Ah, the yellow line on our chart, that gilded serpent of global liquidity, ascends with all the grace of a champagne cork at a debutante ball, while poor asset F languishes in its humdrum horizontal existence. Since M2 is the grand total of money pirouetting through the world economy, an uptick in liquidity has historically been the polite prelude to raucous parties among risk assets – yes, even those digital coins that blink at you from your screen. 🍾

Highlights Points to Bullish Divergence and Latent Opportunity

The most delightful part of this spectacle is the yawning chasm between the exuberant liquidity and our coin’s staid demeanor. One might almost call it a “lagging opportunity,” except that sounds rather dry for what is truly a flamboyant invitation to speculative theatre. Historically, when the global money supply dances faster, neglected digital assets often spring to life with the enthusiasm of debutantes discovering their first pair of diamonds.

The post caption “BULLISH CHART!” shouts across cyberspace like a particularly excitable town crier, suggesting that WIF might, at last, join the grand parade once capital resumes its merry rotation. 🎉

Yet, lest we become hopelessly intoxicated with optimism, the analyst reminds us that liquidity-driven ballets rarely begin on cue. Timing, dear reader, is as capricious as a cat in a ballroom, and only when sentiment sways – perhaps nudged by Bitcoin’s magnificence or a sprinkle of market optimism – does the performance truly commence. Macro liquidity lays the stage, but the actors – the asset itself – must still play its part with grace.

Indeed, WIF’s immediate antics will hinge on the local theatre: trading volumes, speculative whispers, and the steadfastness of the Solana ecosystem that cradles it.

Market Metrics Highlight Neutral but Resilient Structure

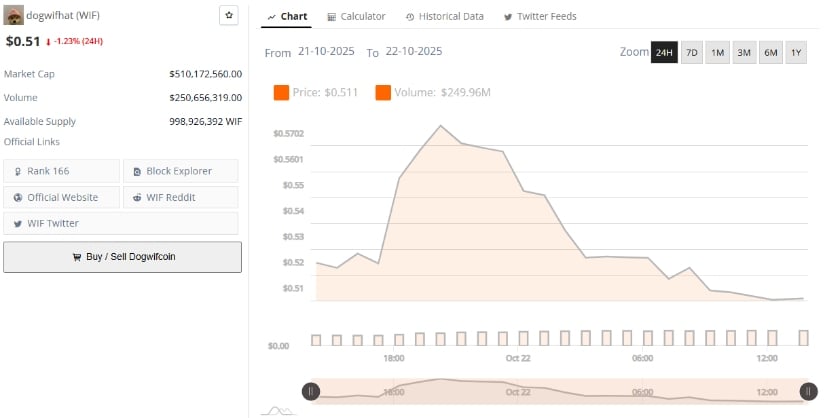

According to the ever-watchful BraveNewCoin, dogwifhat currently trades at a modest $0.51, down a barely noticeable 1.23% over the last 24 hours. Its market capitalization, a dignified $510.17 million, earns it the 166th seat in the global crypto opera, while a 24-hour trading volume of $250.65 million keeps the chorus bustling. 🎭

The circulating supply, nearly a billion tokens, pirouettes gracefully among major exchanges, suggesting that the dancers await only the conductor’s baton – a macro or technical cue – before launching into full choreography.

Technical Indicators Suggest Early Stabilization Phase

On the grand stage of TradingView, the WIF/USDT pair twinkles near $0.507, down 3.61% for the day. The chart unfurls a languid sideways-to-bearish tale, finally flirting with stabilization – a promising whisper of base formation. The BBPower indicator, reading -0.080, murmurs of lingering bearish shadows yet hints at flattening skies, a prelude to fading downside drama. 🌥️

The Chaikin Money Flow, flirting at -0.04, is slightly sulky but far from scandalous, indicating capital tiptoeing rather than stampeding – often a harbinger of the coming volatility waltz. Should CMF turn cheekily upward and BBPower don a positive hue, one might surmise that the selling exodus has ended, and accumulation, like a determined lover, will once again take center stage. 💃

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

2025-10-23 02:55