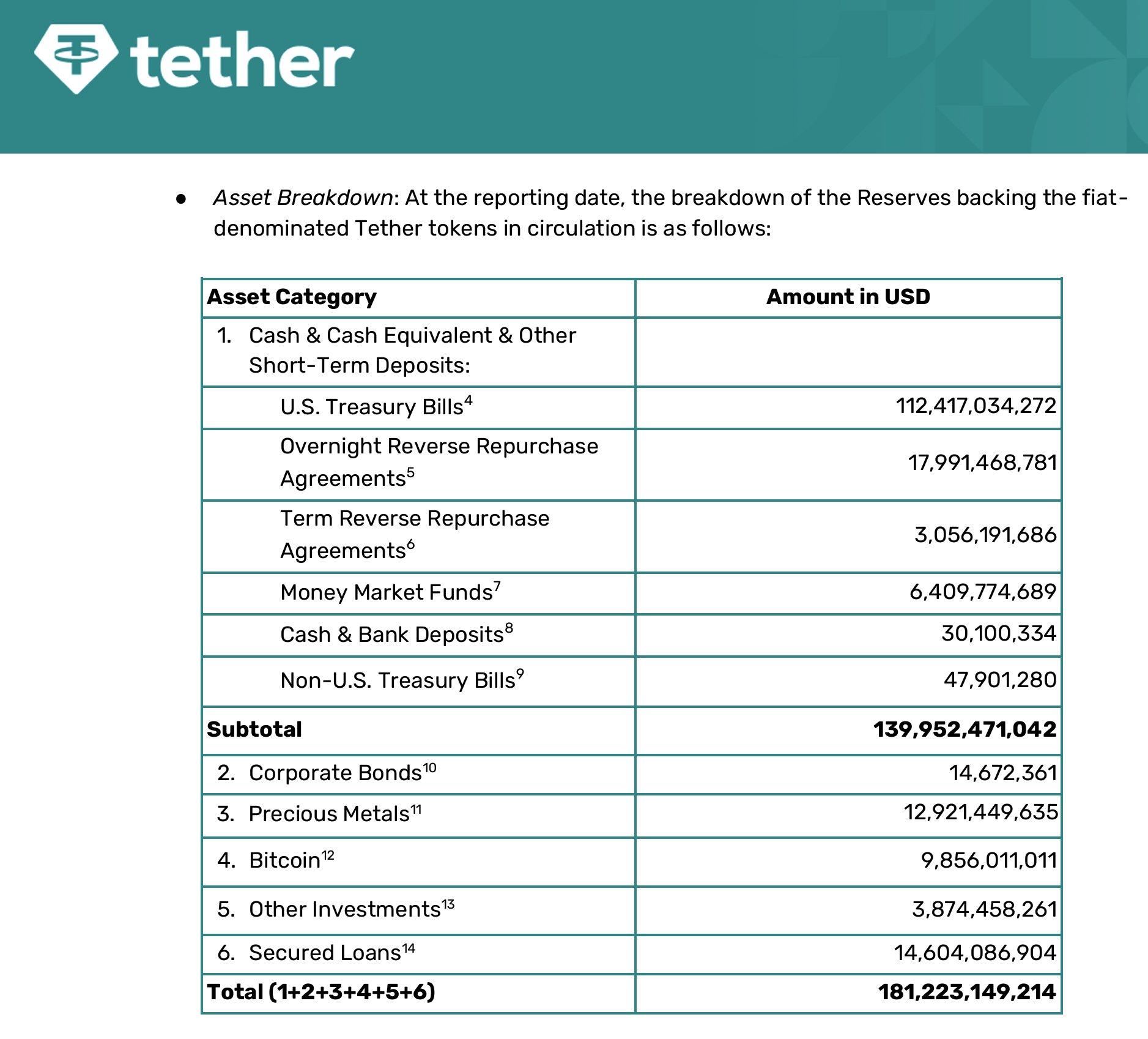

Most of Tether’s reserves are in short-dated Treasuries, reverse repos, money market funds, gold, and, you guessed it, Bitcoin. These assets are valuable, sure, but they’re not liquid gold. It takes time to cash out, and when markets are in turmoil, that time shrinks faster than your New Year’s resolution to go to the gym.

As long as redemptions are low, everything runs like a well-oiled machine. USDT has managed to stay stable, mainly because people are more likely to trade it within crypto exchanges rather than convert it back into fiat. But what if the tide changes? What if something big shakes up the market? A regulatory bombshell or a shock in Asia could trigger a mass exodus that puts Tether’s liquidity to the ultimate test.

And don’t forget 2022-the year Tether made history by processing over two billion dollars in redemptions in just one day. And you know what? It didn’t even break a sweat. In fact, Tether made sure all its customers got their money at par, proving that it could handle some serious outflows. But here’s the thing-it was a one-day event. What happens if the market goes rogue for longer?

Tether is so confident, it’s practically laughing in the face of criticism. “Oh, please,” they say. “You guys are missing the big picture!”

But here’s the thing: this year’s debate is actually worth paying attention to. Finally, we’re moving past the noise and the wild conspiracy theories. The discussions are coming from the very people who rely on Tether every day-traders, analysts, and builders who are taking a cold, hard look at its strengths and weaknesses.

Gone are the days of doomsday predictions. This debate is all about balance sheets, liquidity, and the plumbing of the market. And as USDT grows more central to Asia’s trading flows, it’s exactly the kind of scrutiny the market needs. It’s about time, folks.

Market Movement

BTC: Bitcoin is trading around $86,436, after taking a little dip toward $84,000 during the U.S. session. Why? Well, rate-hike signals from the Bank of Japan are putting some pressure on those risky assets. Go figure!

ETH: Ether is hanging around $2,794, still under a heavy cloud of selling pressure, especially after treasury-linked ETH plays slid over 10% in Monday’s crypto-stock sell-off. Ouch!

Gold: Gold opened at $4,218.50, briefly flirting with $4,300, then rose as investors started pulling back from the crypto and stock markets, while the odds of a Fed rate cut next week skyrocketed to an 87.6% chance. No one’s putting all their eggs in one basket, that’s for sure.

Nikkei 225: Japan’s Nikkei 225 rose by 0.54%, with financials, energy, and basic materials leading the charge. Industrial names like Fanuc and NGK Insulators were soaring, despite JGB yields hitting multi-decade highs. Some things just can’t be stopped, it seems!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

2025-12-02 06:05