Markets

What to know:

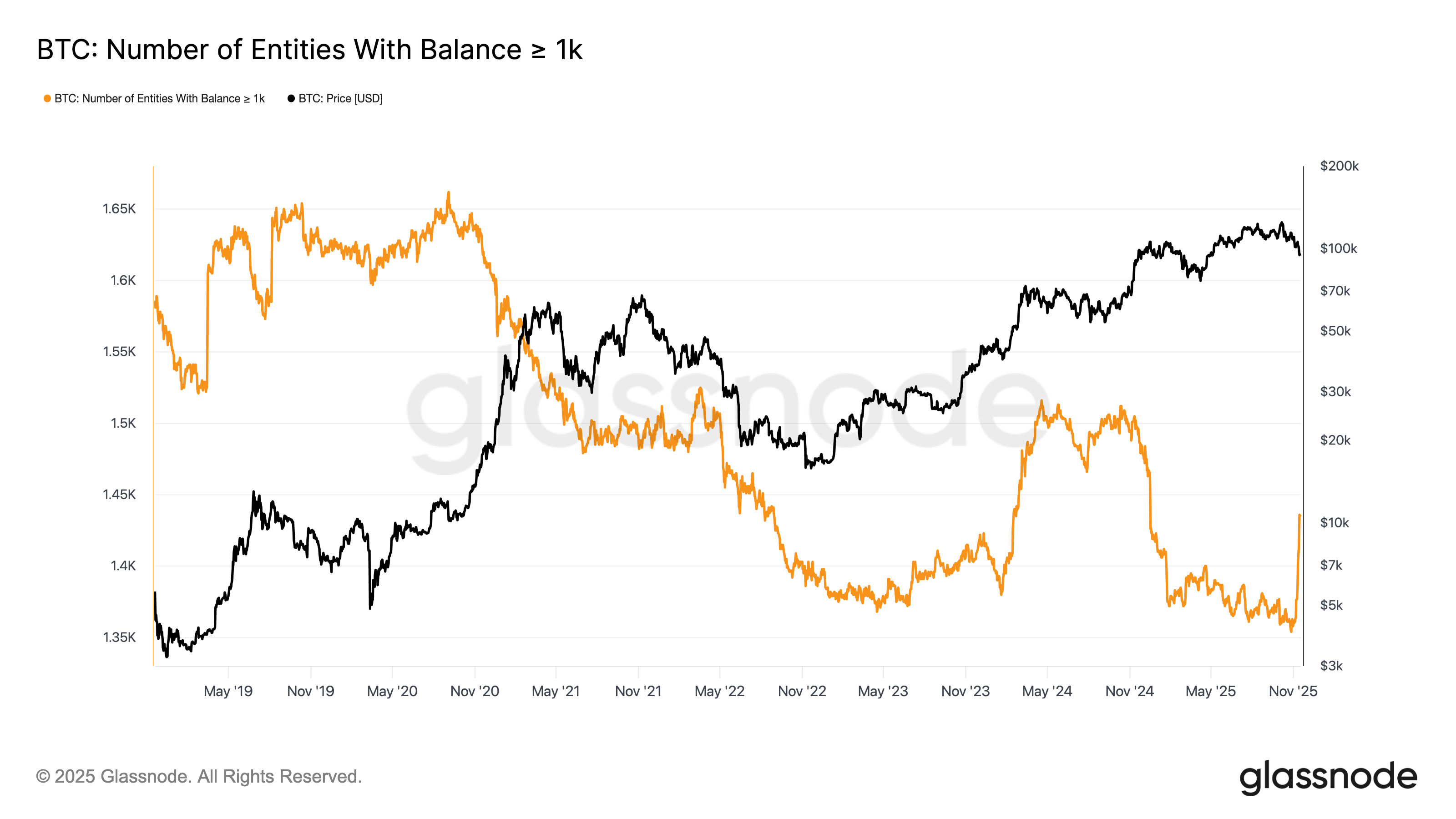

- The count of entities holding at least 1,000 BTC has risen to 1,436 over the past week as bitcoin has plunged to multi-month lows. 🤷♀️💸

- This is a reversal in trend from most of 2025, which saw net selling from larger holders. Because nothing says “I’m confident” like selling when the market’s in the toilet.

Over the past week the number of unique entities holding at least 1,000 BTC has climbed to 1,436 even as bitcoin has tumbled and held firmly below $100,000. Because who doesn’t want to be a millionaire? 📉

This marks a sharp reversal from the broader 2025 trend where “OGs” and long term participants have been steady net sellers. Oh, so that’s why they’re buying. 🤡

For context, this cohort peaked above 1,500 entities in November 2024 in the excitement and bull move following Donald Trump’s election victory. It declined to about 1,300 in October. Because nothing says “I’m a genius” like buying Bitcoin right before a presidential election. 🎤

The last time a price rally was seen with a rise in large holder entities was in January 2024, ahead of the U.S. ETF launch, when the number rose from 1,380 to 1,512 entities. Bitcoin ultimately topped out around $70,000 a couple of months later. Because nothing says “I’m a prophet” like predicting a market crash. 🧙♂️

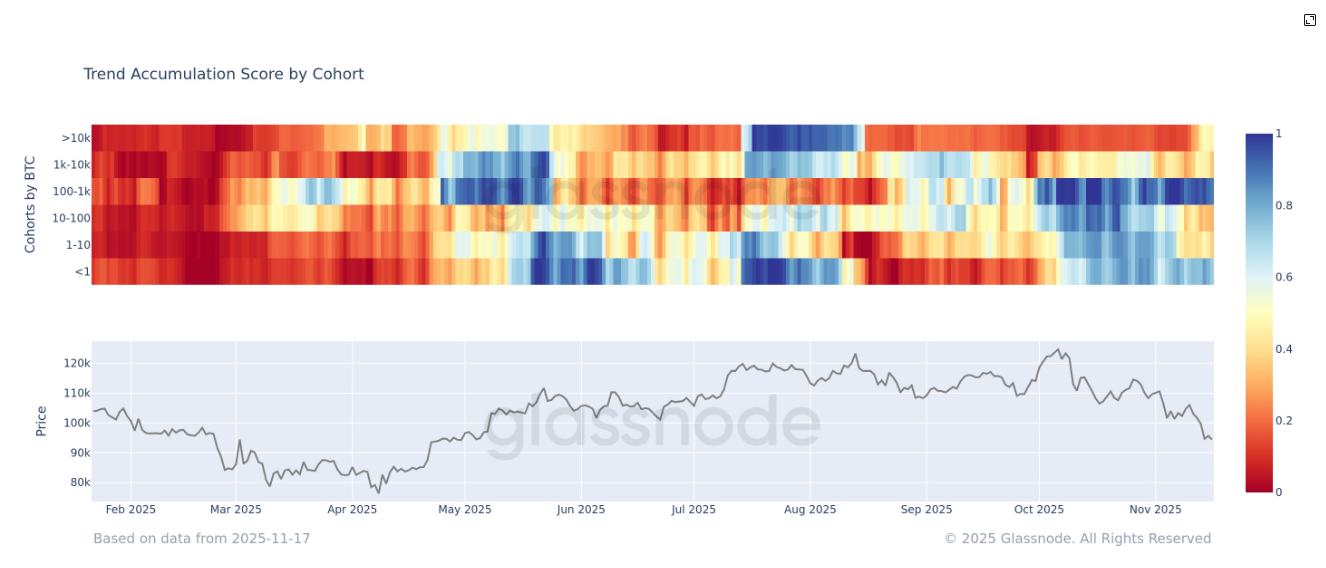

Further evidence supports this from the Accumulation Trend Score by Glassnode which breaks down wallet cohort behavior. Because who needs a crystal ball when you have charts? 📈

This metric measures the relative strength of coin acquisition across different balance tiers based on entity size and the volume of coins accumulated over the past fifteen days. A reading near one indicates accumulation, while a reading near zero indicates distribution. Entities such as exchanges and miners are excluded. Because obviously, we should trust the data. 🤡

For the first time since August, whales holding more than 10,000 BTC are no longer heavy sellers, with their score now around 0.5. Entities holding between 1,000 and 10,000 BTC are now showing modest accumulation. Because nothing says “I’m a risk-taker” like buying when the market’s in freefall. 🎢

The strongest accumulation comes from holders with 100 to 1,000 BTC and from wallets holding less than 1 BTC. The data suggests growing conviction from both large and small entities that bitcoin is undervalued at current levels. Because who doesn’t want to be the one who bought low and held? 🤷♀️

Read More

- Clash Royale Best Boss Bandit Champion decks

- When Is Predator: Badlands’ Digital & Streaming Release Date?

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- Clash Royale Furnace Evolution best decks guide

- eFootball 2026 Show Time National Teams Selection Contract Guide

- You can’t watch Predator: Badlands on Disney+ yet – but here’s when to expect it

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

- VALORANT Game Changers Championship 2025: Match results and more!

- Clash Royale Witch Evolution best decks guide

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

2025-11-17 20:29