Oh, here we go again! Michael Saylor, the man who turned his company into a Bitcoin ATM, has once again hinted at more purchases. Because who needs a stable business when you can just keep buying crypto? 🚀

On August 31, Saylor posted a chart from the “Saylor Tracker” (because of course there’s a tracker named after him), which basically shows how much Bitcoin he’s bought over time. Spoiler: it’s a lot. 📈

Saylor Hints at New Bitcoin Purchase

The image showed clusters of orange dots representing the firm’s buying history, accompanied by his comment, “Bitcoin is still on sale.” Because who doesn’t want to buy something that’s “on sale” when you’re already spending billions? 🛍️

Bitcoin is still on Sale.

– Michael Saylor (@saylor) August 31, 2025

This type of post has historically preceded purchase announcements in the past. Like, “Hey, I’m just casually mentioning Bitcoin is on sale… oh, and I’m buying more. Don’t worry, it’s totally safe. 🤷♀️”

Observers note that the company has filed new Bitcoin purchase disclosures every Monday for the past three weeks, suggesting the pattern could continue into September. Because nothing says “financial responsibility” like Monday morning crypto buys. 🕐💸

Just last week, Strategy revealed it had added 3,081 BTC at a cost of $356.87 million, paying an average of $115,829 per coin. That’s like buying a house every minute for a whole month. 🏠💰

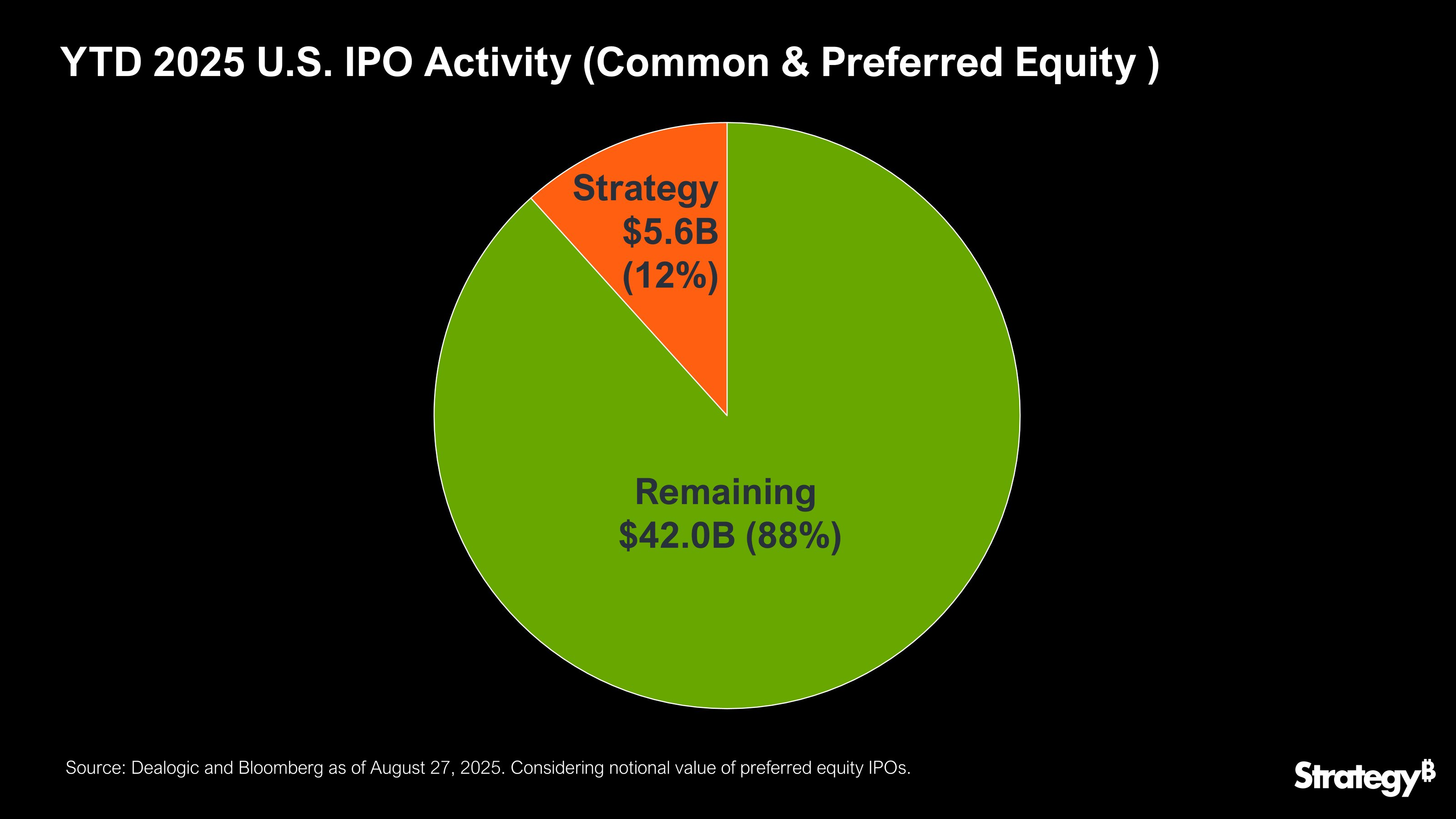

Strategy has relied heavily on equity markets to finance its buying. So far in 2025, the firm has raised $5.6 billion in IPOs, representing about 12% of all US listings. Because nothing says “trust us” like a $5.6 billion loan from your friends. 😂

Meanwhile, this aggressive fundraising has not significantly impacted the firm’s stock performance. Because nothing says “confidence” like a stock that’s doing better than the “Magnificent Seven” tech stocks. 🎯

According to Strategy, its MSTR shares have consistently outperformed the so-called Magnificent Seven technology stocks year-over-year. Because nothing says “market dominance” like a company that’s basically a Bitcoin piggy bank. 🐷

Legal Case Dropped

Saylor’s remark coincided with the withdrawal of a class action lawsuit that had been pending since May. Because nothing says “triumph” like a legal case being dropped with a “with prejudice” clause. 🎉

Investors had alleged that Strategy misled shareholders by overstating the benefits of adopting fair-value accounting, which allows digital asset holdings to be marked at market prices each quarter. Because who doesn’t want to “mark to market” their crypto holdings? 📊

Bloomberg reported that the plaintiffs dismissed the case “with prejudice,” which prevents them from raising the same claims again. Because nothing says “finality” like a legal dismissal that’s as permanent as a TikTok trend. 🚫

That decision removes a significant overhang for the firm and may set a useful precedent for other companies holding Bitcoin as a balance-sheet reserve. Because nothing says “innovation” like using Bitcoin as a corporate savings account. 💰

By securing legal relief while signaling further Bitcoin accumulation, Strategy reinforced its dual approach of leveraging capital markets and doubling down on its Bitcoin-as-treasury model. Because nothing says “business acumen” like a company that’s 100% Bitcoin and 0% common sense. 🤯

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-31 20:17