My dear darlings, gather ’round as we sip our martinis and observe the utterly dramatic spectacle that is Bitcoin’s current state. The darling cryptocurrency is clinging to the $90K mark with all the grace of a socialite at a scandalous soiree. The market, you see, is in a frightful tizzy-some wailing it’s the dawn of a bear market, while others, ever the optimists, insist it’s merely a dramatic pause before the grand finale. Fear, macro pressures, and liquidity shifts are all vying for the spotlight, leaving us with a plot thicker than a Coward play. 🍸

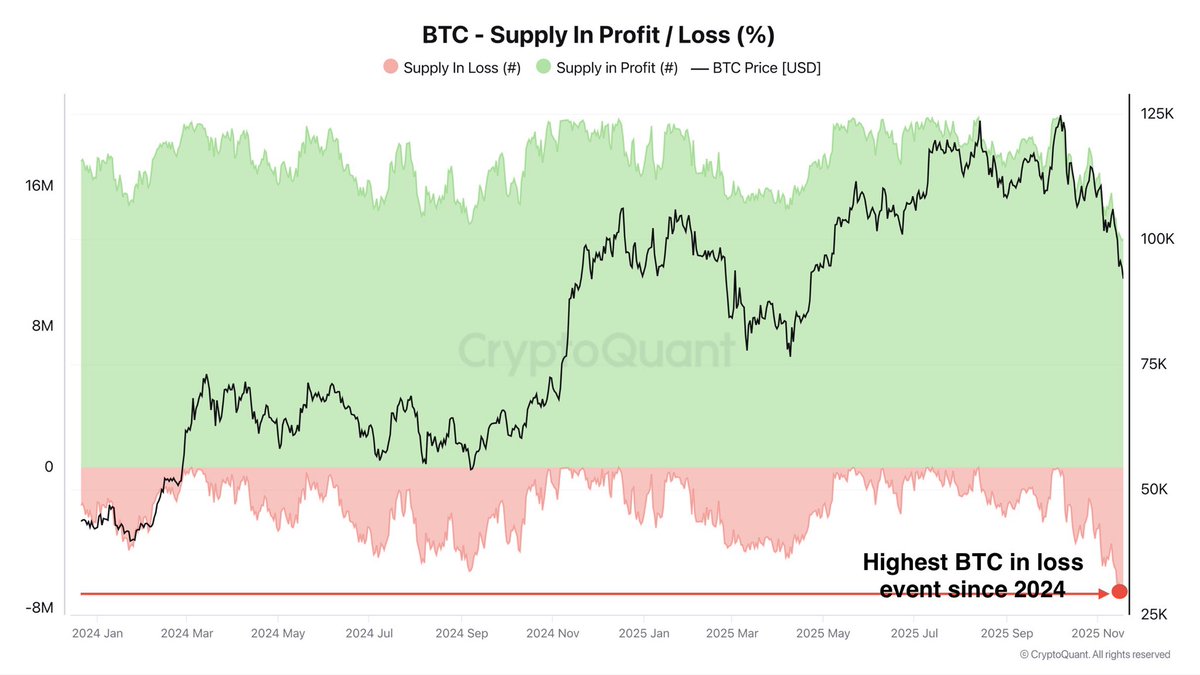

According to the ever-so-clever analyst Darkfost, a staggering 6.96 million BTC are now languishing in unrealized losses-the highest since January 2024. Oh, the humanity! These poor souls accumulated near the previous all-time highs, and now they’re as underwater as a Coward protagonist in a stormy sea. The selling pressure? Utterly emotional, my dears, utterly emotional. 😢

Yet, Bitcoin stubbornly defends the $90K fortress, a testament to demand’s resilience under extreme duress. Is this the beginning of a bear’s reign or the final act before a triumphant rebound? The question lingers like an uninvited guest at a cocktail party. 🍾

Unrealized Losses: A Classic “Change of Hands” Farce

Darkfost, ever the sage, explains that this spike in losses is a simple yet profound affair: a glut of Bitcoin was snapped up near the peaks, leaving recent buyers as forlorn as a Coward character in the third act. Short-term holders, those flighty creatures, are particularly vulnerable, their cost basis clustered like guests at a crowded bar. Their panic selling is as predictable as a Coward quip, amplifying volatility as BTC teeters near $90K. 🥃

But fear not, my loves, for history offers a glimmer of hope. In bullish markets, such phases have been the making of splendid buying opportunities. Weak hands capitulate, and the stalwart, conviction-driven buyers step in-a “change of hands” as dramatic as a Coward plot twist. 🎭

BTC Price Analysis: A Test of Nerve as Momentum Wavers

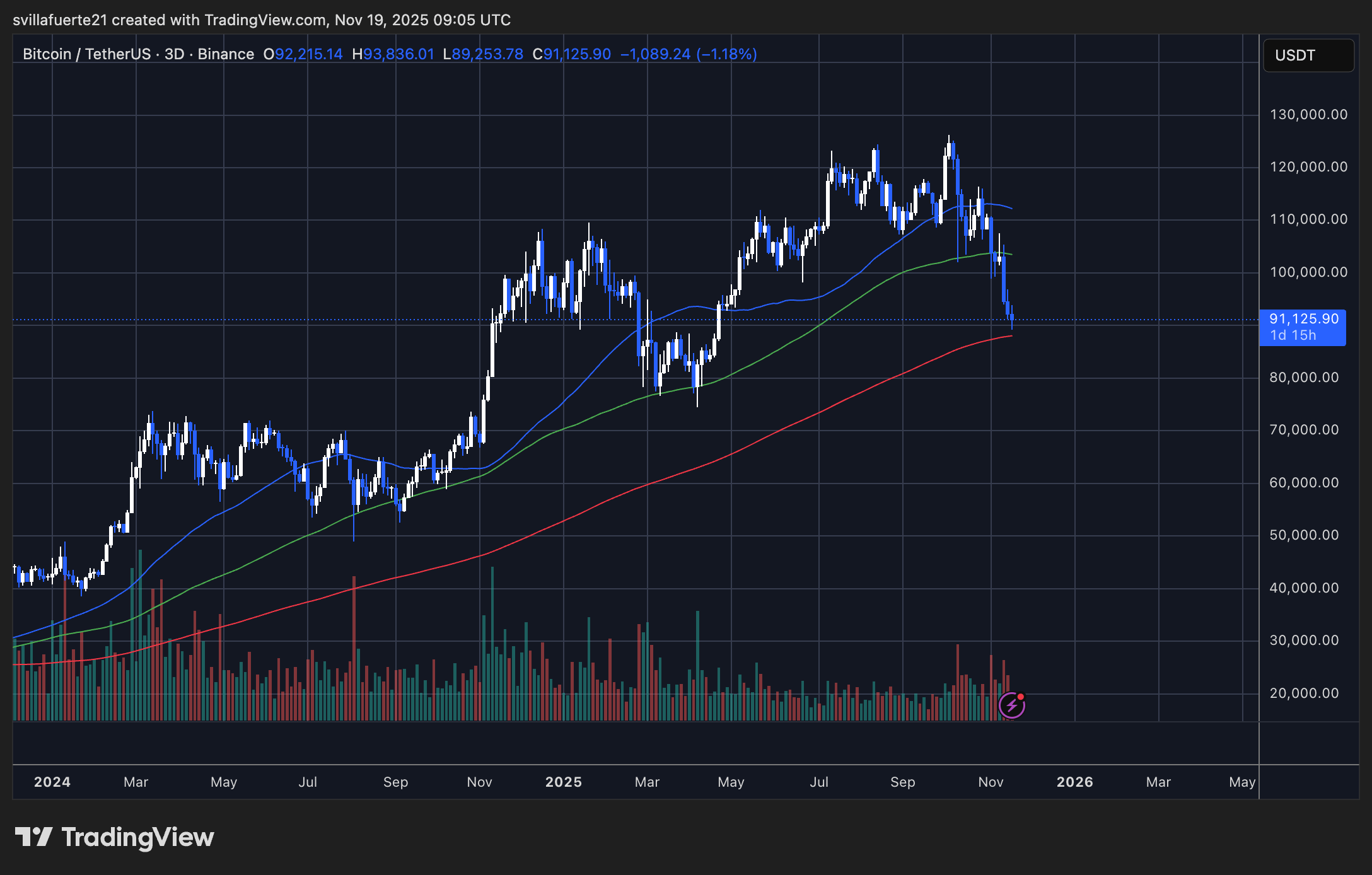

Bitcoin, poor dear, is under the cosh, hovering just above the $90K precipice after a multi-week decline as sharp as a Coward barb. The 3-day chart reveals a break below the 50-day and 100-day moving averages-a loss of momentum as undeniable as a Coward wit. The price now rests on the 200-day moving average, the last bastion of defense in this bullish saga. 🛡️

Recent candles display long lower wicks, suggesting buyers are rallying to the cause, though their efforts are as feeble as a Coward character’s resolve in the face of scandal. Volume swells on the downside, confirming sellers are calling the tune. This pattern, my darlings, echoes late-cycle shakeouts, where volatility clusters near moving averages like guests at a Coward salon. 💃

Structurally, BTC is crafting lower highs and lows-a bearish tableau as clear as a Coward punchline. A break below the 200-day MA could unleash a torrent of downside momentum, exposing liquidity pockets around $85K-$88K. However, should the bulls steady the ship above $90K and reclaim the 100-day MA, it might signal seller exhaustion. Bitcoin, my dears, stands at a crossroads, its fate as uncertain as the ending of a Coward play. 🌪️

So, as we watch this financial drama unfold, let us raise our glasses to Bitcoin-a protagonist as unpredictable as a Coward script. Will it rise to glory or succumb to the bears? Only time, my darlings, will tell. 🥂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-11-19 23:48