They say it. A certain ‘Tiger Research’ – a name that evokes more images of striped beasts than financial prudence – declares Bitcoin might possibly, conceivably, reach $190,000 by the third season of 2025. A 67% increase, they proclaim, as if faith in numbers can conjure such a reality. This surge, naturally, is fueled by the insatiable appetite of ‘institutions’ (those same institutions that once scoffed at the very notion of digital gold) and a global flood of liquidity… which, let’s be honest, seems more likely to inflate a bubble than build a solid foundation. And now, the American worker, through their 401(k)s, must be offered this… *opportunity*? A chance to gamble their retirement savings on a volatile phantom? 🤔

But, of course, such brazen optimism is tempered with a whisper. A mere acknowledgment that the beast might stumble. “Short-term corrections,” they call them. A polite euphemism for the inevitable crash that follows every period of manic exuberance. The signals, they say, are there, flickering like a faulty neon sign. ⚠️

The Dubious Prophecy: How They Arrived at $190,000

This Tiger Research, in its wisdom, has consulted the ‘TVM’ model-Time Value of Money, you see, because everything is about time and money, isn’t it?-enhanced by ‘on-chain metrics’ and the capricious whims of the ‘macroeconomic conditions.’ A truly scientific approach. They claim $190,000 is the ‘fair value’ if things just…continue as they are. As if life were so predictably linear. As if the very forces driving this speculation won’t inevitably shift and betray us all. 💸

The crucial element, they insist, is the influx of institutional money. The shift from the volatile masses to the ‘stable’ hand of the elite. “Institutional buying power outstripping retail buying,” they proclaim. Because, naturally, the voices of the many are less important than the wallets of the few. And the 401(k)… ah, the 401(k). The potential for a tidal wave of unsuspecting funds to prop up this digital house of cards. A grand experiment in collective delusion. A beautiful irony. 🤡

This 401(k) avenue is, apparently, a ‘game-changer’. As if the average American, struggling with bills and inflation, will suddenly embrace Bitcoin as a safe harbor for their future. Give me strength. 🙄 Even a *modest* allocation, they say, could unleash ‘substantial long-term demand.’ Substantial for whom, one wonders? Certainly not the average investor.

The Inevitable Shadows: Warnings from the Oracle

But even the most fervent prophets are forced to acknowledge the coming storms. “Potential short-term correction,” they murmur, as if apologizing for the interruption of their rosy vision. BeInCrypto, in its dutiful reporting, notes a descent towards the $100,000-$107,000 zone. A mere dip, of course, before the inevitable ascent. Except, dips have a habit of becoming canyons. 🌌

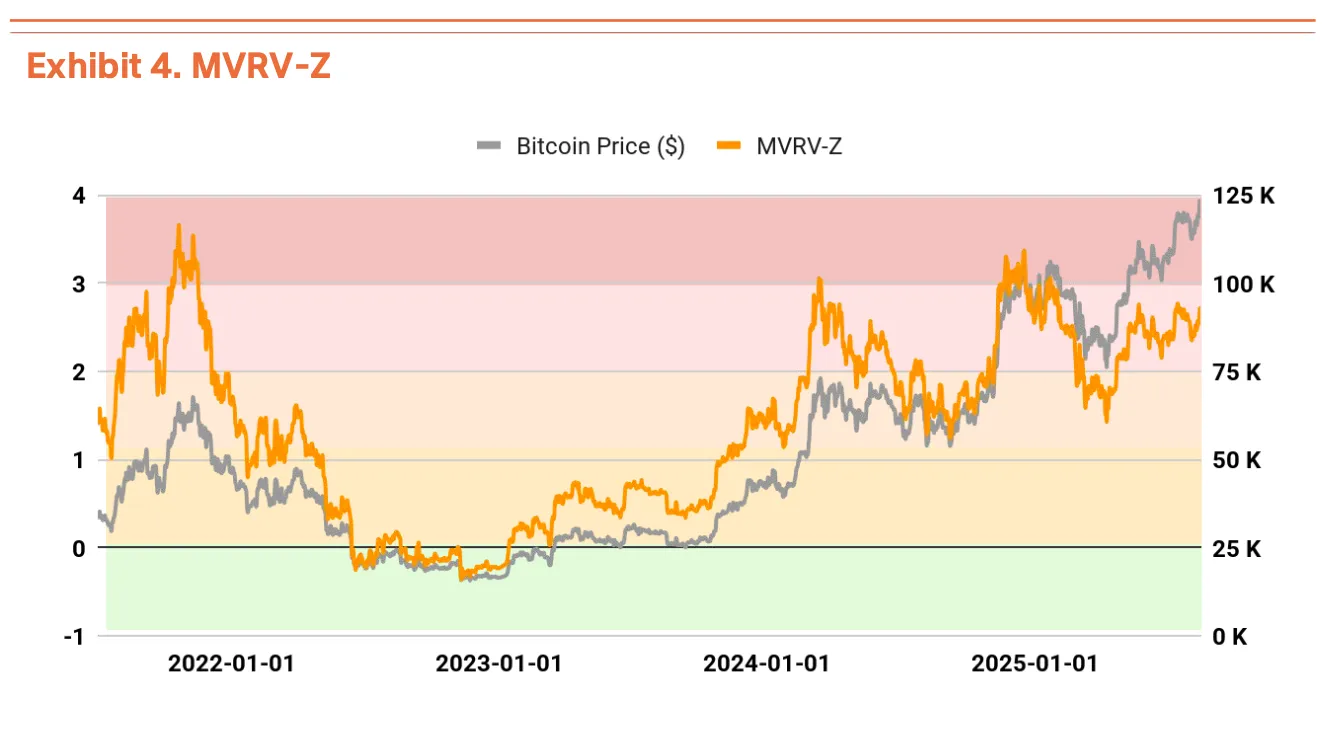

The MVRV-Z indicator, a mystical oracle of sorts, hints at ‘overbought zones.’ Apparently, nobody is excessively greedy… *yet*. But an X user, possessed of either extraordinary insight or incurable optimism, dismisses such concerns. “We’ve got room to run!” he proclaims. The refrain of every bubble, echoing through the ages. 🚀

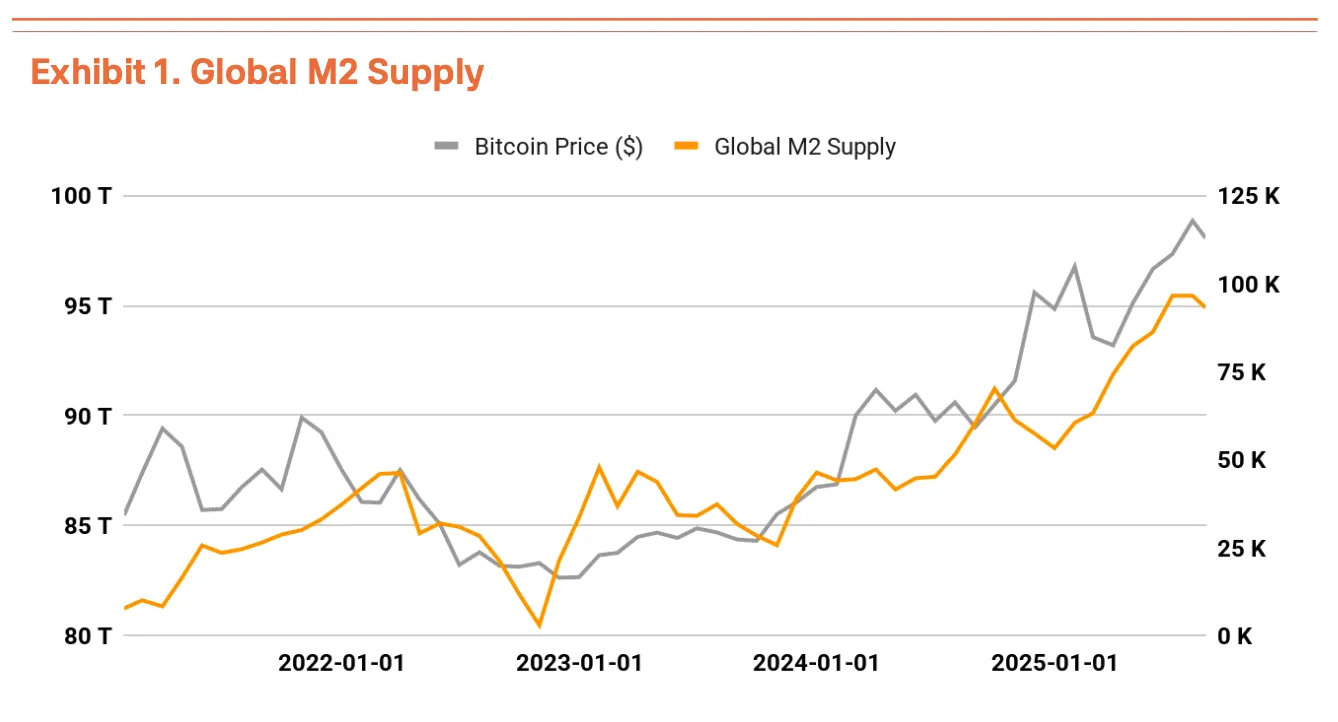

And looming above it all, the unpredictable force of global economics. Interest rates, geopolitical tensions, the shifting sands of liquidity… a chaotic ballet of factors that could send the whole edifice crumbling. They speak of “macroeconomic variables” as if they are merely data points. They are, in truth, the forces of fate. 😈

So, here we are. A forecast of $190,000, shimmering like a mirage in the desert. A siren song of potential wealth. And a gentle reminder that risk management is still… advisable. Whether Bitcoin reaches this promised land, well, that depends on the confluence of greed, hope, and the unpredictable currents of history. And perhaps, a little bit of luck. Or, more realistically, a great deal of manipulation. 🤫

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-28 11:13