Ah, the grand spectacle of the financial arena! Since its dizzying ascent to the heavens of $442 in July, the Strategy (MSTR) stock has been performing a most peculiar dance-a sideways waltz, if you will, eroding the gains of 2025 like a magician’s assistant vanishing into thin air. By Friday, September 26, it had slumped to a mere $309, leaving investors clutching their ledgers in bewilderment. Market soothsayers, with their crystal balls and fractal charts, whisper that MSTR is reenacting its 2021-2023 tragicomedy, a pattern that once unleashed a 50% crash. And who should appear in this melodrama but Peter Schiff, the dour prophet of gold, declaring that Michael Saylor would have fared better clutching a bar of bullion than a digital coin. 🪙✨

Is MSTR Stock Poised for Another 50% Plunge into the Abyss?

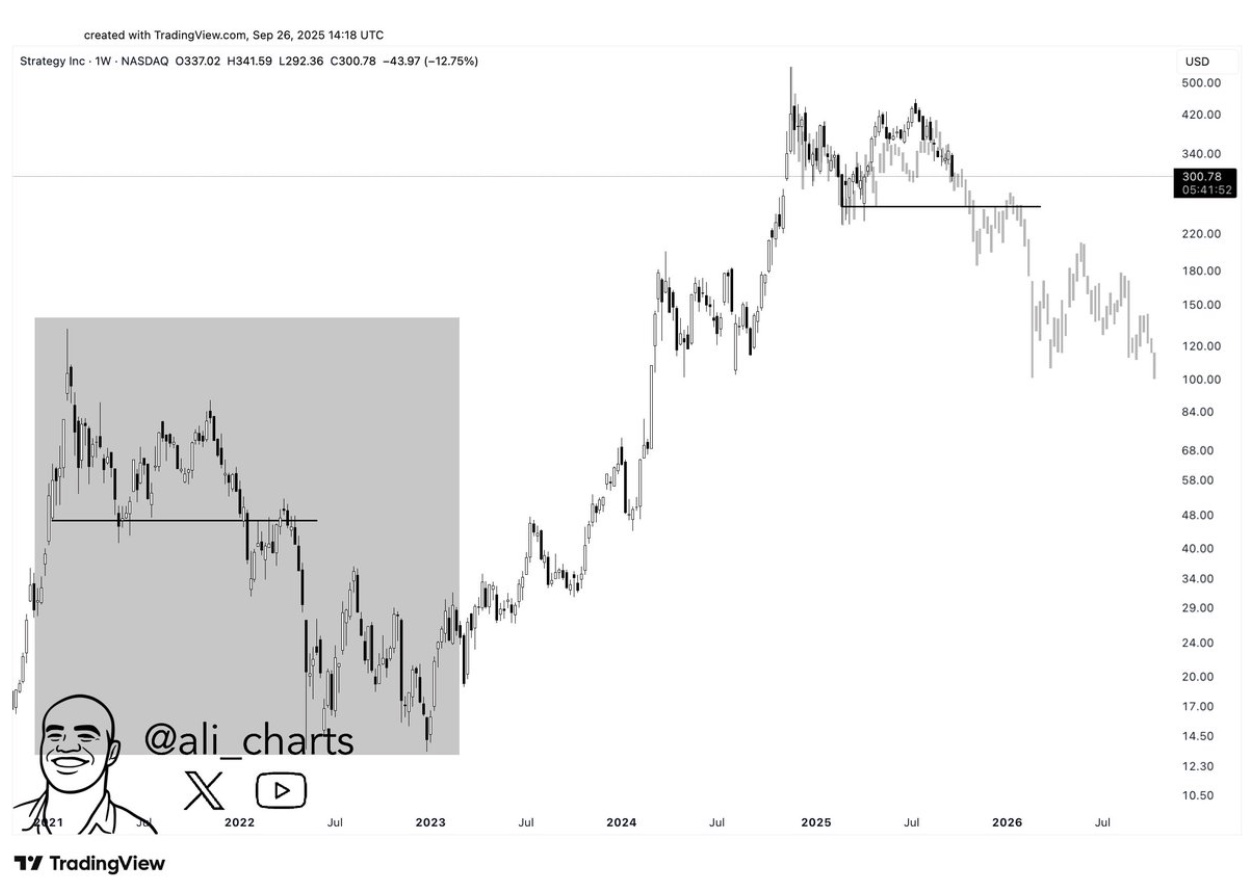

As the MSTR stock meanders through its interminable sideways journey, analysts-those modern-day Cassandras-are sharpening their quills, predicting another 50% descent. Crypto oracle Ali Martinez, with his charts and arrows, proclaims that MSTR is mirroring its 2021-2023 price pattern. The $257 level, he warns, is the last bastion of hope. Should it crumble, the stock may plummet to $120, leaving investors in a state of existential despair. 🌋💸

MSTR stock forms a fractal pattern, or perhaps a Rorschach test for the financially insane | Source: Ali Martinez

Ah, but MSTR is no ordinary stock-it is a siren, luring institutional leviathans with its premium above the value of its Bitcoin hoard. Yet, in 2025, this premium has shriveled like a forgotten balloon, with the company’s net asset value (NAV) deflating from 2x in January to a mere 1.44x today. Still, the Royal Bank of Canada, ever the optimist, increased its stake by 16% last quarter. One must admire their audacity, or perhaps their blindness. 🏦🤡

Analysts, ever the party poopers, suggest this decline reflects investor fatigue, a malaise born of sluggish Bitcoin acquisitions. With the premium evaporating, holding MSTR offers no advantage over clutching Bitcoin directly. The question lingers: why dance with the stock when one can waltz with the coin itself? 🕺💰

As of this writing, Michael Saylor’s Strategy sits atop a mountain of 640,000 BTC, a treasure worth $70 billion at current prices. Yet, some investors tremble at the thought of a BTC crash, fearing it could unleash a forced sell-off of biblical proportions. 🏔️💥

Peter Schiff to Michael Saylor: Gold, Not Bitcoin, Is the True Elixir of Life

Enter Peter Schiff, the gold-clad knight, brandishing his shield of bullion. He declares MicroStrategy’s Bitcoin strategy a folly, leaving it as vulnerable as a tightrope walker without a net. Schiff notes that while Saylor’s Bitcoin purchases show a paper gain of 47%, a gold investment would have yielded a modest 30%. But ah, the liquidity! Schiff argues that $61.5 billion in gold could be liquidated without a ripple, while selling $70 billion in BTC would crash the market like a falling chandelier. 🏰💎

Yet, Saylor remains undeterred, tweeting on Sunday, September 28, with the zeal of a true believer: “Always ₿e Stacking”. One wonders if he is a visionary or a victim of his own hubris. 🦸♂️🤯

Always ₿e Stacking

– Michael Saylor (@saylor) September 28, 2025

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-09-28 23:52