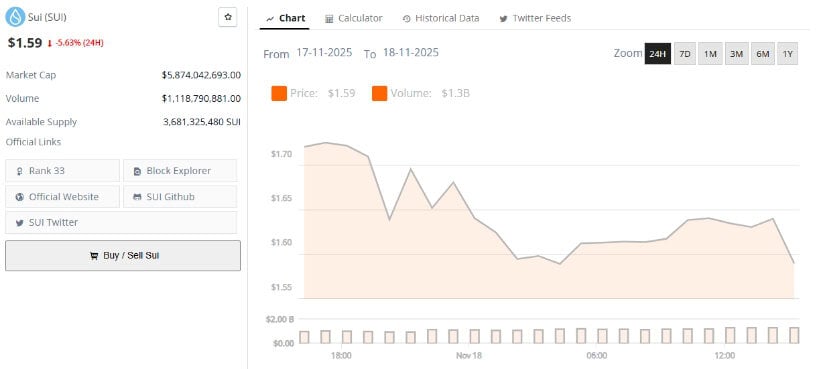

Behold! SUI dances near $1.59-$1.62, teetering like a drunken tightrope walker above the “magical” $1.71 resistance zone. Analysts, those modern-day mystics, claim this level might decide SUI’s fate-or just laugh at our suffering. 🤡

While the Sui ecosystem boasts a shiny new USDsui stablecoin (because who isn’t desperate for more stablecoins?), user activity plummets like a crypto bro selling his NFTs. Traders now squint at charts, hoping their screens don’t shatter from all the conflicting signals. 📉💥

3-Day Chart Analysis: Why $1.71 Is the Wall of Doom

A 3-day SUI/USDT chart reveals the legendary $1.71 resistance zone-a place where heroes have fallen and altcoins have cried. DaanCrypto, that oracle of high-timeframe wisdom, insists holding above this level is “crucial for structural stability.” Or maybe just to avoid crying in public. 😭

Past cycles show SUI respects this zone like a polite guest. But hey, markets are chaotic! Maybe it’ll just throw confetti and collapse. 🎉💣

Forecasting platforms scream at each other:

- Changelly: “Stabilization at $1.71? Maybe! But we’re just robots reading patterns!”

- CoinCodex: “Prepare for a dive to $1.35 by Nov 20! Blame historical volatility!”

Traders now treat $1.71 like a cursed artifact-handle with care or risk summoning doom. 🔮

Technical Indicators: A Symphony of Uncertainty

On 4H and 12H charts, SUI waltzes above $1.65-$1.67, clinging to EMA20 and EMA50 like a leech to a cash register. But this is crypto, darling-no guarantees, just existential dread. 😬

Key observations (because you asked nicely):

- RSI: “Upward trend! Neutral zone! Confusion!”

- Lower wicks: “Buyers are strong… until they’re not.”

- Close above $1.69: “Maybe a rally to $1.77? But only if volume cooperates and Bitcoin doesn’t yawn.” 🤷♂️

Remember: These targets are just guesses. Markets are fickle, and your savings might vanish. 💸

Ecosystem Fundamentals: Stablecoin Magic vs. User Exodus

Sui’s TVL hit $1.19B after launching USDsui, a stablecoin that probably costs more to mint than it’s worth. Meanwhile, daily users dropped to 400k-because who needs fun when you can have profit? 🤷♀️

- Users: “We’re gone. Take it easy on us.”

- On-chain transfers: “Capital flees to safer assets, like socks and goldfish.” 🐠

On-chain researchers sigh: “TVL is great! Users are terrible! Blame the millennials!” 🎮

Price Structure: Resistance Zones That’ll Make You Question Existence

SUI’s been trapped in a descending triangle for a year-like crypto’s version of Groundhog Day. Key resistances:

- $1.73: “The first wall. Climb it, fall off it.”

- $1.77-$1.88: “The Money Pit of Despair.”

- $2.00: “A fantasy! A lie!”

Fail to hold $1.71? SUI might revisit $1.35-$1.40, especially if Bitcoin sneezes. 🦠

User-Focused Insights: How to Lose Your Shirt (And Sanity)

Traders seek confluence-like a Venn diagram of chaos:

- Price above EMAs + rising volume = “Maybe it’ll work!”

- Support retests with higher lows = “Or maybe not!”

- On-chain improvements = “Wait, what’s on-chain again?”

Red flags (because you asked for more despair):

- Close below $1.63-$1.65: “Short-term structure is now a pile of ash.”

- RSI bearish divergence: “Your hope is now a liability.”

- BTC weakness: “Your entire portfolio is now a metaphor.”

Stablecoins help ecosystems grow. They just can’t fix bad timing. 🕒

Final Thoughts

SUI’s fate hinges on $1.71, volume, and whether Bitcoin feels like partying. With mixed signals and analysts arguing like cats in a room, traders should brace for a rollercoaster-or just invest in a hammock. 🛋️

Read More

- Clash Royale Best Boss Bandit Champion decks

- When Is Predator: Badlands’ Digital & Streaming Release Date?

- Clash Royale Furnace Evolution best decks guide

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- eFootball 2026 Show Time National Teams Selection Contract Guide

- VALORANT Game Changers Championship 2025: Match results and more!

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

- Clash Royale Witch Evolution best decks guide

- Before Stranger Things, Super 8 Reinvented Sci-Fi Horror

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

2025-11-19 02:55