After a week of relentless despair, the ETF market finally exhaled, as if waking from a nightmare. Bitcoin, Ether, and Solana ETFs closed Friday in the green, a welcome shift in sentiment, which, in the grand scheme of things, is as reliable as a Russian winter.

ETF Market Finds Relief as 🐴BTC, 🧠ETH, 🚀SOL Deliver an All Green Day

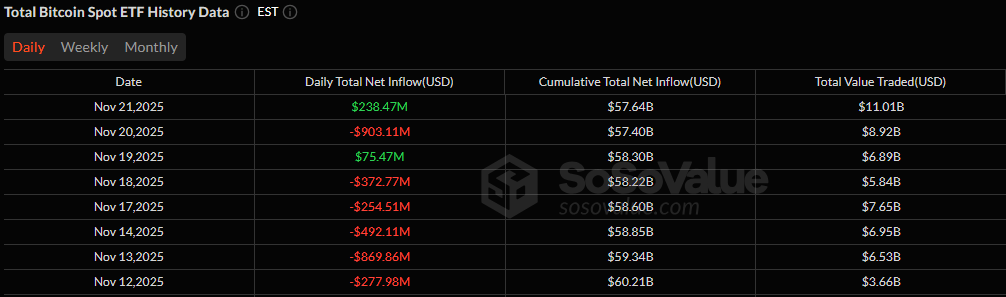

It felt like the kind of market day investors had been waiting for, quietly hopeful, unexpectedly strong, and refreshingly green across the board. After a series of record-setting exits, the crypto ETF market staged a meaningful rebound to close out the week on Friday, Nov. 21. A miracle, perhaps? Or just a temporary reprieve from the abyss.

Bitcoin ETFs led the revival, posting $238.47 million in net inflows, a stark contrast to the punishing outflows earlier in the week. Fidelity’s FBTC drove the turnaround with a $108.02 million entry, while Grayscale’s 🐴Bitcoin Mini Trust added $84.93 million, and Grayscale’s GBTC contributed another $61.53 million. A triumph of greed over fear, or just a fleeting flicker of hope?

A wave of secondary inflows helped reinforce the positive shift, with ARKB at $39.06 million, BTCO at $35.80 million, BITB at $22.83 million, and HODL at $8.31 million. The lone drag came from Blackrock’s IBIT, which saw a $122.01 million outflow, but it wasn’t nearly enough to overshadow the broader momentum. 🚀Bitcoin ETF trading volume surged to $11.02 billion, with net assets ending at $110.11 billion. A feast, if only for a moment.

Ether ETFs also enjoyed a rare break from their extended losing streak, closing with $55.71 million in net inflows. Fidelity’s FETH dominated the day, pulling in a robust $95.40 million, followed by a $7.73 million entry into Grayscale’s Ether Mini Trust and $6.26 million into Bitwise’s ETHW. A brief reprieve, or the dawn of a new era? 🌅

Read more: Bitcoin’s Brutal Flush Sets the Stage for a Violent Upside Rebound

Solana ETFs, now well into a multi-week streak of growth, recorded another $10.58 million in inflows. The day’s gains were led by 21Shares’ TSOL with $5.97 million, followed by Fidelity’s FSOL at $2.97 million, Grayscale’s GSOL at $1.39 million, and Canary’s SOLC with a smaller but steady $244.74K. A steady climb, or a mirage?

After days of heavy red, the market found its footing, and for once, all three major crypto ETF sectors moved in harmony. A fleeting harmony, perhaps, but a harmony nonetheless. 🎶

FAQ 🧠

- What transpired in the ETF market on Friday?

🐴Bitcoin, 🧠Solana ETFs, in a rare moment of unity, recorded net inflows, marking a full-market return to green after a week of historic outflows. A triumph, if only for a fleeting moment. - Which ETF category led the recovery?

🐴Bitcoin ETFs posted the strongest rebound with $238 million in inflows, driven mainly by Fidelity’s FBTC. A beacon of hope, or just a temporary distraction? - Did ether ETFs finally break their losing streak?

Yes, ether ETFs closed positive with $55 million in inflows despite a large outflow from Blackrock’s ETHA. A small victory, but a victory nonetheless. 🏆 How did 🧠Solana ETFs perform?

🧠Solana extended its multi-week growth streak with another $10 million in steady, broad-based inflows. A steady climb, or a fool’s errand?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-11-23 01:43