The debut on November 20 allows investors to gain exposure to XRP without directly holding the token, a feat akin to watching a ballet without the dancers-still, it’s a significant milestone in the cryptocurrency’s journey toward mainstream institutional adoption. 🎭📉

ETF Launch Marks a Key Milestone for XRP

XRP has officially entered a new phase in mainstream markets with the debut of the Bitwise Asset Management spot ETF (ticker: “XRP”) on the New York Stock Exchange (NYSE). The fund began trading on November 20, allowing investors to gain regulated, direct exposure to XRP without holding the token themselves. 🧠💸

Brad Garlinghouse, CEO of Ripple Labs, highlighted the development on X: “The pre‑thanksgiving rush (shall we say, ‘turkey trot’!?) for XRP ETFs starts now… congrats @BitwiseInvest on today’s launch!” 🦃🎉

While this announcement reflects optimism within the XRP community, analysts note that market behavior in the coming days will be influenced by ETF mechanics, historical patterns, and broader crypto sentiment-though, let’s be honest, it’s mostly just a game of musical chairs with a side of speculation. 🎵🎲

What the Bitwise XRP ETF Means

The Bitwise ETF provides U.S. investors with regulated access to XRP through a spot vehicle. Unlike futures ETFs, spot ETFs hold the underlying asset, which can influence demand for XRP on exchanges. This structure can reduce barriers for institutional and retail investors seeking exposure without managing wallets, private keys, or custody concerns. 🛡️🔒

Bitwise charges a 0.34% management fee, waived for the first month on up to US $500 million in assets under management (AUM). Fee waivers can temporarily encourage early inflows, particularly from smaller investors evaluating cost efficiency relative to direct XRP purchases. 💸🧠

Matt Hougan, CIO at Bitwise, described XRP as an “intriguing asset” due to its longevity and extensive use case in cross-border payments and clarified its regulatory status following the SEC lawsuit settlement. Historically, spot ETF debuts for major crypto assets like Bitcoin and Ethereum has produced short-term trading volatility, followed by stabilization as market participants adjust to AUM flows. 📈📉

XRP Price Today-Market Sentiment and Technical Context

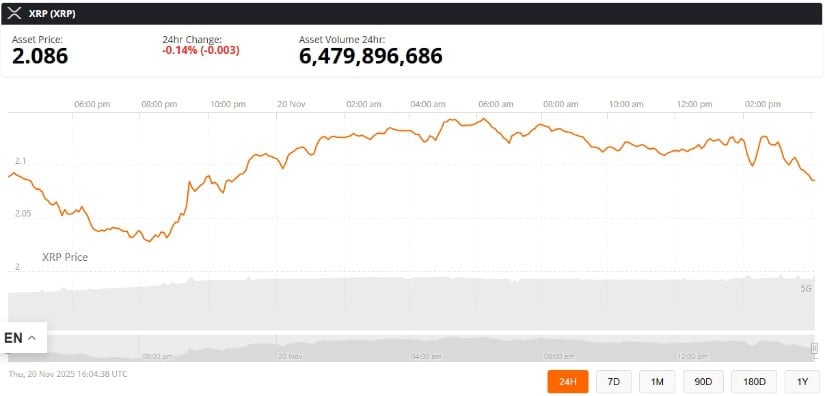

At the time of the ETF launch, XRP traded around US $2.08, down roughly 0.14% over 24 hours, with trading volume near US $6.48 billion. 📉💰

From a technical perspective, analysts monitor key support between US $2.02 and US $2.06. This range has historically served as a floor where buyers step in after corrections. Immediate resistance sits near US $2.17-US $2.18, coinciding with both the 0.236 Fibonacci retracement level and a descending trendline from recent lower highs. A daily close above this range could indicate renewed momentum, whereas rejection may prompt further consolidation. 🧮🌀

Unlike promotional coverage, this analysis emphasizes caution: early ETF flows can lag actual price impact due to market-maker activity and creation/redemption mechanics. Initial trading may reflect temporary arbitrage, not sustained buying pressure. 🧠🌀

Key Factors to Watch Going Forward

- Institutional Flows: Spot ETFs can channel substantial institutional capital into XRP, but flows are often staggered. Market depth and liquidity will determine how quickly price reacts. 🚀⚖️

- Regulatory Clarity: XRP benefits from resolved SEC litigation, which reduces legal uncertainty for institutional investors. This may enhance adoption but does not eliminate macro-level risks. 🧠⚖️

- Technical Levels and Market Structure: The support/resistance zones identified are contextually relevant for short-term price behavior. Support at US $2.02-$2.06 aligns with prior consolidation points, while US $2.17-$2.18 represents a ceiling reinforced by both Fibonacci levels and trendline resistance. 📊📉

- Ticker and Liquidity Considerations: The ETF shares the “XRP” ticker with the underlying token, potentially causing confusion among retail participants. Liquidity fragmentation between the ETF and spot market may temporarily affect price dynamics. 🔄🌀

- Historical Patterns: Previous crypto spot ETF launches have seen initial spikes followed by stabilization, as early inflows meet counterparty liquidity and market-maker hedging. 📈📉

Practical Implications for Investors

The Bitwise XRP ETF offers a regulated pathway for both retail and institutional investors to gain exposure to XRP. Investors should note:

- Retail Investors: May benefit from simplicity and reduced custody risk. Early inflows can be amplified by fee waivers but may also experience volatility due to ETF creation/redemption lags. 🧠💸

- Institutional Investors: Provide liquidity and can drive larger volume swings. Institutional buying may not immediately translate to upward price movement, as market makers hedge ETF exposure. 🧠🌀

- Risk Awareness: Price may consolidate if inflows are slower than expected, or if broader crypto market conditions remain bearish. ETF debut does not guarantee sustained rallies. 🚧📉

Why This Matters for the XRP Community

For over 13 years, XRP has been a key player in crypto, with its network facilitating fast, low-cost cross-border payments. The Bitwise ETF introduces a new audience of investors who previously could not access XRP in regulated channels. 🌍💸

Garlinghouse summarized the significance: “…with today’s launch of the Bitwise XRP ETF, we’re excited to help investors gain exposure to an asset that has the potential to fundamentally reshape how institutions move money and other assets worldwide.” 🌟💡

This statement reflects the potential impact, while the article balances expectation with practical insight. 🧠📊

Final Thoughts

The Bitwise XRP ETF launch represents both opportunity and caution. While it provides new access points for investors and could influence short-term demand, market behavior will depend on actual inflows, liquidity constraints, and macro crypto sentiment. 🧠📉

Investors should observe technical levels closely, consider historical ETF launch behavior, and differentiate between promotional enthusiasm and likely market reactions. XRP’s journey post-ETF will combine regulatory clarity, institutional participation, and market mechanics to determine whether the price sees a breakout or remains in consolidation. 🧠🌀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- M7 Pass Event Guide: All you need to know

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-11-21 00:42