In a world measured by digits and dusty roads, a stretch of price between 1.37 and 1.40 rises like a barbed-wire fence across a parched field. Break through it and the story might lead the day; stumble and the road stays flat as old gravel. 😅

Range Trading Concept Highlights Opportunity

According to a sharp-eyed analyst who posts under the name Personel Trader on X, WLD‘s setup carries the promise of a fair ride if the old ground-support-stays true.

The analysis points to instant buying whispers at the lower levels, a sign that demand still has some grit in its teeth as price retraces. The plan is a quick, sure-footed dance: if support holds, a ten percent rise into the 1.37-1.40 band could come as swift as a sunbeam over a wagon tongue. 😏

Personel Trader also hammers on tight risk management, with stop-losses tucked just beneath the local support. It keeps the prospect of a fall from becoming a ruin, while aiming at the old highs. The creed behind the plan hinges on several signs-price holding at Fibonacci support, prior tremors at demand levels, and a broader market mood that might swing bullish if the wind shifts.

Market Data Shows Liquidity

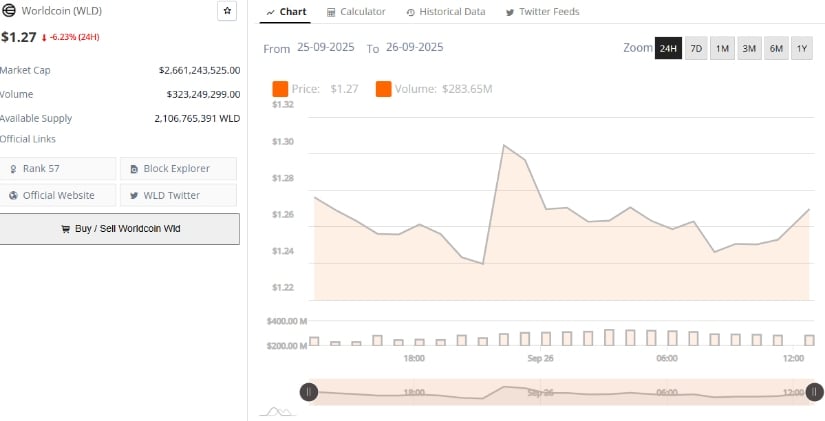

BraveNewCoin’s ledger spreads the weather of the day. Worldcoin trades around $1.27, with a market cap of $2.66 billion and a 24-hour volume of $323 million. 📈

The circulating supply sits at 2.1 billion tokens, lifting the asset to #57 by market cap. Even with a 6.23% drop in the last day, liquidity stays stubbornly robust across exchanges, inviting traders to keep showing up like farmers at a market. 🐄

This backdrop, a long, quiet evening of sentiment, suggests that the air has cooled but the bedrock remains solid enough for a possible spring. If the 1.22-1.20 support range keeps drawing buyers, the token might gather momentum and push toward its upper targets. If not, a break below 1.20 could push the bean-counter down toward the 1.10 zone. 🔔

Technical Indicators Lean Bearish

On the other side, the daily indicators wear a look of near-term weakness, though they keep a door cracked for reversal.

The MACD line sits at 0.036, trailing the signal line at 0.091, with a histogram of -0.056 crying out a bearish crossover. It says momentum has wandered back to the sellers, but a touch of stability near these numbers might coax a rebound. 😌

The Relative Vigor Index (RVI) stands at 31.03 against a moving average of 37.79, a gray reminder of lingering pressure. Readings below 50 tend to favor the sellers, yet the march toward oversold territory hints at a possible short-term bounce. For now, traders watch whether support can hold and reclaim ground, with 1.37-1.40 as the near sticker for the upside. 🤞

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Ireland, Spain and more countries withdraw from Eurovision Song Contest 2026

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

- ‘The Abandons’ tries to mine new ground, but treads old western territory instead

- How to get your Discord Checkpoint 2025

- Best Builds for Undertaker in Elden Ring Nightreign Forsaken Hollows

- HAIKYU!! FLY HIGH Character Tier List

2025-09-26 23:53