Bitcoin and ether ETFs are doing the financial equivalent of slipping on a banana peel-losing a combined $797 million-while Solana ETFs are doing the cha-cha in the corner, scooping up $15 million like it’s happy hour at a crypto bar 🍹💃.

Crypto ETFs in the Red-Except for Solana’s $15 Million Party

Investors are running for the exits from bitcoin and ether ETFs faster than a chicken with its head cut off. Five straight days of sell-offs! Yet, in a plot twist worthy of a Mel Brooks comedy, Solana ETFs are quietly waltzing along, proving that sometimes, the little guy can still dance on the graves of giants 💀🕺.

Bitcoin ETFs had another day that made accountants cry, with $577.74 million fleeing across seven funds. Fidelity’s FBTC took a nose dive of $356.58 million. Ark & 21Shares’ ARKB stumbled out the door with $128.07 million, while Grayscale’s GBTC lost $48.89 million-ouch, that’s gotta sting!

Additional casualties included Vaneck’s HODL (-$17.04 million), Valkyrie’s BRRR (-$11.34 million-did someone say “bad omen”?), Franklin’s EZBC (-$8.72 million), and Bitwise’s BITB (-$7.10 million). With $8.94 billion in trading volume, bitcoin ETF net assets slipped to $134.53 billion, a drop so steep it might qualify as an extreme sport 🎢.

Ether ETFs were not invited to this party, losing $219.37 million across four funds. Blackrock’s ETHA led the sadness parade with $111.08 million walking out the door, followed by Grayscale’s Ether Mini Trust at $68.64 million. Fidelity’s FETH and Grayscale’s ETHE weren’t far behind, each shedding nearly $20 million. Total trading volume was $4.15 billion-basically, people are nervous, and who can blame them? 😬

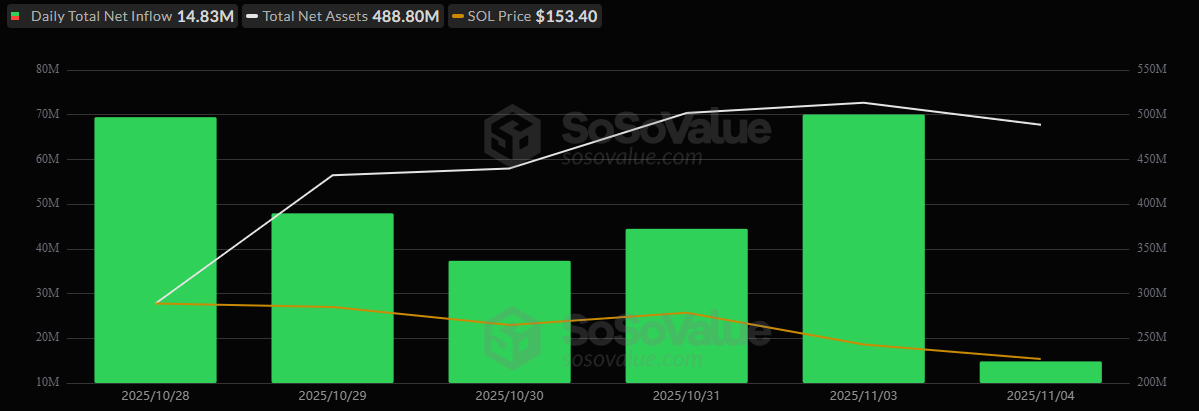

Meanwhile, Solana is the prom queen of the ETF world, attracting $14.83 million in fresh inflows. Bitwise’s BSOL scooped $13.16 million, and Grayscale’s GSOL added $1.67 million, pushing total net assets to $488.80 million on $68.53 million in volume. Go, team Solana! 🎉

So, even as bitcoin and ether ETFs keep slipping on banana peels, Solana quietly winks at investors, hinting that maybe, just maybe, there’s hope for a plot twist in the crypto ETF soap opera.

FAQ📉

- Why did bitcoin and ether ETFs see massive outflows again?

Investors pulled $797 million faster than a magician’s rabbit as market sentiment stayed risk-off for a fifth straight day. - Why are Solana ETFs still attracting inflows?Solana ETFs brought in $15 million, proving optimism sometimes survives even the meanest market chaos.

- Which funds were hit hardest by redemptions?Fidelity’s FBTC and Blackrock’s ETHA led the exodus, losing $356 million and $111 million. Ouch, that’s gotta leave a mark!

- What does this mean for crypto ETF investors?Money is moonwalking away from bitcoin and ether toward alternative assets like Solana, showing that sometimes, small but smart wins the day.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

2025-11-05 16:21