Ah, Ethereum! The crypto that refuses to lie down and die. After a spot of consolidation around $3,500, both the retail peasants and institutional bigwigs have finally decided to show up to the party. Some analysts, ever the optimists, insist that if Ethereum can cling to the $3,000 support level, we might just be in for another glorious trip to $4,300 in the coming weeks. But hey, let’s not get ahead of ourselves. Market activity suggests that people are cautiously, and I mean cautiously, optimistic, with whales scooping up ETH and ETFs flowing in like they just discovered the fountain of youth.

Ethereum’s Impressive Stance at $3,500

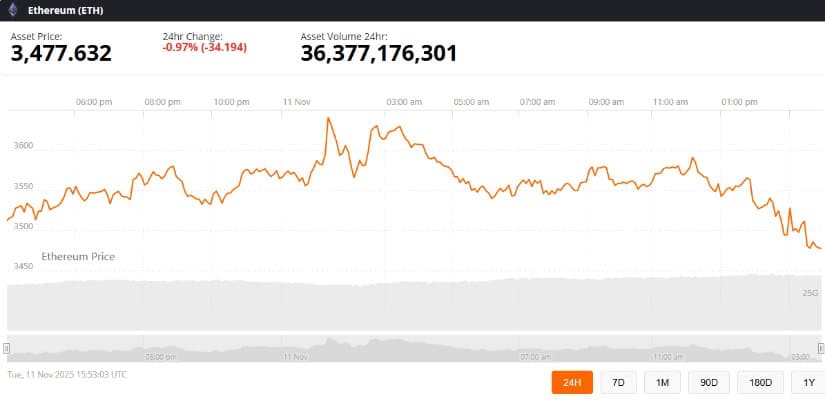

After taking a small dip to $3,400 in mid-November-no biggie-Ethereum has been hanging out around the $3,500 mark. Crypto Caesar, yes, that’s the name, says the bulls “are defending that range hard,” like a toddler clutching a toy. Currently, Ethereum is sitting pretty at $3,564, with some minor losses today, but hey, it’s been worse. Trading volume has surged, but $3,590 seems to be the magic number we’re not quite hitting.

According to the technical charts, Ethereum is bouncing around like a rubber ball in a well, but it’s all part of a healthy pullback, they say. If the $3,000 level holds firm, we might just see Ethereum break out of this phase and aim for that sweet, sweet $4,300 target. Don’t worry, the 2025 trend seems promising-at least from the $2,800 lows.

Whale Watching: The Big Boys are Back!

Oh, look! The whales have emerged from their deep, dark ocean. On-chain data reveals that one verified whale has decided to splash $269 million on 75,418 ETH in just 12 hours. That’s a nice little chunk of change. So now, this whale is swimming around with a total of 266,901 ETH, worth a cool $949 million. Ted Pillows, market analyst extraordinaire, chimes in, “Whales are becoming interested in Ethereum again.” Well, isn’t that just peachy? It’s almost like they know something we don’t.

Despite Ethereum’s unpredictable gyrations, these big purchases coincide with a $1.37 billion ETH buy frenzy. Analysts are getting their hopes up, suggesting that this accumulation could signal the bottom of the market. But remember, folks: no price surges are guaranteed. This could all just be one big, expensive game of ‘wait and see.’

The Dreaded Resistance at $3,700

Ah, but every story has its villain. Enter the resistance at $3,700. Sjuul from AltCryptoGems, ever the bearer of doom and gloom, points out, “This $3.7K level has been support for ages, and now it’s threatening to become resistance.” It’s like that one friend who you’ve known for years but suddenly becomes unbearable at parties. The Bitfinex ETH/USDT chart shows multiple failed attempts to breach this level since late October. If Ethereum doesn’t break through, it could spell trouble for its bullish run.

Currently hovering just below $3,700 at $3,565, Ethereum’s short-term outlook remains as delicate as a soufflé. Traders are advised to stay vigilant and maybe not go all-in just yet. Watch the resistance closely; it might be more stubborn than your aunt at family gatherings.

Short-Term Technical Shenanigans

Intraday analysis shows Ethereum bobbing around like a cork in a storm, stuck between $3,520 and $3,348. Long liquidations are happening like clockwork between $3,507 and $3,460. And for those of you who care about such things, Elliott Wave projections suggest that Ethereum is finishing up a corrective wave, potentially setting up for another glorious rise. Sounds like a soap opera, doesn’t it?

Resistance targets are set at $3,631, $3,665, and $3,707. And if Bitcoin manages to do anything, really, Ethereum might just find itself with some extra momentum to break through.

The Crystal Ball: Ethereum’s Future

Ethereum, ladies and gentlemen, remains the epicenter for those looking to make it big in 2025. With solid support at $3,000 and the added muscle of whale buys and ETF inflows, we might see a rebound to $4,300. The supply is getting staked, the ETF inflows are impressive, and despite the drama, Ethereum seems poised to weather the storm. 32% of Ethereum’s supply is staked, and over $15 billion has flowed into ETFs since 2024, which is nothing to sneeze at.

In conclusion, the next few weeks will likely be a wild ride. Keep an eye on support and resistance levels, the whales, and, of course, Bitcoin’s every move. Analysts are cautiously optimistic-except, perhaps, for the ones who’ve already made their fortunes. Ethereum, my friends, is like that unpredictable teenager who might end up being the next big thing, or just another flash in the pan.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-11-12 00:22