The latest technical contortion, a ‘breakout’ from some line or other scribbled on a chart by a man called ‘CryptoGoos’, has renewed the sort of bullish sentiment that can only be forged in the crucible of profound hope and a wilful disregard for history.

A Marvellous Consensus of Mediocrity

Ethereum, that great digital promise, has settled itself precariously above the $4,600 mark, having flirted with a more respectable figure earlier in the week. The entire endeavour appears to be conducted within a ‘channel’, a sort of tasteful corridor of speculative activity, guarded at one end by ‘support’ and at the other by ‘resistance’-terms which lend an air of athleticism to what is, in essence, a rather static vigil.

“A textbook bullish signal,” declared Mr. Goos, from what one imagines must be a beautifully appointed study, suggesting a fantastical future price of ten thousand dollars, should the ‘momentum’ deign to ‘hold’. One is reminded of a clergyman insisting the weather will hold for the fête. It is a statement of profound optimism, entirely unburdened by evidence.

The technical indicators, those blinking oracles of the modern age, were said to be ‘supportive’. An index of ‘relative strength’ sits at a perfectly middling 54, which is apparently neither here nor there but offers ‘room for upside’, a concept as spacious and ill-defined as a cathedral.

The Great Whale Watch

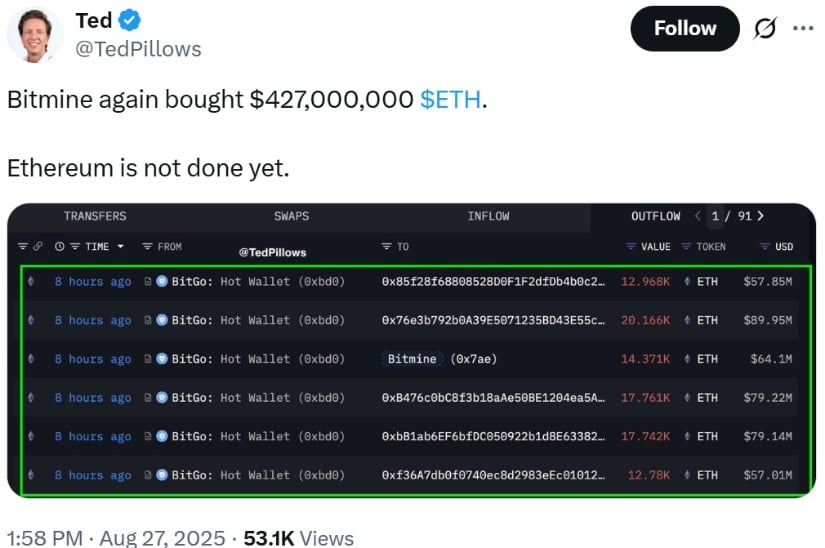

On-chain, a phrase which once described a nautical punishment, now describes the frantic observation of large, wealthy entities-‘whales’-as they move their incomprehensible fortunes about. One such beast, ‘Bitmine’, was seen acquiring a preposterous sum in a single day, an event hailed as a portent of great fortune, rather than what it might more simply be: a very rich person doing a very large thing for reasons entirely unknown to anyone, least of all the analyst ‘@TedPillows’.

This is all presented as a grand divergence from Bitcoin, which is currently experiencing the shame of ‘ETF-related outflows’, a social embarrassment from which Ethereum seems, for the moment, mercifully spared.

The Summit in View

The immediate objective for the ‘bulls’-that cheerful, charging brigade-is to storm the ramparts of $4,800. Should this Alamo be taken, the path is then said to be clear to $5,000, then $5,400, and finally to the sunlit uplands of $6,000, where the air is thin and the sense is thinner.

A man named Lord Hawkins, whose title one suspects is not hereditary, proclaimed the target ‘realistic’, provided the ‘momentum’ and ‘conviction’ remain intact. These are the same qualities required to finish a long novel or a large meal.

Meanwhile, the odds-makers at Polymarket, those cynical bookies of the new economy, offer a seventy-six percent chance of it all reaching five thousand, a bet with all the intellectual rigour of wagering on a particularly volatile horse.

The Engine Room of Hype

Beyond the charts lies the ‘fundamental’ world, where ‘staking’ offers rewards, ‘Layer 2’ solutions promise growth, and ‘gas fees’ are discussed with the tedious solemnity usually reserved for actual utilities. The ‘total value locked’ is a figure of immense importance to those for whom locking value is a primary concern.

A Forecast of Splendid Ambiguity

In conclusion, the future is binary and entirely unknowable. A ‘strong breakout’ could lead to paradise. A ‘breakdown’ could lead to perdition. The only certainty is that September will ‘decide’ the matter, as if a month were a presiding judge and not a mere unit of time.

The entire spectacle is one of high-pressure consolidation, a state of being with which the modern investor is, by now, grimly familiar. One awaits the decision with bated breath and a well-diversified portfolio. 😌

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- All Boss Weaknesses in Elden Ring Nightreign

2025-08-27 23:59