TL;DR

- BNB turned last year’s high into support, holding strong in the $780-$800 zone like a stubborn cat clinging to a sunny windowsill.

- Shorts are gathered at $895, and if BNB rises there, we might just witness a liquidation frenzy that could rival the madness of Black Friday.

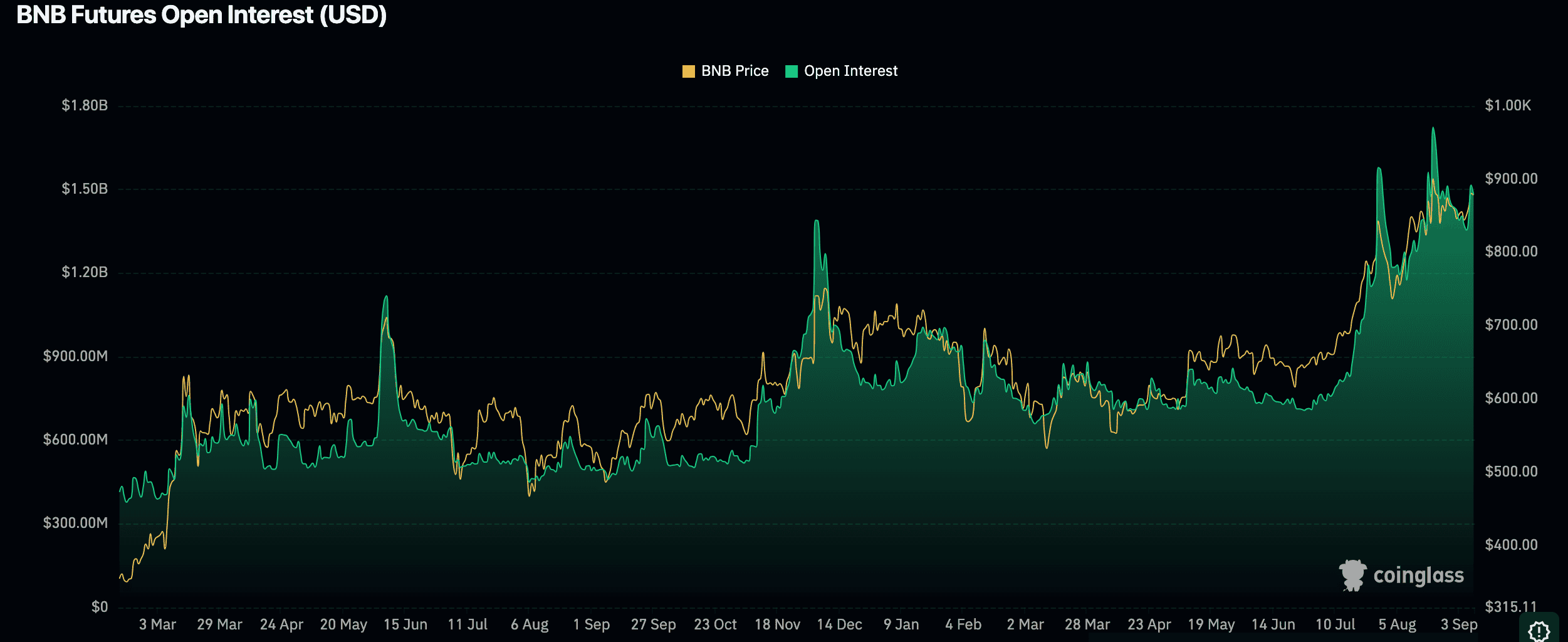

- Open interest at $1.49B is like a double-shot of espresso for the market – volatility incoming.

Breaking Through the Yearly High – A Glorious Return

Ah, BNB. It’s moved past last year’s high, transforming it into a sturdy support level. Crypto Bully, the ever-optimistic analyst, has called it “one of the best-looking charts” out there. Yet, unsurprisingly, it’s getting very little attention. Why? Perhaps people are too busy gazing at their own reflections in the market’s ever-moving waters. A missed opportunity? Maybe.

$BNB

One of the best looking charts, and simultaneously the least mentioned of.

Price action has been so well-behaved recently that it’s almost suspicious. Above last year’s high now acting as support. Honestly, it feels like a stealth move. Not much resistance to get in the way. We’re in uncharted territory now, folks. But any sudden move…

– Crypto Bully (@BullyDCrypto) September 8, 2025

The token is hovering around $880 at the moment, with daily volume clocking in at a solid $1.10 billion. Over the past 24 hours, BNB has gained a modest 1% and has risen by 3% over the week. The $800 zone remains the “sweet spot” for demand. A return to this level could tempt buyers, but if it falls back into last year’s range, well, that’s when things could get a little dicey.

For now, BNB is resting under $900, having completed its spectacular upward sprint. With no major resistance in sight, it’s essentially playing a game of “price discovery” – where the market is testing its own limits. The question is, how long can demand stay strong above support?

Crypto Bully elaborates on the matter:

“Any move back towards the level marked on the chart should be a good bid with tight invalidation. You can’t afford to snooze on this one.”

The $780-$800 zone is still the key level for anyone looking to jump on the BNB bandwagon.

The $895 Liquidity Trap: Will It Be the End or a New Beginning?

Enter CW, the market watcher with a keen eye for liquidity. They’ve pointed out a cluster of leveraged short positions near $895, which could soon cause a “liquidation explosion” if BNB decides to rise. It’s like a pressure cooker waiting for the right moment to blow its lid off.

Highly leveraged short positions blocking the rise of $BNB will be liquidated significantly if it rises to $895.

– CW (@CW8900) September 9, 2025

If the price pushes higher, those shorts will get wiped out, creating a delightful buying frenzy. The market could very well skyrocket, but don’t get too excited – it might also plummet if things go sideways. For now, BNB is bouncing between $875 and $885, with $895 sitting like a big red button that could trigger a chain reaction.

Open Interest: When Leverage Meets Liquidation

Futures open interest in BNB has reached a staggering $1.49 billion, signaling that traders are getting *seriously* leveraged. Both long and short positions are well and truly in play, and with that much juice in the market, things could get… interesting.

With high open interest and increasing price volatility, we could be in for a bumpy ride. If the price continues to climb, short positions may face forced liquidations, pushing the price even higher. If things go south, though, long positions could be wiped out, which would add some serious selling pressure. Either way, expect things to move fast.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- M7 Pass Event Guide: All you need to know

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-09-09 13:32