Well, well, well, it seems Optimism (OP) just can’t decide whether to go up, down, or sideways. Despite a brief flurry of excitement above $0.44, the token has slunk back to the safe, cozy confines of $0.41-because, of course, what better way to confuse everyone than a good ol’ retreat to the status quo? 😏

OP’s Price: Like a Rollercoaster with No Seatbelts

The hourly chart for OP/USD is like that one rollercoaster you went on as a kid-exciting at first, then, well, not so much. Currently, it’s stuck at $0.412, following a 1.64% decline. Earlier, OP decided to show some spunk, recovering from a sleepy $0.32 to above $0.44, but, surprise surprise, the sellers took over, dragging the price back down into the gloomy depths of $0.41-$0.42. You know, just to remind us that no one really knows what’s going on here. 🙄

The aggregated open interest is wading through the murky waters between 50 million and 60 million, reflecting the same level of uncertainty. During price rallies, open interest expands-as fresh buyers and sellers jump in like a bunch of over-caffeinated squirrels. But when things quiet down, it dips, like everyone remembers they have actual lives to attend to. Honestly, the market just can’t seem to pick a side. 🤔

Market Data: No One’s Watching, But Everyone’s Still Waiting

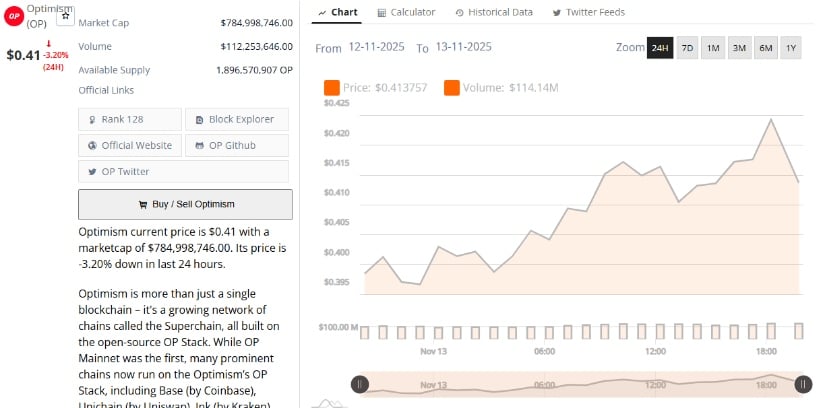

Fast forward to November 2025, and we find OP hanging out at $0.41, down by 3.20% on the day. The market cap is lounging at a cool $784.99 million, which sounds impressive until you realize it’s backed by a 24-hour trading volume of just $112.25 million. The circulating supply? 1.89 billion tokens, which, yes, is a lot, but that doesn’t seem to be getting anyone excited right now. The market has cooled off, and if you’re into cold showers, this is your moment. 🥶

This slowdown is clearly visible in both market cap and volume, and it’s a worrying sign for the layer-2 ecosystem, which is feeling the heat from newer scaling solutions. Sure, Optimism has a great developer team behind it, but unfortunately, even the best developer teams can’t fix a broken price trend. The short-term outlook? Tied to market demand and engagement-both of which seem to have caught a cold. 🤧

TradingView’s Prediction: Bearish, But Maybe Not the End

Looking at TradingView’s indicators, the news isn’t exactly cheerful. OP is stuck below the middle of its Bollinger Bands, hovering at $0.41, with the upper band teasing at $0.47. Basically, it’s like being stuck in traffic while the fast lane is just… right there. This narrowing of the bands suggests that volatility has taken a nap-likely a precursor to some sort of dramatic breakout. Because when things get quiet, they’re definitely about to get louder. 🚨

The Relative Strength Index (RSI) is reading 44.47, while its moving average is trailing behind at 39.07. Translation: Not quite in the “oversold” zone, but certainly not in “let’s go to the moon” territory either. The market might be just sitting there, waiting for some actual direction. Until then, you can expect the price to ping-pong between $0.35 and $0.47. Pretty much like every other market right now-confused and nervously eyeing each other. 😬

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-11-14 02:42