Behold, the token, a beleaguered nobleman, now ensnared in the $1.20-$1.30 realm, where fate teeters on a knife’s edge-will it ascend to the gilded heights of $1.50 or descend into the abyss of despair? 🕯️💸

Price Action: A Dance of Desperation and Hope

In a recent X analysis, Efloud, the modern-day prophet of crypto, declared that WLD has bounced from an untested order block, a “logical support zone” as if the market itself were a fickle lover. The $1.12 level, a “key trigger area,” looms like a specter, ready to unleash chaos should the price dare to fall. 🧙♂️🔮

On the bright side, reclaiming $1.35 is hailed as a “positive milestone” for the bulls, who are currently more enthusiastic than a toddler with a sugar rush. The $1.46 resistance zone? A “battleground” where fortunes will be made or lost, as if the crypto world were a medieval tournament. 🏰⚔️

But failure to hold gains? A return to the “consolidation theme” that has persisted since the September peak-a peak so high, it’s practically a mountain. 🏔️

Efloud, ever the sage, warns of patience, for the asset is navigating “untested areas of market structure,” where liquidity and trader conviction are the true kings. A tale as old as time, but with more spreadsheets. 📊

Market Data: A Tale of Tears and Tedium

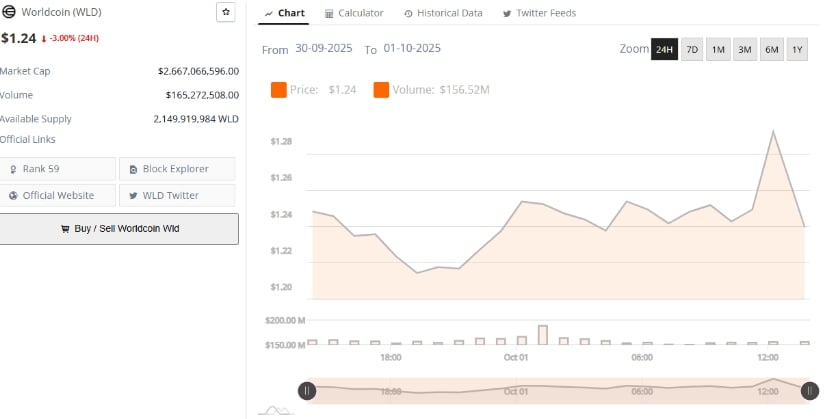

BraveNewCoin reports that Worldcoin is trading at $1.24, a 3.00% decline over 24 hours-a drop so steep, it’s practically a cliff dive. Its market cap? A meager $2.67 billion, ranking it 59th among cryptocurrencies, as if the crypto world were a popularity contest. 🎭

The available supply? A mere 2.15 billion tokens, a number so large it’s practically a metaphor for the project’s scale. Despite the “pullback,” liquidity remains steady, as if the market is merely yawned and continued. 🤪

The broader context? A sharp correction from its September high of $2.20, a fall so dramatic, it’s like watching a tragic opera. Yet, the $1.20-$1.25 area holds, a fragile hope that the coin might “form a new base.” A base so flimsy, it’s held together by wishful thinking. 🧵

Technical Indicators: A Symphony of Contradictions

At the time of writing, WLD is trading near $1.31, up 6% on the day-a short-term “bounce” that’s as reliable as a politician’s promises. Yet, the $1.50 resistance zone remains a “barrier” that continues to reject bullish advances. A barrier so stubborn, it’s practically a wall of bricks. 🧱

The Chaikin Money Flow (CMF) indicator sits at -0.14, a “signal” that capital outflows are dominant. A warning that while price has stabilized, inflows are “not yet strong enough” to support a “sustained recovery.” A warning as clear as a bell, but no one seems to be listening. 🧠

The MACD? A “marginally bullish crossover” with a negative histogram. A mixed signal so confusing, it’s like trying to read a Russian novel in a language you don’t speak. 📖

For traders, the setup is a “caution” that’s as necessary as a life jacket in a hurricane. Sustained inflows and “stronger momentum” would be needed to shift sentiment “decisively” toward bullish. Until then, price movement is “choppy”-a term that sounds more like a salad than a market. 🥗

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-10-02 00:13