As the world watches in awe, a curious phenomenon has occurred in the realm of Bitcoin. US-listed spot Bitcoin ETFs have witnessed a rather impressive influx of $520 million on Tuesday-quite the dramatic shift from the humble $1.15 million just a day before. And let’s not forget the $1.22 billion in withdrawals that came before that. Oh, the drama! 🌪️

This swing in flows is of particular interest, as historically, such movements have been known to spur significant price rallies. At present, Bitcoin hovers around the $104,000 mark, and some (rather optimistic) analysts are predicting that if the buying pressure continues to mount, Bitcoin could very well reach the glorious heights of $160,000 to $170,000. How utterly thrilling! 💸

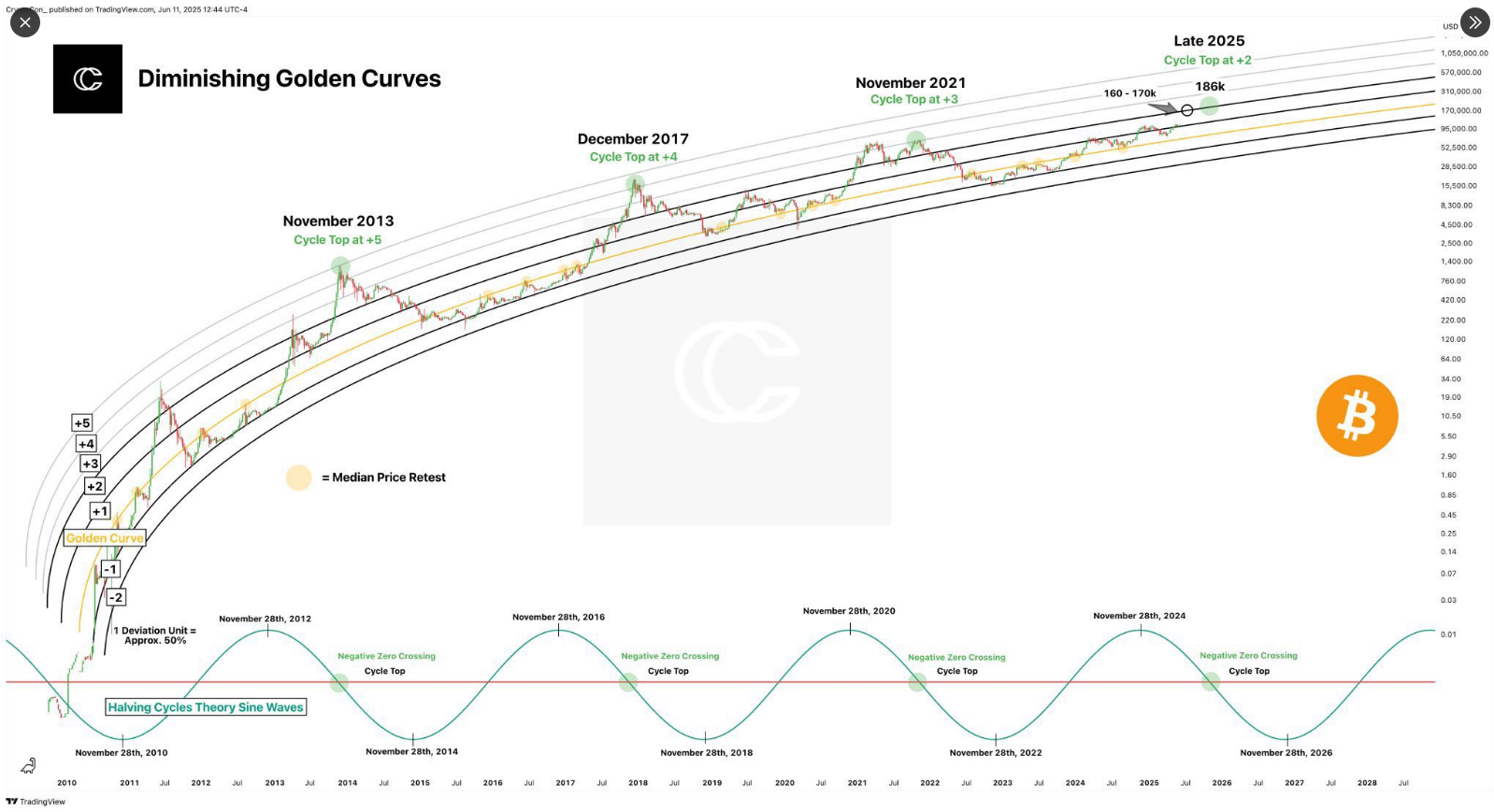

Can We Trust These “Golden Curves” to Predict Bitcoin’s Future? 🤔

Enter CryptoCon, with its so-called “diminishing golden curves,” a model that maps price bands using logarithmic regression. According to this model, Bitcoin has been straying above a “Golden Curve,” and it tracks those deviations to predict the next great peak. Hold on to your hats, folks, because the target is set between $160,000 and $170,000, with an optimistic potential swing towards $186,000! If this happens, Bitcoin could soar by an astonishing 70% from its current price. But of course, we all know how these things tend to unfold… or not. 😏

The next target for #Bitcoin is between $160,000 and $170,000

– Bitcoin Teddy (@Bitcoin_Teddy) November 12, 2025

Looking back at history, we see the past cycle tops at +5 in November 2013, +4 in December 2017, and +3 in November 2021. CryptoCon’s latest projection places the next top at a mere +2 band, suggesting Bitcoin could soon achieve the aforementioned $160,000 to $170,000 range. But hey, let’s not get too carried away just yet. A potential spike to $186,000 is still on the table. 🌟

Will the Halving Cycle Save Us? 🙄

Ah, yes, the halving cycle-Bitcoin’s trusty rhythm. Following the last halving in April 2024, analysts are once again looking to late 2025 for a market peak. Historically, this 12-18 month pattern has been a reliable guide, though it’s hardly a guarantee. Still, it offers some comfort to traders who are looking to time their moves just right. No pressure, right? 😅

Stablecoin reserves and exchange data add more intrigue to the mix. According to Binance, while stablecoin reserves are on the rise, Bitcoin reserves on the exchange are falling-an indication that long-term holders may be quietly accumulating. CryptoQuant analyst Moreno even suggests that liquidity is increasing, and volatility is low. In theory, this makes the risk-reward ratio seem rather appealing to potential buyers. But who can say for sure? 📉📈

As always, market conditions can shift in the blink of an eye. With fresh economic data and the impending end of the US government shutdown, the stage is set for volatility to return. Models like the Diminishing Golden Curves are undoubtedly useful, but history is no guarantee-especially if some unexpected shock comes along to throw everything into chaos. Ah, the joys of market speculation! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

2025-11-13 20:43