Funding rates on crypto derivatives just dove to 3-year lows, like the market flipped the bird amid a tidal wave of liquidations and a total speculative wipeout! 😵💫

These funding rates for crypto derivatives? They’re lower than a snake’s belly in the 2022 bear market flop. All this after billions in leveraged bets got flushed down the toilet like yesterday’s bad trade. 🚽

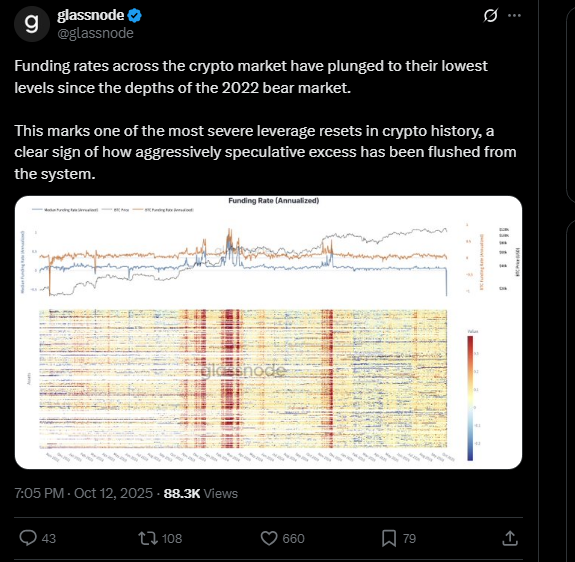

Glassnode, the on-chain sleuths, spilled the beans Sunday on this epic leverage purge – one of the wildest resets in crypto’s madcap history. Who knew deleveraging could be such a blockbuster? 🎥

Source- X (because why not tweet your financial doom? 📱)

Funding rates? Oh, those are the cheeky little payments traders swap in those never-ending perpetual futures contracts, like crypto’s version of a bad blind date. 💸

They keep the contract price from straying too far from the spot price – balance, schmalance! When rates tank low or go negative, shorts are partying harder than longs, betting the house on a price nosedive. 📉

Traders are shelling out cash to hold those gloomy shorts, like paying for the privilege of being the eternal pessimist at the crypto casino. 🎰

Shorts Everywhere – But Hey, Isn’t This Bullish in Disguise? 🤡

Right now, the funding scene screams “oversold apocalypse!” with shorts piling up like bad sequels in a Brooks flick. But wait – could this spark a hilarious short squeeze? Prices tick up, shorts panic-buy, and boom, prices skyrocket! Watch the comedy unfold. 🎪

CoinGlass data shows the crowd’s split: 54% bullish maniacs, 29% bearish grumps, and 16% “meh” neutrals – like a family reunion gone wrong. 🥳😠😐

Open interest? 60:40 longs over shorts – optimists edging out the doomsayers, barely. Yet Bitcoin and Ether perpetuals are dipping negative, like the market’s got a sour stomach. 🤢

Spot markets? They’re bouncing back like a rubber check! Bitcoin’s up over 5% from sub-$110K blues, Ether’s leaped 12% – talk about a V-shaped victory lap! 🏆

Black Friday Bloodbath: Historic Liquidations = Market’s Comedy Reset? 🎭

This funding nosedive follows crypto’s “Black Friday” fiasco – a liquidation extravaganza that makes the original sale look tame. One trillion in market cap? Poof! Down 25% in hours. Leveraged long cowboys? Yee-hawed right out of town, with 1.6 million accounts biting the dust. 💀

Bitcoin’s first big red candle? Nuked 380 billion in cap – historic hilarity! Then, V-shaped rebound as shorts got the squeeze of their lives, like villains in a slapstick chase. 🏃♂️💨

It’s the ultimate deleveraging farce, flushing out the over-speculative clowns to steady the ship. Rebalancing leverage? More like crypto’s needed spa day after a wild party. 🛀

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-10-14 15:29