Ah, Bitcoin. That digital phantom, forever chasing its own tail, and now apparently… ignoring the very signals it was supposed to heed. Our Herr Severino, a Chartered Market Technician-a title which, let me assure you, evokes images of charts, diagrams, and a profound sense of self-importance-claims the copper-to-gold ratio, that most dependable of macro indicators, has thrown a tantrum. It’s broken character, you see. Like a prima donna refusing to sing the aria. 🎭 And the post-halving script? In complete disarray, naturally. Altcoins, those poor, hopeful creatures, are left without their customary rotation. Such drama!

Why This Copper/Gold Business Matters (Supposedly)

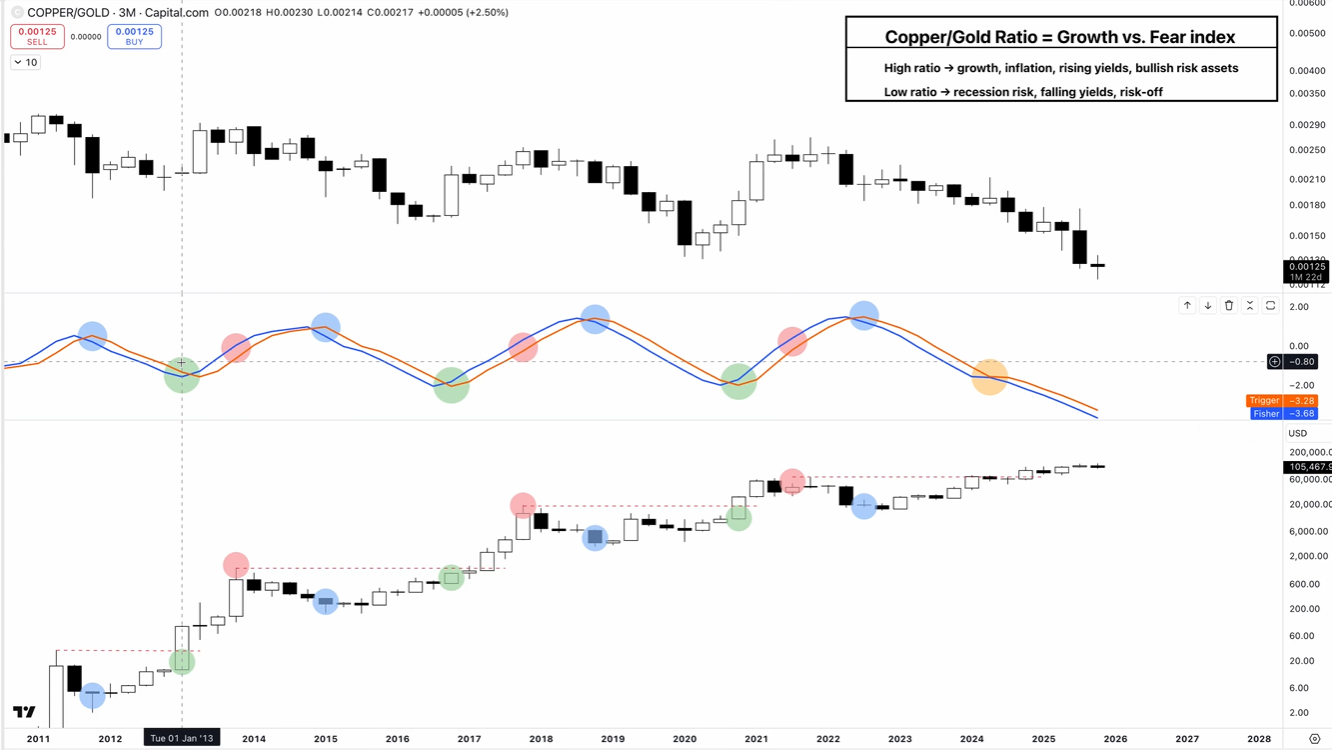

Severino, in a pronouncement delivered over sixteen minutes of video-sixteen minutes! As if we haven’t wasted enough time already-describes this ratio as a “growth versus fear index.” Copper, they say, signifies manic expansion, a giddy embrace of risk. Gold, meanwhile, represents the trembling hand of recession, the quiet desperation of those who chose wisely. Naturally. The crux of the matter? The cyclical turn that should have coincided with Bitcoin’s dramatic ascent simply…didn’t happen. “They say this time is different,” sneered Severino, with the weary cynicism only a market technician can muster. “Well, this time is different!” The business cycle, according to the ratio, remained resolutely slumped. A most inconvenient truth.

It seems our Severino suspects the four-year halving narrative is, at best, a charming fable, and at worst, a deliberate deception. He’s overlaid these halving dates upon…that Fisher Transform-a term that sounds vaguely alchemical-and discovered the true inflection points are macro, not some mystical supply-driven event. “I never really thought it was the halving,” he confided. “It started a bull run in the Nasdaq, too! Honestly, the halving probably has less effect on Bitcoin than a startled cat.” 🐈⬛ The halving merely coincided with, rather than caused, the ratio’s swing and a surge in…risk-on appetite. You understand. A coincidence. These things happen, even in the supposedly rational world of finance.

But alas, this cycle is…deviant. The ratio briefly flirted with a “higher high” – a mere tease, it appears – before collapsing into “another lower low,” a dismal reading not seen for fifteen years. “Since the Great Recession, no less!” Severino lamented. The Fisher Transform, that supposed harbinger of prosperity, failed to deliver its promise. “It was to send Bitcoin into the final stage of parabolic delirium,” he sighed, “but we just…meandered sideways. Like lost souls in a counting house.”

So, Is This The End? (A Dramatic Pause…)

Timing, as always, is everything. Severino observes roughly a year transpires between the ratio’s signal and Bitcoin’s peak. And by that metric, we should have already passed the zenith…or, at least, be preparing for the inevitable descent. But the defining ‘risk-on’ impulse is missing. A murky state of affairs indeed. “Because we didn’t get the full risk on, I don’t know where the risk off signal is,” he confessed, a touch of desperation creeping into his voice.

This, naturally, extends to the fate of altcoins. Normally, that ‘risk-on’ phase heralds ‘alt season’ – a fever dream of spurious gains. But not this time. “We didn’t get it here,” he grumbled, noting Bitcoin’s dominance remains unnervingly stable. (Bitcoin, that greedy tyrant, holding all the cards). And, to add insult to injury, there’s a “strongly negative correlation” between Bitcoin and the ratio. A most unsettling development. “None of the conditions for altcoin season seem to be here based on past economic signals,” he stated, sounding rather disappointed.

Severino avoids a definitive pronouncement, naturally. He acknowledges the ratio’s trend is…ambiguous. One failed breakout doesn’t a trend make. But until it does turn, he advises caution, a retreat to the safety of…well, whatever constitutes ‘safety’ in this chaotic market. “We’re still in the fear sort of side of this ratio. We need to be defensive, and risk off. When it turns up, then we can consider exuberance again.” And as a grand finale, the crushing admission: “It is genuinely different this time.”

At press time, BTC languished at $104,486. A sum, I suspect, that will either make or break a great many people.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-11-12 04:19