Ethereum woke up with a fire in its belly on Sunday, the markets crackling like a dry field in August. Spot prices hovered near $4,014, a number as stubborn as a mule, after a day of jittery dancing between $3,971 and $4,031. The derivatives desks, those wily coyotes, were steering the wagon, their eyes gleaming with a mix of hope and greed.

Calls Howl at the Moon, Puts Whisper in the Shadows: Ethereum’s Derivatives Circus

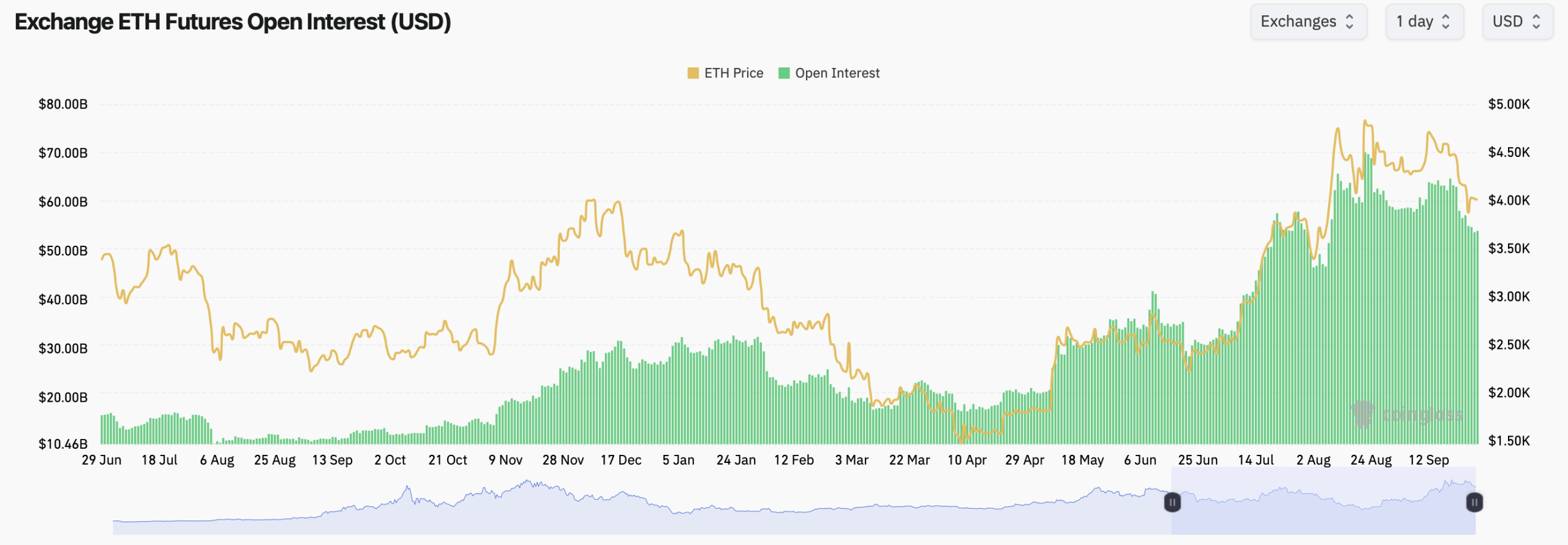

Futures positioning was as lively as a barn dance. Coinglass figures, those trusty old almanacs, showed exchange ether open interest (OI) higher than a scarecrow’s hat, peaking in August and settling like dust in late September. Prices, once soaring above $4,500, had tumbled back to the low $4,000s, like a farmer’s luck after a bad harvest.

The futures exchange leaderboards were crowded, each trader jostling for space like chickens in a coop. CME boasted 2.19 million ETH in open interest (~$8.76 billion), Binance crowed about 2.65 million ETH (~$10.62 billion), and OKX clucked with 820,500 ETH (~$3.29 billion). Bybit, Bitget, Gate, MEXC, WhiteBIT, BingX, and Kucoin were all in the mix, each with their own pile of eggs to protect.

Intraday flows were as mixed as a farmer’s weather predictions. One-hour OI ticks were green, but 24-hour changes turned red at CME, Binance, OKX, Kucoin, WhiteBIT, BingX, and MEXC. Bybit, Gate, and Bitget managed small positives, like a rooster finding a single grain in the dirt. Ratios of OI to 24-hour volume skewed high at WhiteBIT and Bitget, but lean at OKX and BingX, as if the scales were tipped by a gust of wind.

ETH options traders were as busy as bees in a sunflower field. Calls held 63.49% of open interest (1,645,409 ETH), while puts made up 36.51% (946,368 ETH). But the last day’s tape favored protection-puts took 62.11% of volume, versus 37.89% for calls, like a farmer hedging his bets against a storm. 🌧️

Most bets were aimed at year-end, like a family gathering for the holidays. On Deribit, traders piled into late December calls: the $6,000 strike had 92,738 ETH in open interest, followed by $4,000 (76,104 ETH), $7,000 (60,682 ETH), and $5,000 (55,058 ETH). Even $3,000 and $2,000 had solid stacks, like a well-stocked pantry.

Today’s heaviest trading leaned protective, like a mother hen guarding her chicks. Bybit saw big volume in puts: the Oct. 17 $2,000 put traded 29,019 ETH, and the March 27, 2026 $500 put moved 10,967 ETH. On the upside, Deribit’s Oct. 31 $6,000 call moved ~3,502 ETH, while OKX’s Sept. 29 $4,100 call and Binance’s Sept. 29 $3,750 put were also active, like a game of tug-of-war between bulls and bears. 🐂🐻

“Max pain”-the price where the most options expire worthless-sits near $4,000 in the near term, like a stubborn rock in the middle of a stream. It dips toward $2,500 around the Mar. 27, 2026 expiry, then bends back toward $4,000 into late June and early fall 2026, suggesting traders are bracing for choppy waters, like a sailor expecting a storm. ⛈️

Put simply, leverage prefers higher strikes by December, while flows hedge the belly. That mix hints at a range-bound dance near $4,000, with fatter tails both ways as macro and ETF headlines swirl like leaves in the wind. 🍂

With Ethereum parked around $4,014, futures and options together whisper: patience pays. Bulls have the open-interest stack, bears have the fresh volume, and both sides have plenty of exits marked around $4,000. Volatility sellers may lean in if rallies fade into resistance, like a farmer waiting for the right moment to harvest. 🌾

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

2025-09-28 19:03