Ah, the markets. Such a swirling vortex of hope, fear, and, let us not forget, the persistent human tendency towards… folly. 🙄 It seems our modern alchemists, those chasing digital gold in the form of cryptocurrencies, have found themselves somewhat… outpaced. By *actual* gold. A substance, one might recall, that has held value for millennia, largely because it cannot be conjured into existence with a few lines of code.

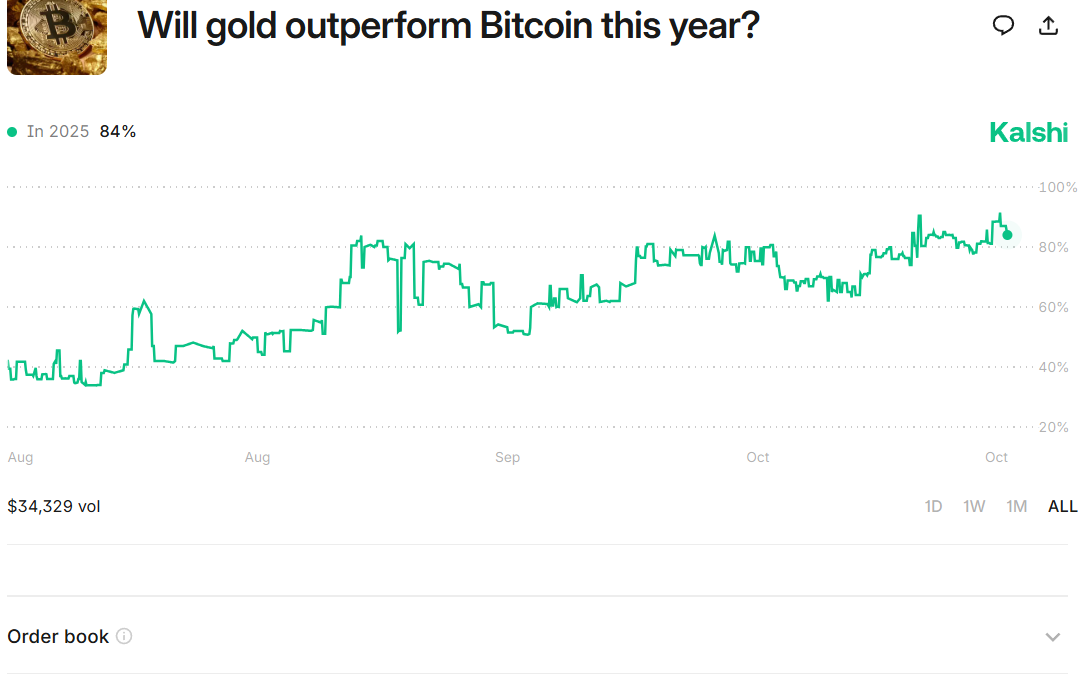

It is reported, with a degree of astonishment that perhaps suggests we should all be spending more time reading history books, that gold has ascended nearly 60% this year. Bitcoin, meanwhile, manages a mere 13%. A respectable increase, undoubtedly, for a digital phantom, but hardly a triumph when compared to the steady gleam of the precious metal. Analysts, those keen observers of the human condition, proclaim gold not to be overpriced. One wonders, are they implying *bitcoin* is?

The crypto-traders, alas, seem captivated by a dangerous game. Like moths to a flame, they embrace leverage – a concept best understood as borrowing money to amplify both potential gains *and* inevitable losses. 📉 A grand experiment in risk, it appears, with a considerable number finding themselves on the wrong side of the ledger. Only a third are enjoying the fruits of their daring, while the rest are left contemplating the ephemeral nature of speculative wealth. 😅

Consider the tale of this “Machi Big Brother,” a modern Icarus who, with excessive ambition and a generous helping of borrowed funds, soared too close to the sun… or, in this case, the volatile price of Bitcoin. From a rather impressive $43 million in profit, he has descended to a considerably less impressive -$13 million. A humbling lesson, one might say, in the dangers of hubris and the cruel arithmetic of high finance.

Machi Big Brother(@machibigbrother) just got liquidated again – his account balance is down to only $32.8K.

He’s gone from +$43.64M in profits to now over -$13M in losses!

– Lookonchain (@lookonchain) October 16, 2025

And the market, ever the discerning judge, has spoken. A massive deleveraging – a term that sounds suspiciously like a societal purging – has occurred, wiping out mountains of borrowed money and leaving the field in a state of “reset.” Funding rates echo the despair of prior collapses, and even those who once championed these digital assets now speak of contraction. Bitcoin, it seems, may be forced to retreat below the $108,000 mark, a fate that would undoubtedly cause much gnashing of teeth among its adherents.

Gold, however, remains serene. Driven by the age-old anxieties of geopolitical unrest and the quiet comfort of stable value, it continues to attract those who seek shelter from the storm. A tale of two markets, truly. One built on speculation and the fragile assurances of technology, the other on the enduring foundations of human fear and a certain amount of common sense. 😉

For now, it is clear: the market desires a bull run in Bitcoin, but the reality it receives is far more… golden.

Market Movement:

BTC: Bitcoin, presently trading around $108,287, experiences a decline due to risk aversion, profit-taking, and the unending uncertainties of the world.

ETH: Ether, at $3891, mirrors Bitcoin’s slide as the allure of speculation wanes and doubts creep into the minds of investors.

Gold: Gold ascends, as prudent investors seek respite from the volatile winds of fortune.

Nikkei 225: The Nikkei 225 dips 0.3% as anxieties regarding global conflicts weigh heavily on Asian markets.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-10-17 05:51