So, there you are, staring at your Bitcoin wallet like it’s a magic 8-ball, hoping it’ll say “Outlook good,” but instead, it’s just giving you the financial equivalent of “Don’t count on it.” Bitcoin, the digital darling of the crypto world, is currently doing its best impression of a depressed sloth, clinging to the $113,000 branch for dear life. Will it rebound, or will it plummet into the abyss like a forgotten sock in the dryer? 🧦💨

- Bitcoin, in a rare moment of optimism, decided to take a recovery wave from the $108,750 zone. It’s like watching a goldfish attempt to climb out of its bowl – admirable, but probably doomed. 🐠

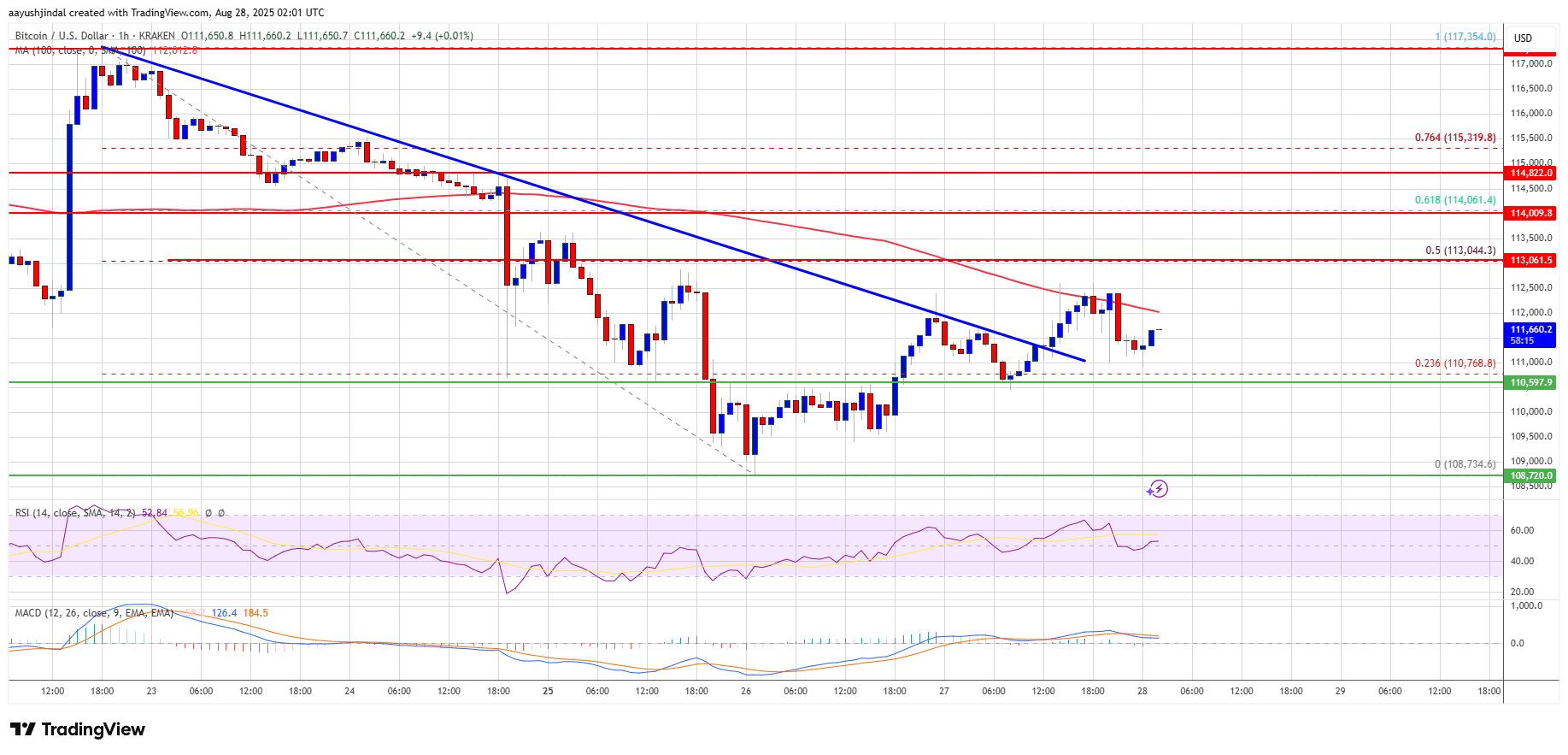

- The price is now trading below $112,500 and the 100 hourly Simple Moving Average. Because, of course, why stick to the plan when you can just drift aimlessly? 🌊

- There was a break above a key bearish trend line with resistance at $111,350 on the hourly chart of the BTC/USD pair (data feed from Kraken). Kraken, the mythical sea monster, probably has better things to do than watch this drama unfold. 🦑

- The pair might start another increase if it clears the $113,000 resistance zone. Or it might just sit there and ponder the meaning of life. 🤔

Bitcoin, in its infinite wisdom, decided to extend its losses after closing below the $112,000 level. It’s like it read the room and said, “Yeah, let’s make this worse.” BTC gained bearish momentum and traded below the $111,500 support zone, because why not add a little extra misery to the mix? 😢

There was a move below the $110,500 support zone and the 100 hourly Simple Moving Average. The pair tested the $108,750 zone, forming a low at $108,734. Then, in a surprising twist, it started a recovery wave, moving above the $112,000 level. It’s like watching a soap opera, but with more numbers and less kissing. 💏

The price surpassed the 23.6% Fib retracement level of the key drop from the $117,354 swing high to the $110,734 low. And, in a moment of sheer audacity, there was a break above a key bearish trend line with resistance at $111,350 on the hourly chart of the BTC/USD pair. Bitcoin, you sly dog, you almost had us fooled. 🐶

Now, Bitcoin is trading below $112,500 and the 100 hourly Simple Moving Average. Immediate resistance on the upside is near the $112,500 level. The first key resistance is near the $113,000 level, or the 50% Fib retracement level of the key drop from the $117,354 swing high to the $110,734 low. The next resistance could be $114,000, because why stop the fun now? 🎢

A close above the $114,000 resistance might send the price further higher. In this wild scenario, the price could rise and test the $115,000 resistance level. Any more gains might send the price toward the $115,500 level. The main target could be $116,500, but let’s not get ahead of ourselves. After all, this is Bitcoin we’re talking about. 🚀

But, because life is a cruel mistress, if Bitcoin fails to rise above the $113,000 resistance zone, it could start a fresh decline. Immediate support is near the $110,600 level. The first major support is near the $109,500 level. The next support is now near the $108,750 zone. Any more losses might send the price toward the $107,100 support in the near term. The main support sits at $105,500, below which BTC might accelerate lower. It’s like a financial freefall, but with more existential dread. 🪂

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone. It’s like it’s running out of steam, much like our enthusiasm for this whole ordeal. 🏃♂️💨

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level. It’s basically saying, “I’m tired, leave me alone.” 😴

Major Support Levels – $110,600, followed by $109,500. Because, you know, it’s always good to have a safety net, even if it’s made of financial hopes and dreams. 🕸️

Major Resistance Levels – $112,500 and $113,000. These are the walls Bitcoin keeps banging its head against. Maybe it should try a door instead? 🚪

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-08-28 05:14