Behold, the cryptocurrency, now trading at a mere $90,700, which is but a whisper in the grand scheme of things! 🧐💸 Buyers, those valiant knights, defend crucial levels, while on-chain and technical metrics whisper of a potential plunge to $45,880. 🧙♂️📉

This analysis, a veritable labyrinth of CryptoQuant’s on-chain data, Fibonacci retracements, and Elliott Wave structures, offers a data-driven perspective-though crypto markets, as ever, are a dance of uncertainties. 🌀🎭

Is Bitcoin Eyeing a Potential Bottom Near $45,880?

On-chain metrics, that most enigmatic of indicators, suggest Bitcoin might yet find its way to $45,880. The CVDD metric, a curious creature that compares coin value against blockchain “age,” has historically aligned with cycle bottoms: $3,200 in 2018 and $16,000 in 2022. 🐷📊

Crypto analyst Ali, a man of profound on-chain wisdom, remarks, “The CVDD alignment with past lows is a historically validated framework-though it’s probabilistic, not a divine decree.” 🧠✨

The November 2025 decline, a mere 17% drop from $110,000 to $91,000, is but a trifling matter in the grand tapestry of market volatility. 📉🐴 Traders, beware: deeper corrections may test the $70,000-$45,880 range. 🧍♂️📉

Bitcoin Holds Key $90K Support Amid Q4 Volatility

Despite the downturn, Bitcoin, that fickle lover, has found short-term support between $90,300 and $90,500-the bottom of a rising price channel. Investors, those valiant defenders, are not in panic but in calculated defiance. 🧑🤝🧑📈

Technical observations reveal small-bodied candles with long lower wicks, a sign of accumulation, not a chaotic sell-off. Trading volumes, meanwhile, have moderated, signaling a consolidation phase. 🧗♀️🔄

Cointelegraph analysts warn: this zone is crucial for a rebound. Short-term resistance levels loom at $91,200, $93,400, and $95,000. A failure to hold support could send BTC tumbling to $88,000 or $82,000. 🐍📉

Fibonacci Levels Define the Next Major Move

Fibonacci retracement levels, those trusty Russian nesting dolls of technical analysis, provide context for potential trend reversals. Bitcoin’s price now hovers near the 38.2% level at $98,100. 🧸🌀

The 61.8% retracement near $108,900 is the next target for trend continuation, while the upper end of the reload zone around $116,527 is a high-probability reaction area. Failure to reclaim these levels? A recipe for renewed downside pressure. 🍃📉

Wave Structure and Mid-Term Projection

Using Elliott Wave analysis, Bitcoin appears to be in Wave 4 of an impulse cycle, with corrective movements likely testing the $80,000-$69,000 zone. Wave 4, that sly trickster, typically retraces 23.6%-38.2% of Wave 3. 🌀👻

If Wave 4 holds, Wave 5 could propel BTC higher, with projections clustering between $147,000 and $213,000. But heed this: these forecasts are conditional, like a Russian matryoshka-open one and another awaits. 🧸💰

Q4 Performance and Market Context

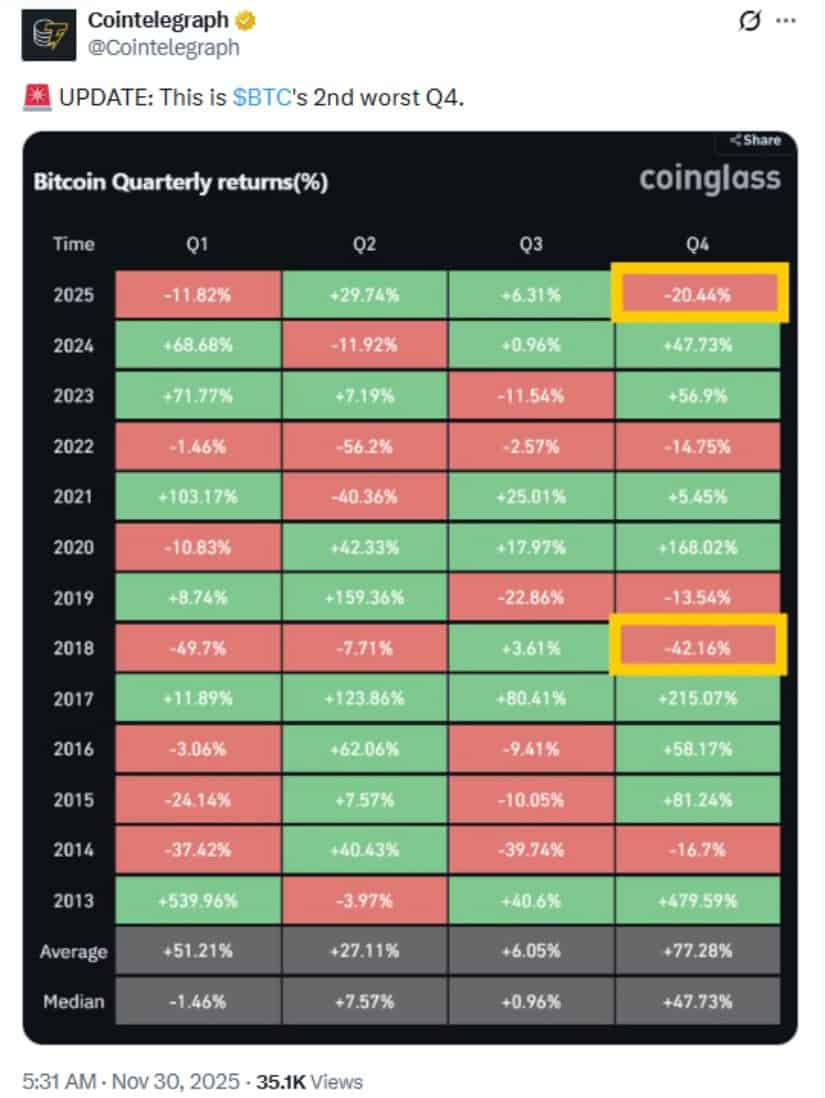

Bitcoin’s Q4 2025 performance has been historically weak, with returns around -20.44%, ranking as the second-worst quarterly result after Q4 2018’s -42.16%. 📉🦄 This downturn coincided with forced liquidations exceeding $1 billion, a technical “death cross,” and Fed hawkishness. 🐐📉

While historical patterns hint at recovery, continued whale activity and macroeconomic uncertainty demand caution. 🧠🌀

Looking Ahead: Neutral Stance Amid Technical Signals

Bitcoin’s current consolidation phase is a tale of two possibilities: short-term support near $90,000 holds, while deeper corrections toward $45,880 remain plausible. 🧭💸 The next decisive move depends on reclaiming key Fibonacci levels and confirming Wave 5 momentum. 🧙♂️🌀

Traders and investors should monitor:

Technical confirmations (e.g., breaks above $108,900 and $116,527) 🧾

Liquidity conditions across spot and derivatives markets 🧩

Macro factors, including Fed policy and ETF flows 🐐📈

With these factors converging, BTC remains at a pivotal juncture, where on-chain metrics, historical cycles, and price structure will shape its trajectory. A dance of data-driven decisions, indeed. 🎭📊

Read More

- Clash Royale Best Boss Bandit Champion decks

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- December 18 Will Be A Devastating Day For Stephen Amell Arrow Fans

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Mobile Legends X SpongeBob Collab Skins: All MLBB skins, prices and availability

- Mobile Legends December 2025 Leaks: Upcoming new skins, heroes, events and more

- Esports World Cup invests $20 million into global esports ecosystem

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- BLEACH: Soul Resonance: The Complete Combat System Guide and Tips

2025-11-30 23:04