In a most unfortunate turn of events, the cryptocurrency market has begun its week on a most dismal note, experiencing a grievous decline of nearly 4.5% in value, with the unfortunate loss of hundreds of billions in market capitalisation within the short span of a mere 24 hours. Bitcoin, as the most well-known of these digital assets, led the decline, sliding approximately 3% to $112,800, thereby dragging the entire market lower in its wake. How very undignified, I daresay!

Whilst the common explanation points to a mere lack of momentum and some unseemly profit-taking, a far more subtle and insidious influence can be found in the quiet workings of the bond market, which, like a shadowy figure lurking behind the curtain, shapes the sentiments of global investors with great precision.

The Dreaded 2-Year Bond Yields, Prithee!

Bond yields are, as one might imagine, more than just mere numbers on a ledger for the Wall Street gentry. They are, in fact, the very harbingers of where one’s money might flow. As the esteemed analyst Mihir so sagely observes, the U.S. Treasury yields have become one of the most powerful signals for both stocks and crypto. How dreadfully important they have become!

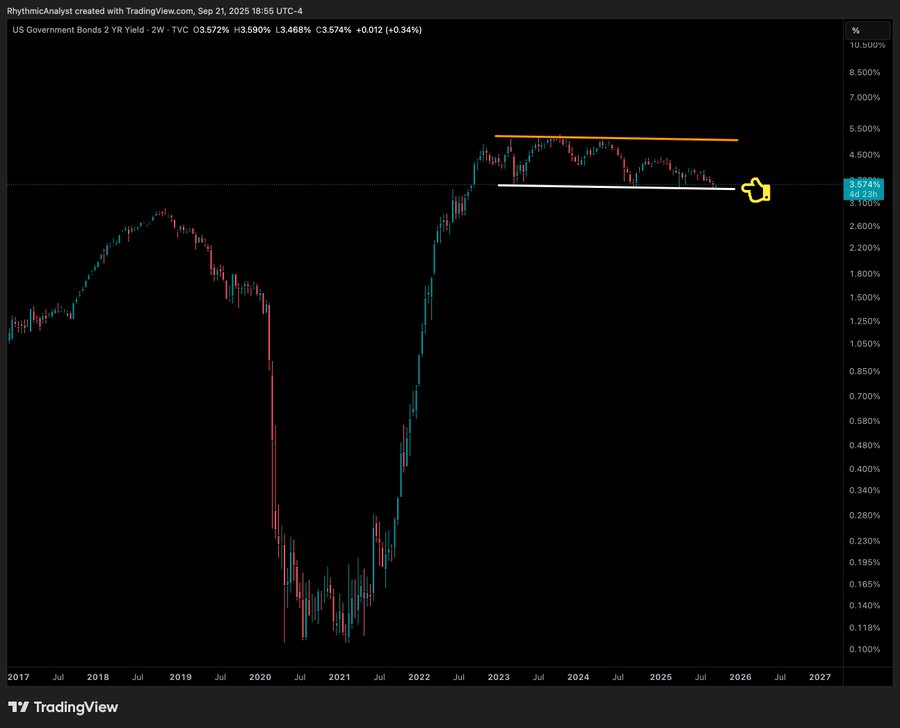

Following the extravagant era of COVID-induced money printing, yields, naturally, surged higher, a reflection of the rising uncertainty in the world. Yet since early 2023, the 2-year yields have rather languished in place, allowing for riskier assets such as crypto to rise. However, one must not be so easily deceived-rising yields are most unkind to Bitcoin and its less illustrious cousins, as investors flock to safer, though less rewarding, returns.

At present, the yields sit precariously upon a support level, awaiting a further decline. Should they fall further, one fears a significant shift in global markets may follow. A most alarming prospect indeed!

Mihir, ever the prudent observer, suggests that the weeks ahead will reveal whether this bond-induced pressure becomes the primary driver for crypto prices. We shall see, we shall see!

The Fading Hopes of a Fed Rate Cut

This ominous pressure on bonds comes just as the once-hopeful buzz surrounding the Fed’s recent rate cut begins to fade. Bitcoin and its kin dropped with alarming suddenness late on Sunday, as traders grew increasingly cautious about what future policy moves might lie ahead. Oh, how fickle the market can be!

Jerome Powell, the esteemed Chairman of the Federal Reserve, described the rate cut as nothing more than a “risk management” measure, offering little comfort to the market with his suggestion that there is no immediate necessity for further cuts. His words, filled with such cautious restraint, only served to further unsettle the market, as it became evident that traders were to be in no hurry for the promised relief. How dreadfully cautious!

The result, one might imagine, was a veritable frenzy of liquidations. In the span of just one day, 403,784 traders were utterly wiped out, and a staggering $1.7 billion was lost in total liquidations. The greatest misfortune befell a trader on OKX, whose BTC trade of $12.74 million met with an unfortunate and abrupt end. Truly, it is a tragic tale!

Alas! The Altcoins Fare Worse

As Bitcoin floundered, the altcoins, those poor unfortunate souls, suffered even sharper declines. Ethereum fell by over 7% to $4,190, a low not seen for more than a month. XRP sank by 6% to $2.76, its lowest in three weeks. Solana dropped by 7%, and Cardano found itself sinking a dreadful 9%.

Even the meme coins, those frivolous yet beloved tokens, were not spared from this calamity. Dogecoin plummeted by 11%, and the TRUMP coin, I do declare, fell a most undignified 9%. Such is the misfortune of the crypto market, my dear reader. Truly, a tale of woe!

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

2025-09-22 10:58