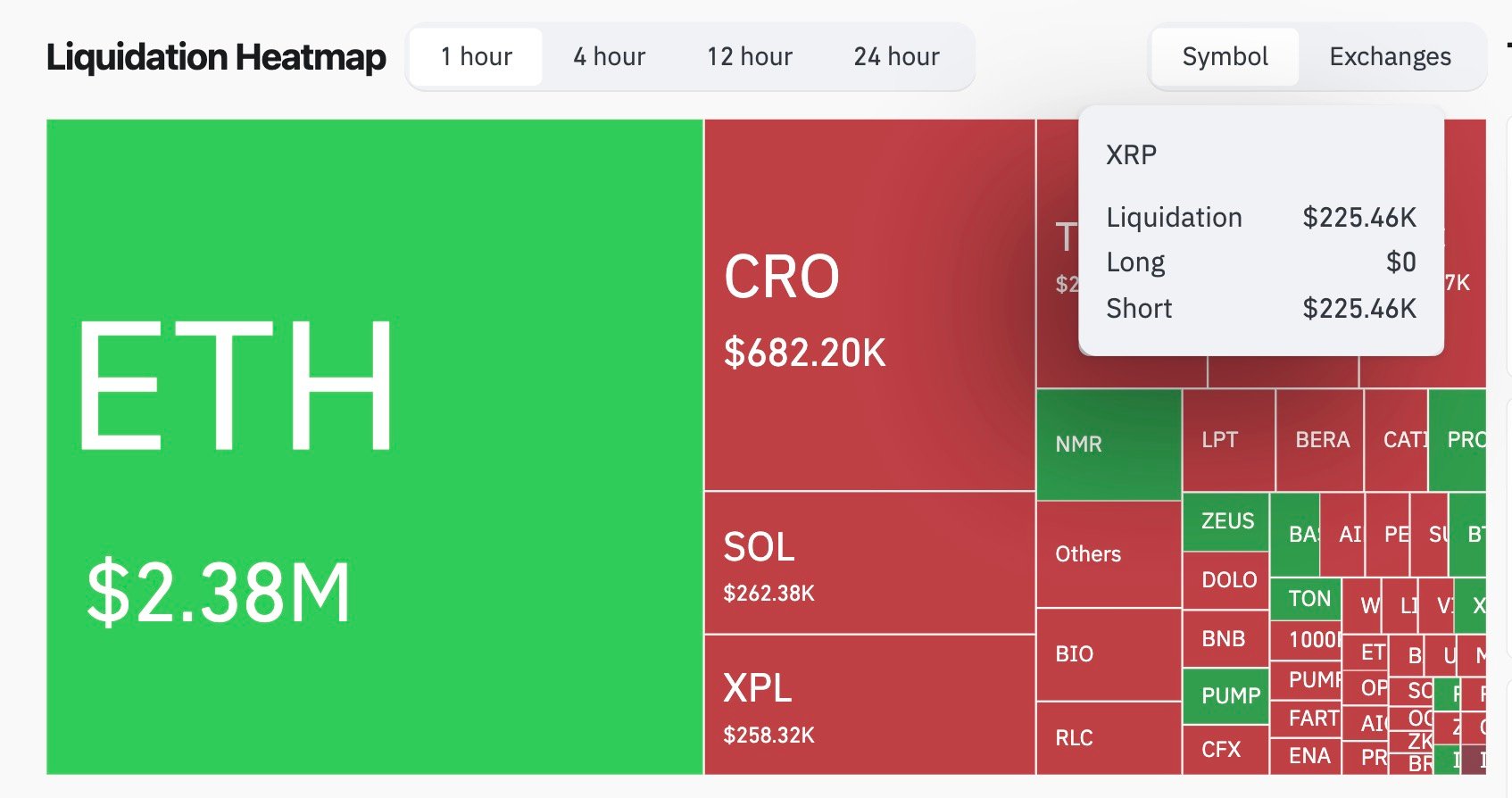

So there I was, sipping my coffee, when suddenly XRP decided it was time for a spectacle-a liquidation circus of staggering proportions. Picture this: $225,460 of shorts got obliterated faster than your New Year’s resolutions, yet oddly, not a single marginal buyer showed up to the party-yes, zero buyers, as if everyone had suddenly decided to take a vow of silence on purchasing crypto. CoinGlass reports this bizarre imbalance, which is about as predictable as a squirrel on a caffeine binge.

But here’s the kicker-if you had even a dollar in long liquidations, the catastrophe would have soared past a mind-boggling 22,546,000%. That’s right, more zeros than a kid’s piggy bank after Halloween. An imbalance so colossal it defies mathematics, common sense, and probably a few laws of physics. Someone call Einstein, because this is about as close to chaos theory as markets get.

Meanwhile, the U.S. economy put on its best suit, reporting a 3.3% growth quarter-on-quarter-beating expectations (who knew economists could be surprised?) and strutting past the previous 3%. Growth! Who knew? The American economy is basically the overachieving kid in class who also happens to be the star quarterback.

On the job front, weekly claims dipped to 229,000-just a smidge lower than everyone’s guess of 230,000-and a little lower than last week’s 235,000. It’s an economic neutral ground, like that one sock that never finds its partner, but it tends to tilt the scales slightly in favor of stocks and digital doodads, if you’re into that sort of thing.

XRP: The Price’s Nervous Breakdown

Meanwhile, XRP’s price chart looked like a toddler’s temper tantrum-bouncing from $3.10 down to $3.03 in the blink of an eye. Capitalism’s version of musical chairs, with volatile clusters forming faster than you can say “liquidity crisis.” Automated flow chaos was the conductor, orchestrating sharp swings on a thin order book that seemed like it was held together with duct tape and hope.

The liquidations? Shorts got wiped out like they were kindling in a forest fire, while longs stubbornly stuck around-probably hoping their investment would turn into a rocket, but it kind of just sputtered. And all of this? Gone in a matter of minutes, leaving traders to wonder if their screens were malfunctioning or if they’d accidentally wandered into a movie set for “Market Meltdown.”

Next up: Non-Farm Payrolls on September 5 at 3:30 p.m. Eastern. If the labor market keeps chilling in its current state, crypto and stocks might just get a bit more love before the Federal Reserve’s grand policy dance on September 16-17. But beware-the fragility of markets during these events is about as stable as a house of cards in a hurricane.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- All Brawl Stars Brawliday Rewards For 2025

2025-08-28 18:33