What to Know:

- Bitcoin clings to $100K like a drunkard to a lamppost, with models whispering of a $135K-$140K crescendo by 2025. A bold prediction, or merely a poet’s delusion?

- BlackRock and Fidelity, those institutional titans, continue to pour liquidity into Bitcoin’s lap. Their presence is as comforting as a wet umbrella at a garden party.

- Bitcoin Hyper ($HYPER) has raised $25.7M, nearly hitting $26M in its presale. A project so ambitious, it claims to marry dApps and smart contracts to Bitcoin. One might call it a fairy tale… if the fairy had a whitepaper.

- $HYPER offers 46% staking APY. One might think the project was devised by a poet, not a programmer. At $0.013215 per token, it’s practically a discount on tomorrow’s chaos.

Bitcoin’s price remains above the sacred $100K threshold, consolidating near $103,700 after a 3% dip that would make a Victorian faint. Yet, like a stubborn peacock, it refuses to abandon its 50-day trend average near $108K. The bullish trend persists, or perhaps it’s merely too proud to admit defeat.

Institutional inflows into Bitcoin ETFs continue unabated, with BlackRock’s IBIT now eclipsing Coinbase’s Deribit. A $38 billion crown for a platform that once sounded like a typo. Progress, my dear reader, is a fickle mistress.

These inflows have done little to quell volatility, but hey, who needs stability when you can have a rollercoaster of emotions and a spreadsheet of losses?

Quantitative models predict a $135K-$140K peak by December 2025, provided Bitcoin doesn’t trip over its own ego. A lofty goal, or a cry for help dressed in numbers.

Amidst this chaos, Bitcoin’s Layer-2 scaling networks-those digital Swiss Army knives-have regained attention. They promise to turn Bitcoin into a DeFi titan, or perhaps just a slightly less sluggish one.

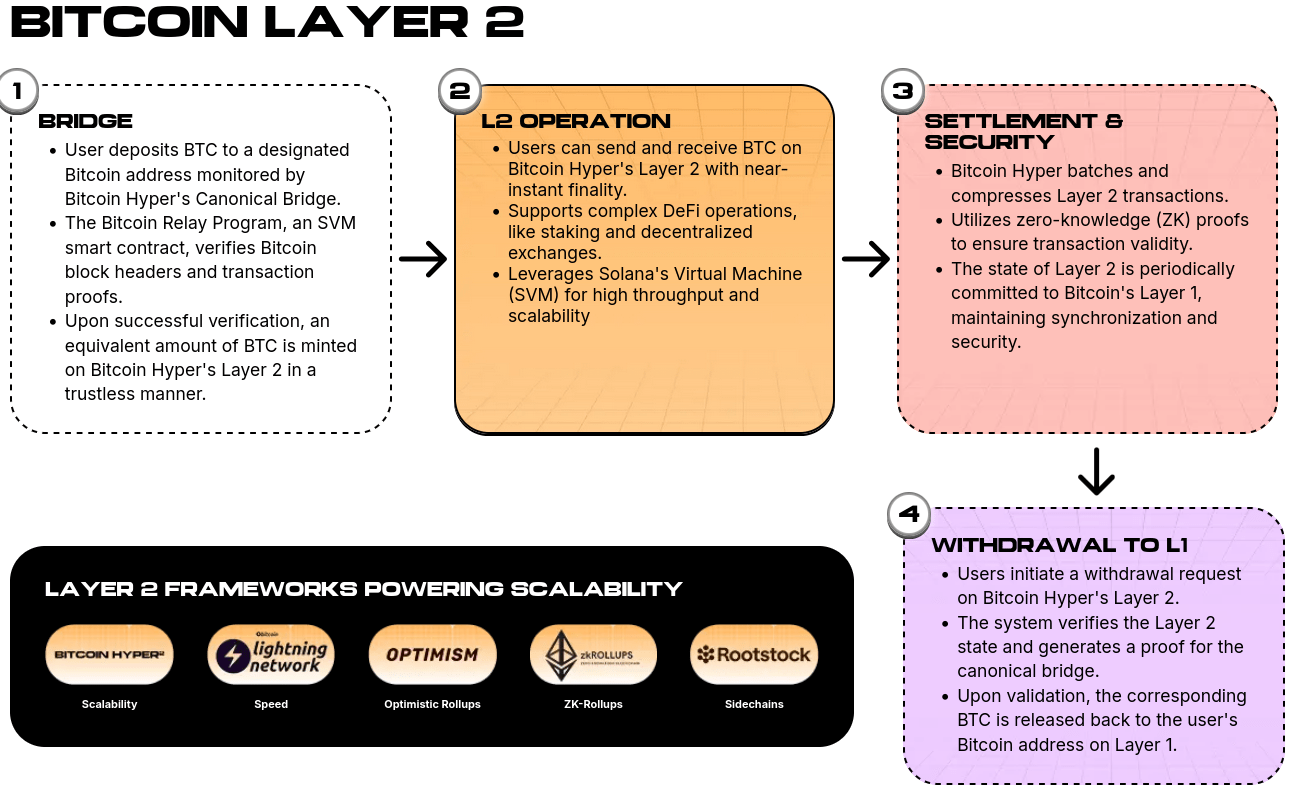

Bitcoin Hyper ($HYPER), that audacious Layer-2 platform, seeks to make Bitcoin faster than a gossip at a dinner party. It’s a project so confident in its utility, it’s already raised $25.7M. One might call it a masterpiece… if the masterpiece included a roadmap and a budget.

As Bitcoin marches toward its 2025 crescendo, Layer-2 ecosystems will likely bask in its reflected glory. Ethereum’s Arbitrum and Polygon may soon find themselves outshone by a newcomer with a name that screams both ambition and mild confusion.

Bitcoin Hyper ($HYPER) aims to combine scalability, low fees, and EVM compatibility. A trinity of virtues, or a marketing department’s fever dream? Only time will tell.

The project’s Canonical Bridge and Solana Virtual Machine sound like tech jargon crafted by a committee of poets and engineers. It promises transactions faster than a Victorian’s sigh. One might call it a revolution… if the revolution included a beta test.

This hybrid model, blending Bitcoin’s security with Layer-2 whimsy, could turn $BTC into a DeFi haven. A feat worthy of a standing ovation-or at least a raised eyebrow.

$HYPER, the ecosystem’s token, boasts capped supply and transparent vesting. A charming combination, or a desperate attempt to mimic legitimacy? The market shall judge.

Price predictions for $HYPER range from $0.08625 in 2026 to $0.253 by 2030. A 552% to 1,814% leap, or a gamble dressed in graphs? The future, as ever, is a gamble best left to those with nothing to lose.

At $0.013215 per token, with 46% staking rewards, $HYPER offers passive income for the optimistic. A reward for faith, or a tax on hope? You decide.

For investors craving Bitcoin’s growth without the hassle of mining, $HYPER is an “asymmetrical opportunity.” A phrase so overused, it’s practically a metaphor for itself.

Here’s how to buy Bitcoin Hyper right now. Or, as Wilde might say, “buy it before the next crash, or the one after that.”

Buy $HYPER on the official site.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-11-04 15:44