President Nayib Bukele of El Salvador has graced the occasion of Bitcoin Day with a rather bold and symbolic gesture, which has, of course, set the rumor mill ablaze. Speculation now runs rampant about the fate of the world’s most volatile digital asset-Bitcoin.

At a time when the stars may not quite be aligned, as historical patterns hint at impending turbulence, Bukele has placed his faith, and considerable funds, in the crypto craze.

Bukele’s Bitcoin Day Gesture Meets Market Seasonality Warnings

On the 7th of September, the ever-confident Bukele shared his intentions on X (formerly Twitter), stating that he would purchase 21 BTC to commemorate Bitcoin Day. With Bitcoin’s current price hovering around $111,175, this bold move amounts to a whopping $2.334 million.

Buying 21 bitcoin for Bitcoin Day.

– Nayib Bukele (@nayibbukele) September 7, 2025

Let us not forget, on the very same day, back in 2021, El Salvador made history by adopting Bitcoin as legal tender. This made the Central American country the darling of crypto enthusiasts worldwide, for better or for worse.

“El Salvador Celebrates Bitcoin Day! The Bitcoin Office is proud to have been building Bitcoin country for three of the four years since El Salvador made Bitcoin legal tender,” said the Bitcoin Office.

What perfect timing, indeed, as the Bitcoin versus gold debate rages on.

On the heels of major players like Tether, El Salvador itself made headlines recently, with the rising fortunes of gold in the region as the Bitcoin strategy finds itself under an increasingly global microscope.

However, as this year’s celebrations unfold, there is no shortage of skepticism. The IMF has taken to questioning the very authenticity of El Salvador’s Bitcoin-based claims, and as one would expect, not all are convinced by Bukele’s master plan.

Show purchase orders.

– Sani | TimechainIndex.com (@SaniExp) September 7, 2025

MicroStrategy’s Michael Saylor Drops a Hint About More Bitcoin Buys

But wait-Bukele isn’t the only one stoking the fire. Enter Michael Saylor, the co-founder and executive chairman of MicroStrategy, who, in his ever-cryptic manner, hinted that the company might be adding more Bitcoin to its already hefty trove.

Needs More Orange

– Michael Saylor (@saylor) September 7, 2025

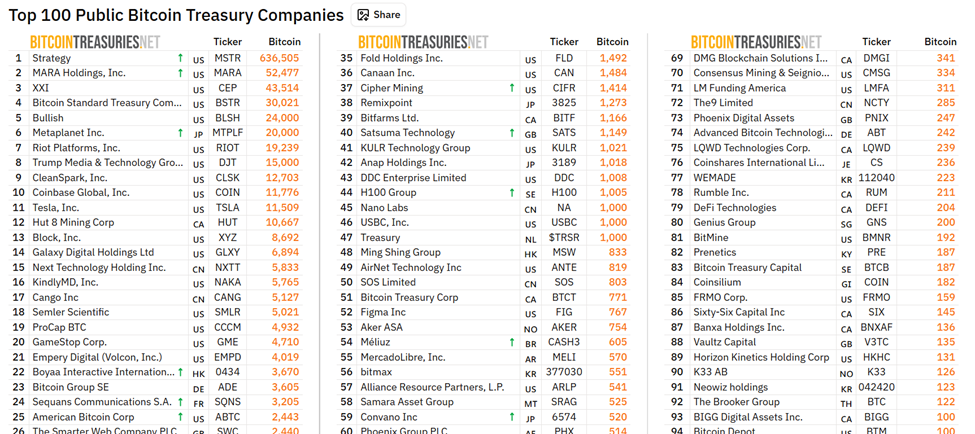

The remark was, of course, interpreted by all who follow Saylor as a not-so-subtle hint about MicroStrategy’s next Bitcoin purchase. With over 636,000 BTC already under its belt, MicroStrategy has become a proxy for Bitcoin exposure on Wall Street.

While investors keenly monitor his every move, Saylor’s methods are not without their critics. Hedge fund veteran Fred Krueger, for one, took issue with claims that MicroStrategy’s debt-fueled Bitcoin strategy is merely a Ponzi scheme.

A lot of people think Saylor is running a Ponzi.

And that selling BTC would somehow “improve things”

I completely disagree.A Ponzi is an UNSTABLE situation.

You either raise more money to pay off the old users, or the whole thing breaks.

MSTR, on the other hand, is very…– Fred Krueger (@dotkrueger) September 7, 2025

Is September 8 A Bearish Calendar Marker?

Despite the outward display of confidence from both Bukele and Saylor, some analysts suggest that September 8 might not be the best day to count your Bitcoin blessings.

Timothy Peterson, author of *Metcalfe’s Law as a Model for Bitcoin’s Value*, noted that September 8 has historically been one of Bitcoin’s weakest trading days.

“On any given day, Bitcoin is up 53% of the time for a typical gain of +0.10%. September 8 is down 72% of the time for a typical loss of -1.30%. This makes it the 7th worst day of the year,” Peterson explained.

To make matters worse, he noted, September 8 has a tendency to predict the rest of the month. When the day ends in the red, Bitcoin typically posts a monthly loss 90% of the time.

Such data paints a rather ominous picture when set against the backdrop of Bitcoin’s milestone moments and the often-brutal market realities. Whale Insider brought a particularly sobering reminder: $10 billion worth of BTC short positions could be liquidated if Bitcoin prices hit $117,000.

JUST IN: $10,000,000,000 $BTC short positions to be liquidated at $117,000.

– Whale Insider (@WhaleInsider) September 7, 2025

Nevertheless, the true believers are undeterred. Billy Boone, for instance, reassured followers that Bitcoin’s market is governed by a mere two million coins in active circulation, and when they run out, well, it won’t be a gradual affair.

“When those dry up, it’s not gradual,” he wrote.

This belief is in line with El Salvador’s strategy, with the government positioning Bitcoin as a cornerstone of its national reserves, right alongside gold. The bet? That scarcity and digital adoption will shield the nation from the volatility of fiat currencies.

As Bitcoin’s anniversary of its legal tender status approaches, the market’s rollercoaster ride continues, with Bukele’s 21 BTC gesture and Saylor’s cryptic “More Orange” hint suggesting unwavering optimism. Yet, for all their confidence, the data demands caution.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- All Brawl Stars Brawliday Rewards For 2025

2025-09-08 00:38