In the hushed corners of the Bundestag, where the air smells faintly of bureaucracy and regret, the Alternative for Germany (AfD) has cast a stone into the pond of fiscal policy. Their motion? To elevate Bitcoin from a digital curiosity to a national reserve asset, a move as bold as a farmer swapping his plow for a rocket ship. But here’s the kicker: in July 2024, Germany sold 50,000 Bitcoin for $3 billion-coins now worth $6.5 billion. A decision that makes one wonder if the German treasury’s accountants were paid in Monopoly money. 🤷♂️

What the AfD Wants

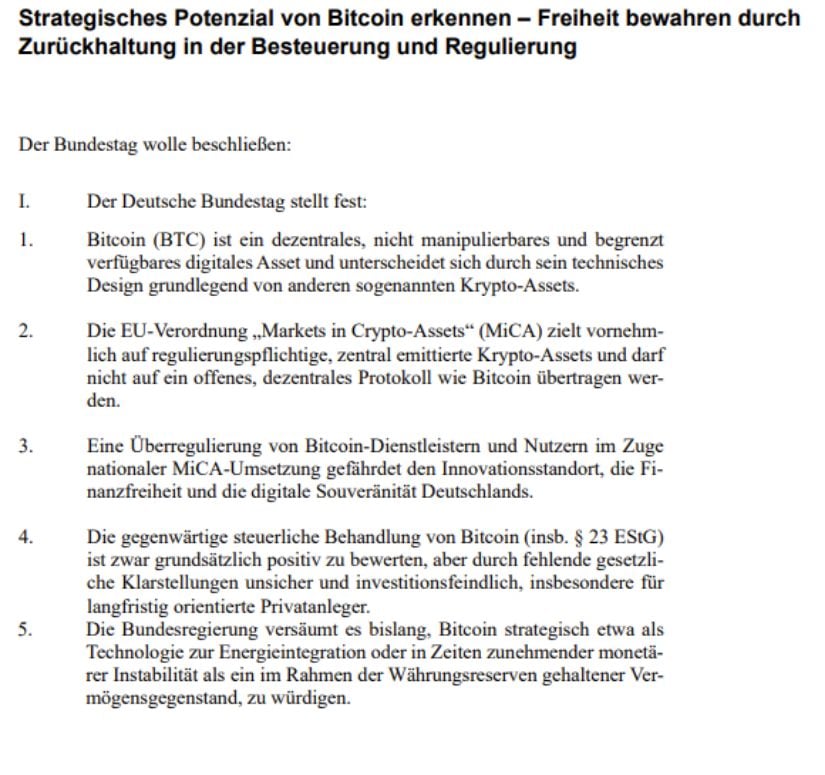

On October 24, 2025, the AfD dropped a manifesto on the parliamentary table, arguing that Bitcoin isn’t just crypto-it’s a “digital gold” that shouldn’t be shackled by Europe’s MiCA regulations. “Overregulation,” they declared, “is a thief in the night, stealing Germany’s innovation, freedom, and digital dignity.” Their plan? Snag 2% of Bitcoin’s supply, a heist of sorts that France might envy. After all, the French are eyeing 420,000 Bitcoin themselves, probably while sipping espresso and muttering about la vie. ☕

The AfD also wants to preserve Germany’s sweet tax loophole: hold Bitcoin for 12 months, and the gains are yours to keep. They’re fighting to keep it VAT-free and protect citizens’ right to stash their own coins. Because nothing says “sovereignty” like a citizen holding a digital ledger in their pocket, right? 🗝️

Germany’s Costly Mistake

Let’s rewind to July 2024. German authorities, in a fiscal decision that could’ve been scripted by a sleep-deprived intern, sold 50,000 Bitcoin seized from a pirated movie site called movie2k. They pocketed $2.9 billion… only for Bitcoin to moonwalk to $113,000. The result? A $3.5 billion phantom haunting the halls of power. And don’t get me started on the market crash they triggered. Bitcoin’s price nosedived from $70k to $56k, leaving investors clutching their wallets like a toddler holding a melting ice cream cone. 🍦

Europe Joins the Bitcoin Reserve Trend

France, ever the copycat, is now drafting legislation to amass 420,000 Bitcoin using nuclear energy surpluses and seized crypto. Switzerland, meanwhile, is flirting with constitutional changes to let Bitcoin join the central bank’s balance sheet. And the U.S.? They’ve already created a Strategic Bitcoin Reserve, consolidating 198,000 Bitcoin from criminal seizures. Sixteen states are playing along, proving that Bitcoin isn’t just a currency-it’s a geopolitical game of musical chairs. 🎭

Real Challenges Ahead

But let’s not get carried away. The AfD is an opposition party, and Germany’s governing coalition is about as likely to hand them a victory as a cat is to learn calculus. The motion will trudge through committees, where it’ll likely be buried under a mountain of paperwork. And then there’s the technical nightmare: storing Bitcoin securely, managing keys, and explaining volatility to a public that still thinks “blockchain” is a new type of cheese. 🧀

Federal Reserve Chair Jerome Powell summed it up best: “Bitcoin isn’t on our list of allowable assets.” Translation: “We’re not ready to admit we’re out of our depth.”

Germany’s Growing Bitcoin Economy

While politicians dither, the private sector is sprinting ahead. Hamburg’s Aifinyo AG is investing €3 million in Bitcoin, eyeing 10,000 coins by 2027. Garry Krugljakow, the company’s Bitcoin guru, predicts DAX firms will soon treat Bitcoin like a financial vitamin. “Inflation protection,” he says, “or perish.” Meanwhile, Germany ranks third in Europe for crypto value received-a country that sold Bitcoin in 2024 but still issues more MiCA licenses than any EU nation. Talk about mixed signals. 🤪

The Bottom Line

The AfD’s motion may die a quiet death, but the conversation is alive and well. Bitcoin, once dismissed as a millennial fad, is now a fixture in discussions about monetary sovereignty. Whether Germany builds a reserve or not, the debate itself is a sign that the world is changing faster than the average bureaucrat can file a report. And as Bitcoin soars above $110k, one thing’s clear: governments who sell too soon may find themselves staring at a golden opportunity they let slip through their fingers. 💸

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-10-30 23:45