In the twilight of Saturday’s market, where shadows of bulls and bears entwine, Bitcoin flutters between $95,871 and $96,341, a moth trapped in the flicker of candlesticks. Traders, a herd flustered as autumn leaves, scramble to reposition after the great descent beneath the six-figure threshold-a first since June, like a poet forgetting his verse.

Futures Traders Cut Risk While Options Flow Points to Continued Volatility

The pullback, a cruel muse, shaved 5.6% from Bitcoin’s weekly aria, though a 1.4% intraday trill today keeps sentiment from spiraling into Wagnerian despair. Across futures, coinglass.com’s ledger whispers of 699,010 BTC in open interest, $67.22 billion-a cooling bath from recent fever dreams, where forced deleveraging and risk-off retreats tango like lovers in a storm.

CME, that stately institution, clutches 143,170 BTC ($13.76 billion) with a 20.47% grip, its OI rising 0.33% hourly. One might call it “nibbling,” not panic, as if sipping tea while the world trembles. Binance trails closely, 134,130 BTC ($12.89 billion), its 5.20% daily rise suggesting traders are spinning wheels, not fleeing trains. OKX, Bybit, and Kucoin add fresh ink to the ledger, while Gate and BingX crumble like stale cookies-BingX’s OI plunging 15.36% in 24 hours. Leverage? Gone. Poof. 🎩🐇

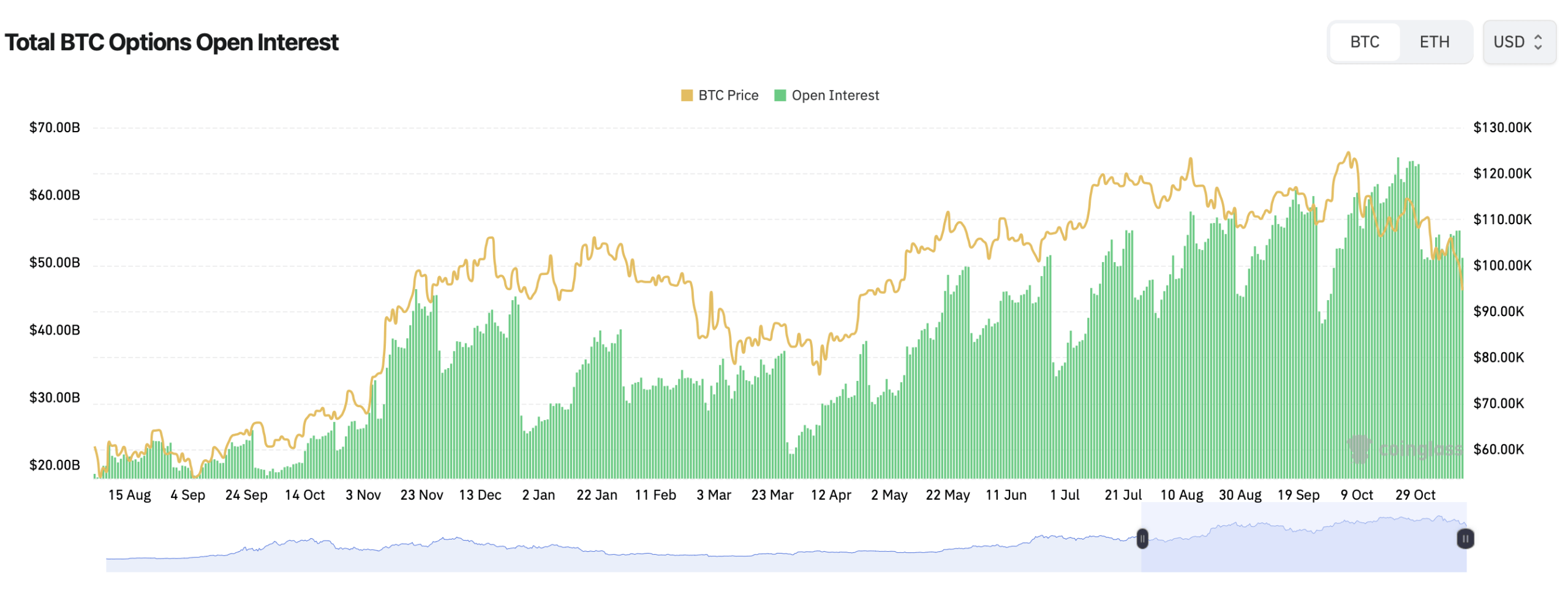

The yearly OI trend, like a stubborn old friend, clings to historic highs despite the recent slump. The market hums a familiar tune-clean-up phases, precursors to rebounds or corrections, depending on who’s telling the tale.

The options market, meanwhile, struts in a different key. Calls, bold as poets, claim 60.24% of open interest (279,653 BTC), their optimism drowning puts’ 184,559 BTC. Over 24 hours, calls logged 23,214 BTC in volume, a bullish sonnet to the $90,000 test. Deribit’s contracts cluster at $85k puts and $140k-$200k calls, a mix of hedging and long-dated speculation. Nov. 28, 2025’s $90k strike? A fortress against deeper slides.

Max pain levels, those sly puppeteers, underline indecision. Deribit’s neon-lit zone ($100k-$105k) clashes with Binance’s $110k-$150k bullish gamble. OKX’s max pain hovers closer to spot, $97k-$105k-a tightrope walk for breakout chasers. Despite turbulence, calls retain their edge, whispering Q4 rebound dreams louder than bears’ growls.

Futures trim risk; options sing of strength. Max pain clusters around current prices, Bitcoin stuck in a narrow cage until some cosmic catalyst shatters the glass. Traders brace, one eye on the upside-just in case Bitcoin, that sly fox, decides to dance again. 💸🕺

FAQ ❓

- What is Bitcoin’s total futures open interest today?

Bitcoin’s futures OI? A $67.22 billion symphony across exchanges. 🎶 - Are traders leaning toward calls or puts in the Bitcoin options market?

Calls, 60% of OI, shout bullish optimism. Puts? Whispering doubts. 🗣️🤫 - Where are max pain levels clustering for Bitcoin options?

$95k-$105k, depending on the exchange. A tightrope for all. 🧗 - Which exchanges lead Bitcoin derivatives activity?

CME, Binance, OKX, Bybit, Deribit. The usual suspects. 🕵️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-11-15 18:16