Ah, dear reader! Let us take a delightful jaunt into the bountiful fields of the crypto market, which has finally decided to dance gaily like a capering child at a county fair. At our latest sundry examination on this Wednesday, it appears that investors, those gallant knights of finance, have seized the moment to capitalize on a recently minted dip-like sailors hoisting sails to catch a fortuitous breeze. And behold! Open interest, that enigmatic creature, is lifting its head again after enjoying a well-earned nap.

- Among the sprightly top gainers in our merry crypto carnival are the likes of ZKsync, Zcash, Aster, and Quant-names that sound like a bewitched tea party, don’t you think?

- This jubilant rebound coincides with the Supreme Court engaging in a riveting cavalcade concerning none other than Donald Trump’s tariffs.

- One cannot overlook the serendipitous rise of open interest returning to its former glory!

To our astonishment, Bitcoin (BTC) has leapt forth by a wholesome 1.4%, now sporting a figure of $104,000 and Ripple (XRP) has similarly decided to join the fun with a 2% frolic to $2.2. The usual suspects, those ever-cheerful altcoins ZKsync, Zcash, Aster, and Quant, are leading the festivities.

SCOTUS: The Tariff Tea Party Continues

Now, one might ponder what stirred the crypto kettle to boil over so vigorously. Lo and behold, the esteemed U.S. Supreme Court has graciously taken on the task of dissecting the legality of President Trump’s tariffs, much to the chagrin of our tea-sipping friends at lower courts who have already thrown in the towel.

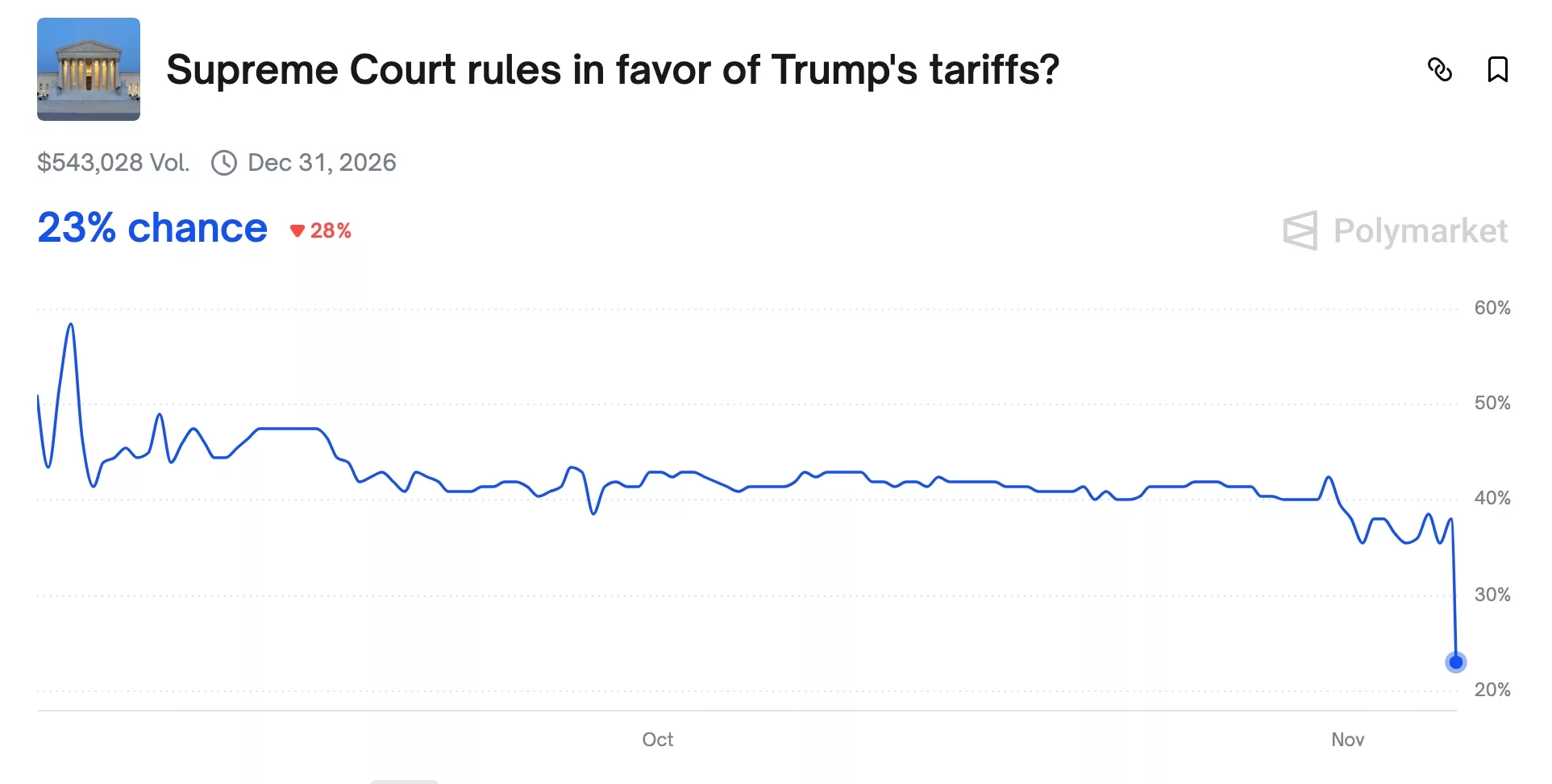

In a shocking twist, a Polymarket poll, hefty with a weighty $542,800, predicts that the court will actually rule against Trump. The odds of a Trump victory have taken a nosedive from a robust 43% to a feeble 20%-oh, the drama! 🎭

Should fate decree Trump’s defeat, we could very well witness the administration being spurred to lower those pesky tariffs. A reduction in these burdensome tariffs could lead to a delightful decrease in inflation, thus sending the Federal Reserve scurrying to cut interest rates like a dog chasing its tail. And you see, cryptocurrencies tend to thrive when such monetary machinations occur! 💃

Yet, fear not, for Trump still has a plethora of tariff options at his dubious disposal. One such gem is the elusive Section 301, which permits tariffs in reaction to unfair trade shenanigans from foreign sovereigns.

The Crypto Rally: It’s Alive! …Again!

As if plucked from the pages of a Victorian melodrama, our crypto market recovery also comes with tales of rising leverage dancing back into the fold. According to the scribes at CoinGlass, futures open interest has surged by 2.13% to a staggering $143 billion.

A rising open interest paints a bullish picture, akin to a summer day when the sun peeks through the clouds. However, one must remember-this current level of open interest is still but a shadow of its former self from the halcyon days of yore.

A free-fall of sorts occurred post last month’s liquidation, which resulted in a staggering loss of $1.6 million and a sight to behold-$20 billion evaporating in a mere day! Talk about a wild ride, eh? 🎢

Tidings of Joy in Crypto News

Meanwhile, the spirits of crypto enthusiasts are elevated, buoyed by joyous tidings from within the industry. Citadel and Fortress Capital have gallantly taken a stake in Ripple Labs, sending the valuation soaring to a princely $40 billion. One does wonder if they celebrated with a nice spot of tea. ☕

Not to miss the revelry, ZKsync has thrown a spanner into the works by announcing a token-burning fiesta, while Chainlink has paired up with S&P Global to launch the S&P Digital Markets 50 Index. Who knew crypto could be so cultured?

S&P Dow Jones Indices (@SPGlobal) and @DinariGlobal have selected Chainlink as the official oracle provider for the S&P Digital Markets 50 Index to power official index values and live token prices for its multi-asset index.

The integration on Avalanche…

– Chainlink (@chainlink) November 5, 2025

Yet, lurking in the shadows, there remains a cautionary whisper-what if this jubilant crypto rally is but a fleeting “dead-cat bounce”? Ah, yes, a DCB, or bull trap for the less fanciful. The scenario where an asset briefly rises before tumbling back into the depths of despair-how sinister!

Seven-Day Declines: A Comic Tragedy

| Asset | Price | 7-Day Gains +/- |

| Bitcoin (BTC) | $103,944 | -7.1% |

| Ethereum (ETH) | $3,435 | -14.3% |

| Solana (SOL) | $162 | -18% |

| XRP (XRP) | $2.28 | -14% |

| BNB (BNB) | $962 | -13.2% |

| Cardano (ADA) | $0.54 | -16.3% |

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-11-05 21:52