My dear reader, prepare to be charmed by the latest dalliance of the tech titan: Google Finance has decided to waltz with Polymarket and Kalshi, those cheeky prediction market platforms, and introduce their blockchain-based flirtations to the masses. One might say it’s the ultimate cocktail party-where GDP forecasts and crypto bets clink glasses. 🥂

Very soon, the discerning user of Google Finance shall be able to inquire, “What will GDP growth be in 2025?” and receive not mere opinions, but the collective wisdom of thousands wagering real money. How quaint! After all, what could possibly be more reliable than people gambling their hard-earned cash on whether your aunt Mabel will win the election? 🎲

This union is nothing short of revolutionary for prediction markets and cryptocurrency. Let us dissect why, with the elegance of a well-tied cravat.

How the Integration Works

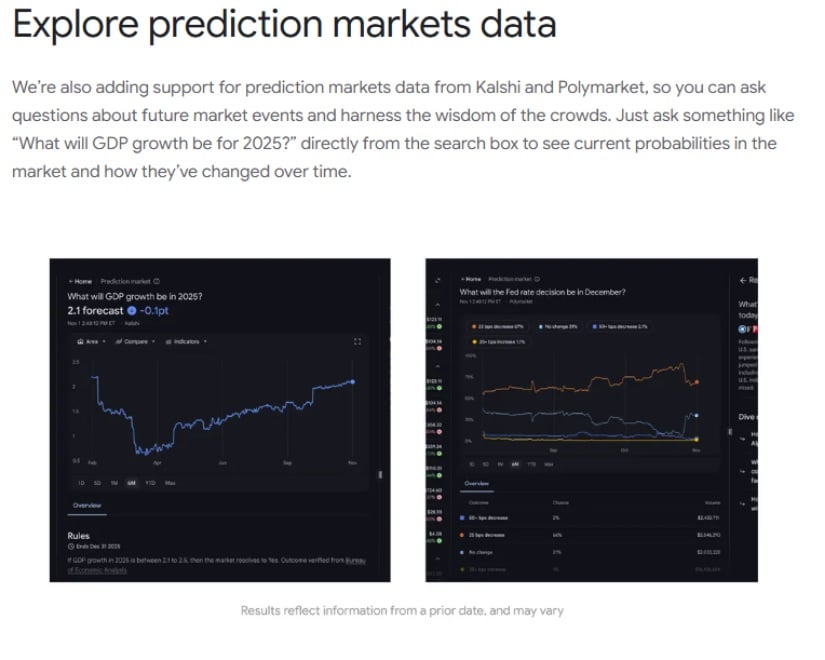

Google Finance, in its infinite wisdom, is rolling out AI-powered features, and prediction markets are the cherry on top of this digital sundae. Users may now type queries into the search box and receive instant probabilities, as if consulting a fortune-teller who’s also a mathematician. How droll!

The feature will debut to Google Labs enthusiasts before spreading to the wider public. Oh, and they’ve added “Deep Search” capabilities using Gemini AI models-because why settle for one search when you can have hundreds? 🤖

What distinguishes this from a regular Google search? Why, the data comes from actual bets, of course! When people risk their own funds, they tend to be less… whimsical than when filling out surveys. A lesson we’ve all learned from Aunt Mabel’s “sure thing” investments. 💸

Understanding Prediction Markets

Prediction markets, darling, are akin to stock markets, but instead of shares, you trade contracts based on whether events will transpire. If you fancy an event at 60% likelihood, you might purchase shares at $0.60. Should it occur, you pocket $1 per share. Should it not? Well, perhaps it’s time for a stiff drink. 🍸

Polymarket, the belle of the ball, recently secured $2 billion from Intercontinental Exchange (NYSE’s parent) at an $8 billion valuation. Its rival, Kalshi, raised $300 million at a $5 billion valuation, with investors like Sequoia and Andreessen Horowitz nodding sagely. During the 2024 U.S. election, trading volumes soared to $2 billion weekly-clearly, democracy has never been so thrilling. 🏆

The Crypto Connection

This announcement is a masterstroke for cryptocurrency, as Polymarket operates entirely on blockchain. Every trade occurs on Polygon, a layer-2 network built on Ethereum, and transactions use USDC-a stablecoin. One might say it’s the perfect marriage of innovation and practicality.

Polymarket has processed over $14 billion in lifetime volume, with 20,000 to 30,000 daily traders. All this activity fuels demand for USDC, ensuring crypto’s rails keep chugging along, even if users are blissfully unaware of the machinery behind the curtain. 🛤️

This is significant, you see, because it demonstrates blockchain’s potential to power mainstream applications. Users needn’t care about Polygon’s inner workings-they simply wish to predict outcomes. Yet, behind the scenes, crypto’s infrastructure ensures fast, cheap, and transparent transactions. A bit of magic, really. ✨

Google’s endorsement also validates blockchain as a legitimate financial tool. By placing prediction markets alongside traditional stocks and bonds, they’re whispering to millions: “Trust this.” How bold. 💼

Growing Adoption and Competition

Prediction markets are transitioning from niche crypto projects to mainstream finance tools. In October, Polymarket and Kalshi became the NHL’s first licensed prediction markets-a triumph! Traditional betting apps like DraftKings and FanDuel are now scrambling, like ants at a picnic. 🐞

Robinhood, ever the opportunist, partnered with Kalshi in August to offer football game contracts. CEO Vlad Tenev declared prediction markets “on fire” during earnings calls, and Robinhood has since expanded its offerings. Even Gemini, the Winklevoss twins’ brainchild, is seeking regulatory approval for its own platform. The race is on! 🏁

Challenges and Concerns

Despite the glamour, prediction markets face challenges. A Columbia University study revealed nearly 25% of Polymarket’s trading volume may be fake, with users inflating activity for token rewards. One might call it a bit of a bun fight. 🐰

Regulatory hurdles abound. Polymarket was banned in the U.S. in 2022 for operating an unregistered exchange but has since acquired a new license. Lawmakers argue these platforms are merely gambling with extra steps. Google itself tightened gambling ads while adding prediction markets-how delightfully contradictory! 😏

Accuracy and manipulation also loom. While prediction markets often outperform polls, large traders can sway outcomes with big bets, creating false signals. A game of chess, perhaps, but with higher stakes. ♟️

What This Means for Crypto Prices

The integration won’t directly affect crypto prices, but it boosts visibility and usage of crypto infrastructure. More USDC usage in prediction markets means increased demand for stablecoins-a vital cog in the crypto ecosystem.

Looking ahead, VanEck predicts Bitcoin could hit $180,000, while Bitwise forecasts $200,000. Ethereum, darling, may surpass $6,000. Kalshi’s crypto head claims prediction markets should be on “every large crypto app” within 12 months. If true, it’ll create a stablecoin gold rush. 🏦

The Road Ahead

If Google’s rollout succeeds, prediction market probabilities could become as ubiquitous as stock quotes. For crypto advocates, this is validation that blockchain solves real problems-transparency, global access, and fast settlements. All things blockchain does better than traditional systems. A bit of a showoff, really. 😎

The coming weeks will reveal whether mainstream users embrace this new tool or find it bewildering. Google’s reputation and user base give this integration the best shot yet at bringing blockchain to the uninitiated. A triumph, perhaps? Or a folly? Only time will tell. ⏳

Looking Forward: Mainstream Meets Blockchain

Google Finance’s embrace of prediction markets marks a pivotal moment where mainstream platforms and blockchain collide. Whether you’re a crypto enthusiast or simply curious about forecasting, this integration democratizes advanced tools. The success of this venture will undoubtedly influence how tech giants view blockchain’s role in the future. A new era beckons! 🌟

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-11-08 03:36