Ah, Bitcoin, that fickle darling of the digital realm, has once again risen from the ashes of its own melodrama, breaching a resistance level as though it were merely a trifling social engagement. Yet, the institutions, those dour guardians of the financial establishment, persist in their selling spree, as if the very soul of cryptocurrency were on clearance. How utterly banal. 🤑

- After a series of days as dreary as a Victorian novel, Bitcoin has rebounded with all the grace of a dandy escaping a dull party. 🎩

- The Coinbase Premium Index, that dour sentinel of market sentiment, remains as negative as a critic at a comedy show, signaling that US institutions are selling with the fervor of a spurned lover. 💔

- Spot ETF outflows, those pesky harbingers of doom, continue to play the role of the villain in this financial tragicomedy, driving institutional selling with relentless predictability. 🎭

The Coinbase Premium Index, that tiresome metric comparing Bitcoin’s price on Coinbase with Binance, lingers in negative territory, according to the ever-watchful Darkfost. It reveals, with all the subtlety of a sledgehammer, that institutional players and US-based investors are selling more aggressively than retail traders. Coinbase, the darling of institutions, versus Binance, the playground of the plebeian retail trader-how delightfully predictable. 🧐

The sell-side pressure, a tiresome monologue in this endless drama, has been attributed to the relentless outflows from spot ETFs. How tedious it all becomes, like a dinner party with no wit and too much wine. 🍷

Since November 21, when the Coinbase Premium Index took a nosedive into negativity, professional investors have been offloading Bitcoin with the zeal of a Puritan casting out sin. Yet, the depth of this negativity has softened, like a villain realizing their heart is not entirely made of stone. Progress, however glacial, is progress. ❄️

While the index remains negative, the trend, like a poorly written redemption arc, shows improvement. How quaint. 🌱

A fleeting respite or the dawn of a new era?

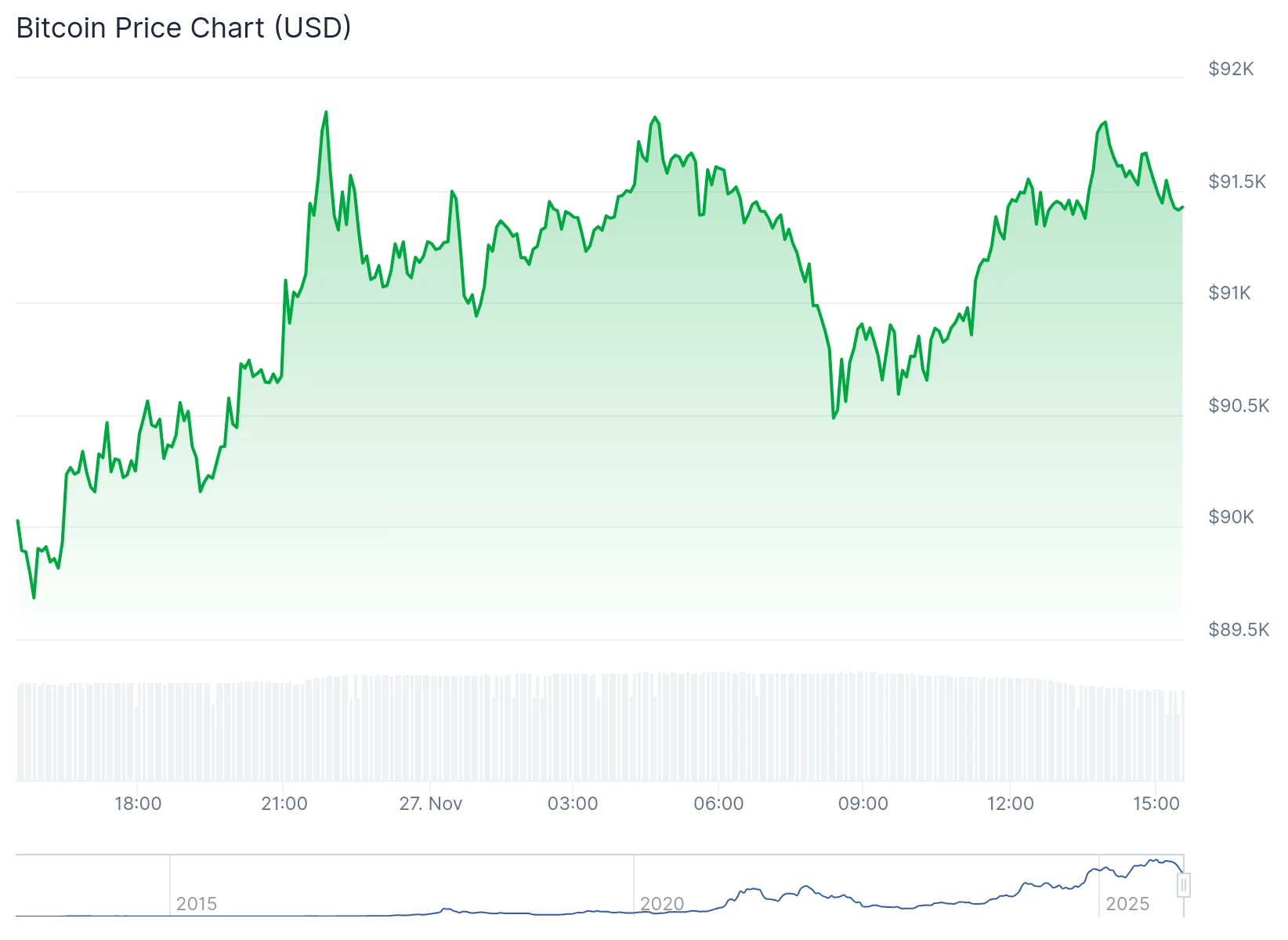

Bitcoin, that tempestuous muse, has bounced from the 200-day moving average on the three-day chart, a level as historically significant as a forgotten anniversary. The cryptocurrency, ever the dramatist, pushed back toward a nearby resistance area, as though it had a score to settle. 🗡️

Currently, Bitcoin trades below both the 50-day and 100-day moving averages, which have turned downward with all the enthusiasm of a funeral procession. Volume during the sell-off exceeded that of the bounce, suggesting sellers were more committed than buyers-a tale as old as time itself. ⏳

From its October all-time high, Bitcoin experienced a correction as sharp as a wit’s retort. Market participants, those eternal optimists and pessimists, continue to debate whether this bounce is a mere interlude or the prologue to a grand recovery. Only time, that implacable judge, will tell. ⌛

Read More

- Clash Royale Best Boss Bandit Champion decks

- Chuck Mangione, Grammy-winning jazz superstar and composer, dies at 84

- December 18 Will Be A Devastating Day For Stephen Amell Arrow Fans

- Clash Royale Furnace Evolution best decks guide

- Now That The Bear Season 4 Is Out, I’m Flashing Back To Sitcom Icons David Alan Grier And Wendi McLendon-Covey Debating Whether It’s Really A Comedy

- Clash Royale Witch Evolution best decks guide

- Riot Games announces End of Year Charity Voting campaign

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

- All Soulframe Founder tiers and rewards

- BLEACH: Soul Resonance Character Tier List

2025-11-28 01:29