Enter the wild world of blockchain reorgs, where networks play musical chairs with blocks, leaving proof-of-work systems feeling a bit, well, vulnerable. Enter: Monero’s 2025 circus, four years after Bitcoin SV’s own 51% shenanigans.

Me, I’ve Decoded Reorgs

Imagine this: a blockchain reorg, where one chain of blocks goes out like a lead balloon, and another-one with more proof-of-work-steps in for a lavish makeover. It’s like substituting your whole ledger. Suddenly, all those orphaned block transactions nip, skip, and jump back to the mempool, like they’re auditioning for a comeback later-or they stay home forever.

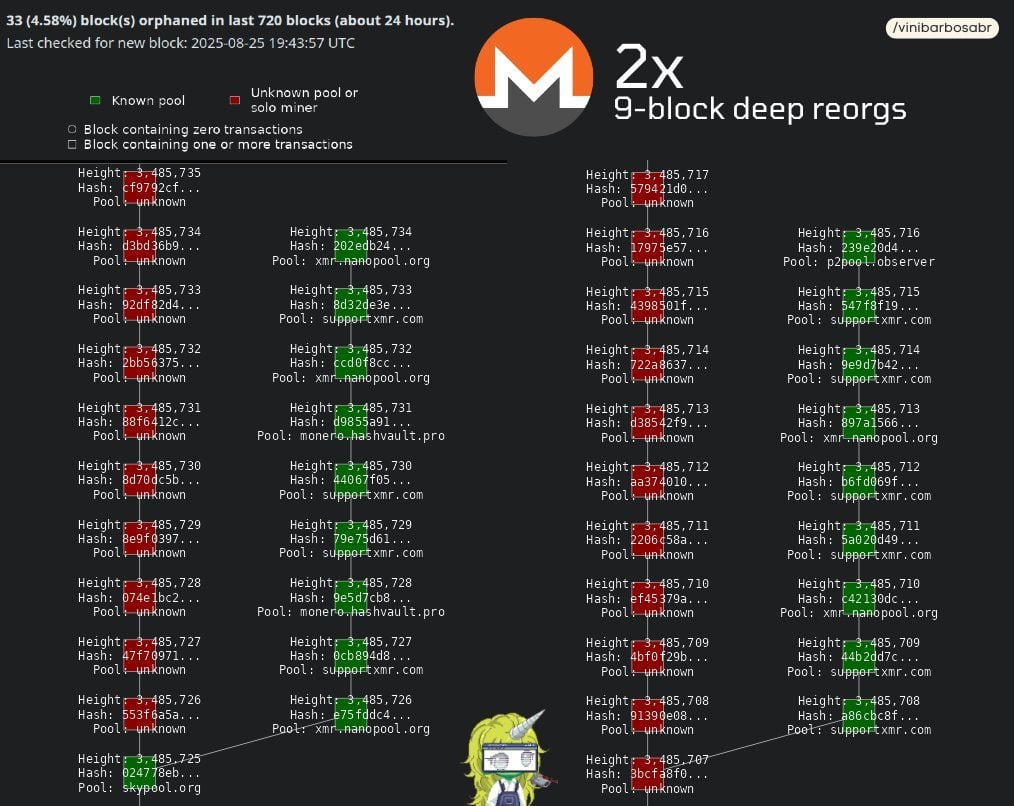

This funhouse ride opens the door to double-spending-think of it as spending your Monero only for them to vanish and somehow still be sitting snugly in your pocket. In August 2025, Monero had this “party” hosted by Qubic, the mining goody-two-shoes, and I mean, ostensibly an experiment. They flexed their hashrate muscles and-poof!-chains appeared and disappeared like magic.

Initial reorg showed a six-block rewiring-a classic reorg flex-and more followed, striking twice with a nine-block reorg. It stemmed from Qubic’s hashrate shenanigans, leading nodes to jump like they’d gone on a shuffle dance class. Risks: double-spends, censorship, and the romantic story of blocks playing hide and go seek, then never coming back.

Exchanges like Kraken, bless their hearts, hit the pause button on Monero deposits, demanding a bonkers 720 confirmations-like seriously, who has that time?-to protect from losses. This chaos led Monero to have a deep, existential convo over changing its consensus game plan, with suggestions like marriage proposals to Bitcoin, or decking out with geographically spread-out miners to curb bully pools. Or maybe just take on Dash’s Chainlocks to keep chains in line.

In 2021, Bitcoin SV caught a similar bug when some shadowy miner had to flex their 51% muscles, slicing the chain into pieces. It was a veritable block party that claimed massive reorgs. The culprits? Stealthy miners creating secret block sleights, posing familiar risks: double-spends, instability-cue the gasp!-and a general community tremble.

All this points out the whimsical nature of PoW’s promises: transactions wait for more confirmations like characters in a soap opera, but a strong 51% pull can rewrite their stories. So basically, reorgs can be meddling troublemakers involved in a plot twist that leaves us scrambling for subplot inspections.

Monero and BSV’s sagas show the two sides of reorgs-normal when things are chill, but disruptive when someone decides to stir the pot. It’s a hairy reminder of the need for properly distributed hashrate to avoid blockchain hiccups.

Now, Bitcoin, waltzing around with its herculean hashrate and factory of exahashes per second, is like the high-stakes poker player in the room. The cost needed to try and tip Bitcoin’s kaleidoscope balance? Astronomical! Might as well try to move Mt. Everest with a whisk. The scale of investment needed would send your books into an existential crisis. It’s just not worth the rage.

But our underdogs Monero and BSV, they have lighter wallets and thus, lower barriers to funk with. Their smaller hashrate means it’s easier to enlist in crypto chaos.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-27 05:58