Oh dearie me! Just when you thought Crypto Twitter was calming down, it turned into a raucous circus once again! 🎪 Screenshots, wallet trackers, and those pesky red candles formed a monstrous spectacle-a tale of ‘massive manipulation’ concocted by mysterious “major platforms” or, dare I say, shadowy over-the-counter (OTC) desks, likely lurking in dark corners! But, if you squint really hard and take a step back from the cacophony, you might just find that the real villain in bitcoin’s dramatic tumble from $122,000 to $109,683 isn’t a menacing puppet master after all. No, no-it’s merely the frothy brew of pure volatility, hocus-pocus psychology, and a robust sprinkle of fear!

The Anatomy of Panic Tweets: Inside Crypto’s Latest Meltdown

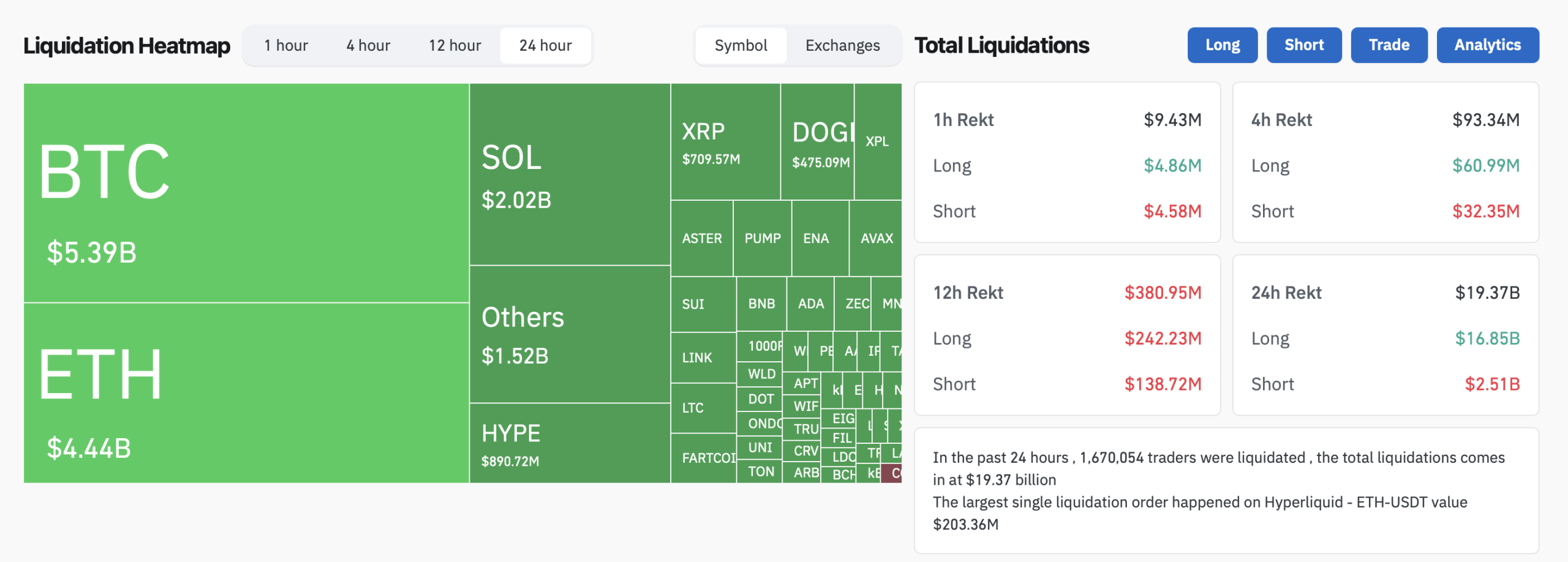

Friday was nothing short of a dizzying rollercoaster ride for the crypto markets, with digital assets flailing their arms as they tried to recover from one of the wackiest trading days ever recorded in the land of eco-friendly computers. According to the fancified charts from derivatives platforms, over $20 billion in long and short positions went poof! in just 24 hours – the largest single-day wipeout in crypto history! Now, doesn’t that just tickle your fancy?

Every time the market dips, a commotion erupts on social media like children fighting over candy bars. The names change, the screenshots morph, but the recipe remains unchanged: a sprinkle of whale activity, a blood-red chart just begging for commentary, and voilà! Instant accusations! Why, these posts rack up likes faster than a cat video, hitting traders’ worst fears-“Somebody’s got to be in control!” But let’s face it, blockchain transparency doesn’t always mean you’ve cracked the code; correlation isn’t causation, my dear Watson!

Now, here’s the pickle: wallet data may look dramatic-almost like an opera in five acts-but it’s missing its context! A glorious deposit to a major platform could very well be just good old internal rebalancing-not a precursor to an impending liquidation doom. Those OTC desks? They might just be moving funds around for some good ol’ client redemptions or to seize a juicy arbitrage opportunity. Without timestamps tied to executed trades, all the on-chain flows tell you is half the yarn! And half-tales, when paired with panic, are the origin of myths, much like the legend of the Loch Ness Monster!

Oh, sweet liquidations, many have blamed you, but remember, context is queen! Earlier that week, reports revealed a monster-sized expiration of over $5.3 billion in bitcoin and ethereum options on one major derivatives platform alone. Meanwhile, the cheeky BTC dangled ever so precariously just shy of its “max pain” level-where most options expire like balloons at a birthday party, all sad and deflated! Combine that with the overly-enthusiastic energy of “Uptober,” and the over-leveraged long positions stacked up quicker than you can say “Bob’s your uncle!” turning bullish excitement into a delicious frenzy of liquidations.

Now here’s a chuckler: Crypto is, hands down, one of the few markets where narratives gallop faster than an excited herd of elephants! 🐘 A simple tweet showcasing a “$700 million deposit” will get tens of thousands of eyes glued before anyone bothers to check if those funds even fancied a little visit to the spot markets! It’s the digital equivalent of shouting “fire!” in a crowded room-elbowing through chaos left and right! Still, savvy data analysts will tell you that genuine manipulation leaves clearer footprints than a giant’s shoe in a pigsty!

Simple math of liquidity, my friends! 🧮 When prices reach dizzying heights, spreads tighten like a pair of pants after a pie-eating contest, and leverage increases. If a few overly ambitious positions decide to unwind, the dramatic consequences look catastrophic, like finding $20 billion went to sleep and never woke up! But fret not, it’s just a feedback loop-bots selling into weakness, emotional traders reacting as though they’ve just seen a ghost, and boom! Automated liquidations take their turn on the stage. Why, this same phenomenon happens in equities, just without the memes and laser eyes!

Of course, one can’t help but sympathize with the believers! Crypto has danced with manipulation before-like a twinkle-toed tango! From dainty altcoins to coordinated wash trades, the scars are still fresh. Who could forget the commotion left in the wake of FTX and Luna? Those collapses rattled market confidence and reshaped the risk awareness of digital assets-a cautionary tale that in crypto, trust can vanish quicker than your favorite chocolate at a children’s party!

Yet, painting every major drawdown as a grand scheme gives too much credit to a handful of actors while underestimating the delightful chaos of free markets! Sometimes, bitcoin merely corrects itself-nary a puppet string in sight!

Meanwhile, those major platforms are under the watchful eye of scrutiny and regulations galore! Their internal risk teams monitor every inflow and outflow, like hawks on the hunt, so they can avoid any nasty systemic shocks. The idea that they’d toss away their credibility for a quick crash is simply ludicrous-one would have to have rocks in their head! Their business thrives on trust and volume, both of which evaporate faster than snow on a sunny day when traders panic!

The real kicker is that these “market dump” tales can actually stir up more volatility! Retail traders hit the panic button and sell, whales take their leave, and liquidity thins out until the next dip feels like a slap on the wrist. So, the conspiracy becomes a self-fulfilling prophecy-not because it’s grounded in truth, but because enough folks choose to believe it! Fear is a remarkable market mover, sometimes flinging itself ahead of the fundamentals!

Crypto’s transparency is both its crowning glory and its biggest burden. Every wallet movement and liquidation story becomes a headline; every transaction sparks a new theory! But, seasoned investors know that the uproar isn’t always the evidence. Until we have proof otherwise, most of these dramatic dumps are simply the market being what it has always been-fast, emotional, and brutally efficient! Sometimes the simplest explanation is the one that rings the truest bell.

So, the next time your feed floods with liquidation charts, wallet IDs, and those blood-red emojis 🤬, take a moment to breathe! Ask yourself if the data truly points to manipulation or is merely reflecting activity. Because in crypto, perception shapes price-and panic often scribbles the tale before reality has a chance to catch its breath!

And remember, whether you’re riding the wild market waves long or short, one thing’s for certain-the current U.S. president has a remarkable knack for stirring things up online! Just a single Truth Social post from the big cheese can flip the mood faster than a meme coin going to the moon! 🚀

💡FAQ

- Are large wallet transfers proof of manipulation? Not usually; many are just internal movements or OTC settlements. 🤷♂️

- Can manipulation happen? Sure! But there needs to be solid proof, my dear Watson! 🔍

- Why does Bitcoin drop so sharply sometimes? Liquidations, leverage, and sudden sentiment shifts can send it tumbling like a toddler in a tantrum! 🤪

- What’s the best trader reaction to these rumors? Verify data, keep your cool, and don’t trade based solely on social media panic-no matter how bright the colors are! 🌈

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-10-11 19:49