Oh, the noble Bitcoin, that fickle darling of financiers, has lately become quite the tempest. Its price, which was once as stable as the Queen’s favorite tea service, now dances wildly, much to the amusement-and dismay-of those who dare to wager on it. Market observers, with their magnifying glasses and cautious whispers, declare that the game of options is once again pulling the strings behind the curtain. Two months of turbulence have transformed the once predictable routine into a spectacle fit for Bedlam.

The Numbers That Make Traders Fret

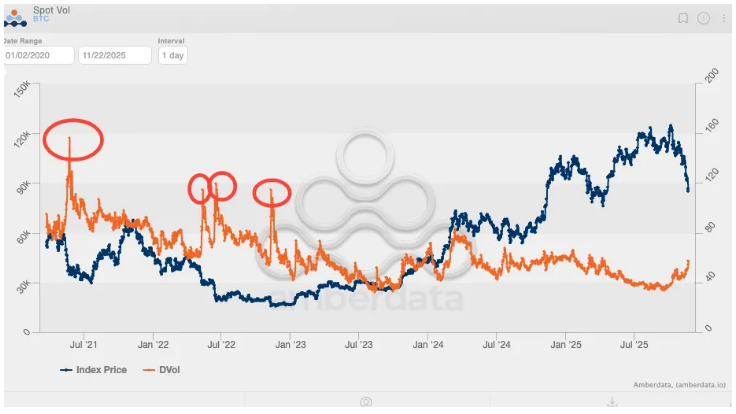

According to the venerable Mr. Jeff Park, implied volatility, which had long been kept below the modest threshold of 80%, is now creeping intriguingly close to 60%. Such a rise, you see, is not merely a number but a signal-a clarion call that the options market might be amplifying the bounces of our dear crypto. Think back to January of 2021, when a dash of derivatives enthusiasm propelled Bitcoin to a staggering $69,000. Truly, when traders ride the derivatives carriage, the ride becomes anything but dull, with outsized trends ready to sweep all before them.

Price Descends and Positions Are Cleared-Oh My!

Just recently, Bitcoin took a plunge below the $85,000 mark-an event that sent trembling liquidations through the market’s veins. Some losses, it appears, are the unfortunate consequence of highly leveraged positions being forcibly closed-poor souls-while others are the longer-term holders, with their profit-taking habits, doing their part in this fiscal ballet. The analysts at Bitfinex, with a pinch of wit, describe this upheaval as “tactical rebalancing”-which sounds less alarming than “chaotic chaos,” but remains equally entertaining. Meanwhile, Binance’s CEO Richard Teng suggests that this volatility is hardly unique-just another day in the life of asset markets!

Derivatives, Shocks, and Whimsical Flickers

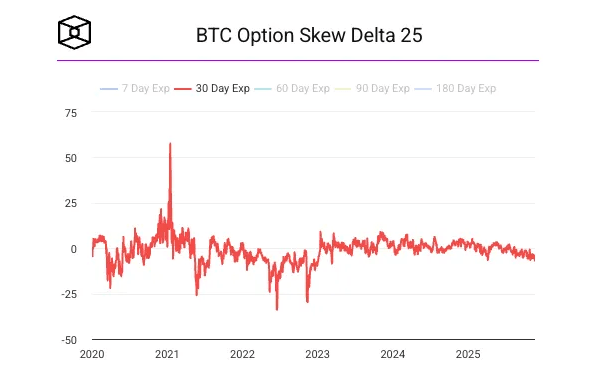

Traders, always the thrill-seekers, know well that options can sharpen the market’s every move. When contracts grow large-think of them as magnetized to the spot market-hedging becomes a frantic dance, pushing prices up or down with startling speed. Remember 2021? A heated surge driven by derivatives-like a grand Venetian masque-may be peering back from the shadows once again, for implied volatility is quietly ascending. Sentinels of the surface observe minor signs of option-driven mischief, even if the current chaos isn’t quite the hurricane of yesteryears.

Meanwhile, as if the market were not already in enough of a tizzy, the CME FedWatch tool reveals a tantalizing 71% probability of a 25-basis point rate cut come December-a veritable rollercoaster from the previous modest 30-40%. Words from New York’s very own Mr. John Williams suggest policy might pivot towards the neutral, leaving both sides of the debate clutching their teacups. Should a rate cut materialize, risk assets may dazzle anew; if not, expect volatility to dance on, much to everyone’s chagrin or delight.

In the coming weeks, traders will be as watchful as a cat in an alley, seeking clues whether December will bring sweet relief or another storm. Until macro strokes and options whispers align, expect the market to bob and weave-some will sit tight, others will chase the thrill of every tick, trading amidst the chaos with more flair than propriety.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-11-25 00:06