Markets

What’s the Hot Gossip?

- Apparently, Strategy’s share price is less “free-fall panic” and more “narrowing gap” between what the company is worth and how many Bitcoins they’re hoarding. So, not mismanagement. Just some gentle existential dread-like normal finance things.

- The company doesn’t just count coins. It invents entire new ways to do money, like that perpetual preferred stock. Permanent capital! Because sometimes you want your funds to stick around longer than your last situationship.

- Fancy a dabble in Bitcoin but afraid your hands will get dirty? S&P 500 inclusion might be coming, making Strategy your shiny, squeaky-clean gateway drug, according to Analyst Mark Palmer (who, let’s be honest, probably doesn’t sleep).

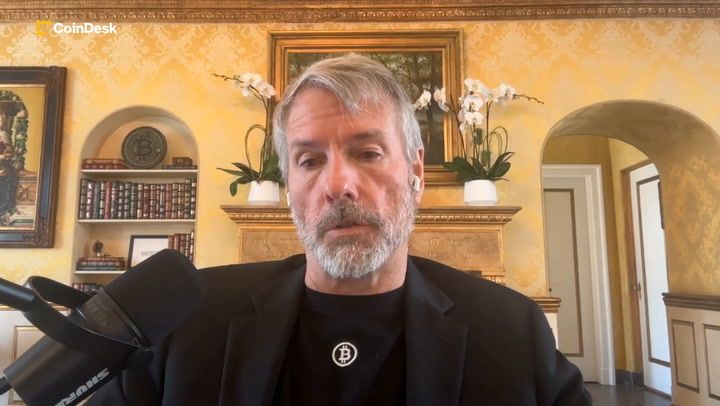

So, Strategy (yes, boring name, but bear with me) has recently watched its share price take a leisurely tumble down the financial escalator-cue retail investors blaming Executive Chairman Michael Saylor for allegedly breaking his own equity rule. 💔 Not quite the scandal you were hoping for, but hang in there.

The critics claim Saylor was as disciplined as a toddler at a birthday party. He relaxed the rule on issuing equity when the gap between share value and bitcoin stash (mNAV, because finance loves acronyms) shrank below 2.5x. Palmer, the overly caffeinated Benchmark analyst, says: Wrong! The real culprit is market drama. Less company chaos, more “every market everywhere is performing a synchronized interpretive dance.”

What really happened? Strategy said “Why not issue equity whenever we feel like it?” on August 18, tossing the old restriction out the window. Not a tantrum-just restoring flexibility. Now they can scoop up cheap bitcoin like it’s Black Friday every weekday, keeping the “buy-more-bitcoin” carousel spinning and us all feeling slightly dizzy.

This is vintage Strategy: deftly shimmying the balance sheet, slapping debt off the table, doing sexy things with convertible bonds, and making up instruments like perpetual preferred stock-money conversations as wild as a group therapy session.

Insiders whisper that nobody appreciates the financial innovation, but, like the best kept secret in high school, hedge funds and volatility traders can’t get enough. It’s a perpetual preferred party, expanding their audience, validating their love of weird bitcoin-backed bonds, and helping them stake a claim as the coolest nerds at the crypto-traditional market mashup.

Now, picture this: Strategy strutting onto the S&P 500 index like a contestant on Love Island. Billions in passive money flood in, making their bitcoin holdings mainstream-and awkward-alongside Coinbase and Block. Congratulations, everyone, you did crypto without even downloading an app.

Meanwhile, Palmer waves his “BUY” flag and shouts about a $705 price target (which is twice today’s share price, $332, in case you’d like to become a minimalist overnight). Strategy is, allegedly, the “most liquid and direct way” to hitch a ride on Bitcoin’s rollercoaster-no pickaxes, no mining drama, just pure financial mosquitoes.

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-09-02 16:22