The steep decline that sent Worldcoin tumbling below the $1.00 mark has finally slowed down, with the price now hinting at some semblance of stability. It’s as if the market participants woke up and said, “Hmm, maybe we should rethink this whole panic-selling thing,” and now we’re seeing a bit of cautious optimism creeping in. The current vibe? Less volatility, more cautious accumulation-classic signs that the market is winding down from a correction. Of course, it’s anyone’s guess if this newfound calm will last, but let’s pretend for a second it might.

Leverage Reset: When Liquidations Do All the Heavy Lifting

On the shorter timeframes, WLD has been consolidating like a sloth after a week-long marathon. The liquidation-induced crash saw open interest plunge from over 300 million to just 111 million, according to the data from derivatives markets. This is what we call a “deleverage phase”-essentially, a market-wide spring cleaning where all the overly enthusiastic bets are wiped out. It’s a little like shaking out a rug to get rid of the dust. What’s left is a more sustainable market with fewer speculative positions. Probably for the best, honestly.

These are the conditions where things generally calm down. With less leverage on the table, the wild price swings become less likely. The crypto world, in its chaotic glory, has had its fun, but now we’re seeing a more steady hand at play. With open interest staying flat and low, the market is starting to behave more like a traditional spot-driven exchange than a circus of futures traders chasing the next big move. If this calm holds, we could be seeing the beginning of a recovery-emphasis on “could.”

Market Data: Volatility Taking a Nap

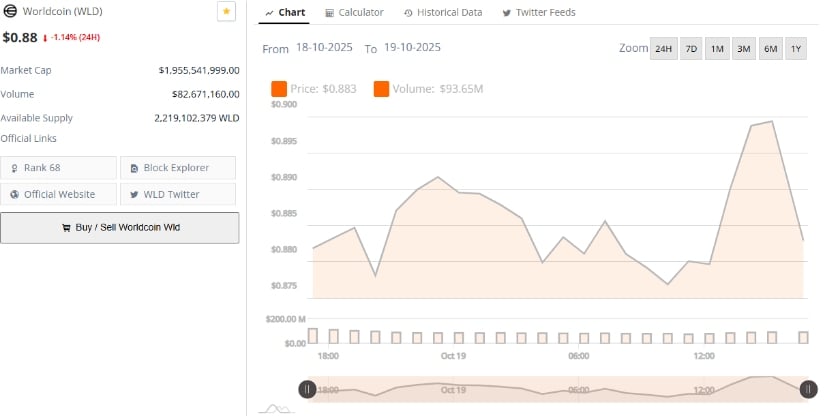

As it stands, Worldcoin is trading at $0.88, down a modest 1.14% in the last 24 hours, according to BraveNewCoin’s latest data. The market cap sits comfortably at $1.95 billion, and the 24-hour trading volume is at $82.6 million-nothing to sneeze at. Despite the lackluster performance, the liquidity is consistent, and the heavy selling pressure that plagued the coin earlier seems to have backed off. Could it be that the worst is over? Time will tell, but the markets are definitely less panicked than before.

This shift marks a departure from the earlier mayhem. No more wild price swings, no more dramatic moves. Instead, we’ve got buyers and sellers quietly sitting on their hands, waiting for a clearer signal before making any big moves. It’s like a crowded room full of people trying to figure out if the last piece of cake is worth the fight.

Technical Indicators: Worldcoin May Have Found Its Bottom (Or Not)

As of this writing, WLD/USDT is hanging around $0.905, according to TradingView. The Bollinger Bands are squeezing tighter than a pair of jeans after Thanksgiving dinner. The upper band is near $1.46, the baseline sits at $1.10, and the lower band hovers around $0.73. What does this tell us? The price is consolidating near the bottom of the range, which could mean we’re primed for a potential bounce-if, of course, the buyers don’t decide to take a nap again.

The Relative Strength Index (RSI) is sitting at a mere 37.11, with the moving average at 38.60-both under the neutral 50 mark. Translation: the bears are still in control, but their grip is loosening. Historically, when RSI dips below 40, recovery is often just around the corner-especially if volatility and open interest start to calm down. So, if the $0.90 support holds, we could be looking at a short-term rebound up to the Bollinger upper band at $1.45-imagine a 60% jump from where we’re at now. But, let’s not get too excited just yet; if the price falls below $0.73, all bets are off, and we’re back to square one.

In short, we’ve got reduced leverage, lower volatility, and oversold conditions. It’s like the market is taking a deep breath before making its next move. Will it be a breakout or a breakdown? The stage is set, and only time will tell-so keep your seatbelt fastened, folks. It’s going to be a bumpy ride either way. 😊

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-10-20 00:12