The question, that most vulgar of interrogatives, fluttered moth-like against the windowpane of every crypto-exchange-would a decisive rupture below the rather arbitrary and, one must confess, aesthetically displeasing figure of one hundred and five thousand dollars spell the end of our gaudy, digital bull? A certain market soothsayer, one ‘CrediBULL Crypto’ (a nom de guerre as subtly nuanced as a bull in a proverbial china shop), delivered unto his legion of four-hundred-and-seventy-six-thousand acolytes a crisp, nocturnal rebuttal. He posited, with the weary patience of a man explaining rain to a duck, that while this sum represents a key threshold for the most ‘aggressive’-how I adore that euphemism for ‘greedy’-upside trajectory, its loss would not, in itself, murder the higher-time-frame uptrend. Merely wound it, perhaps, and force it to wear a rather unbecoming bandage.

“No,” he scribbled into the digital void, “if $105,000 is lost it’s not ‘over’ it just means the most aggressive/bullish scenario is out of play and a deeper correction is a lot more likely.” He then directed the philistine masses, with a sigh one could almost hear, to a moving-picture show on the YouTube, wherein the true line in the sand-a far more respectable $74,000-was explained. “All explained in my last Youtube vid so before you ask ‘why so low for HTF invalidation’ go watch the vid :).” The smiley, a primitive glyph of our times, hung in the air like a misplaced semicolon.

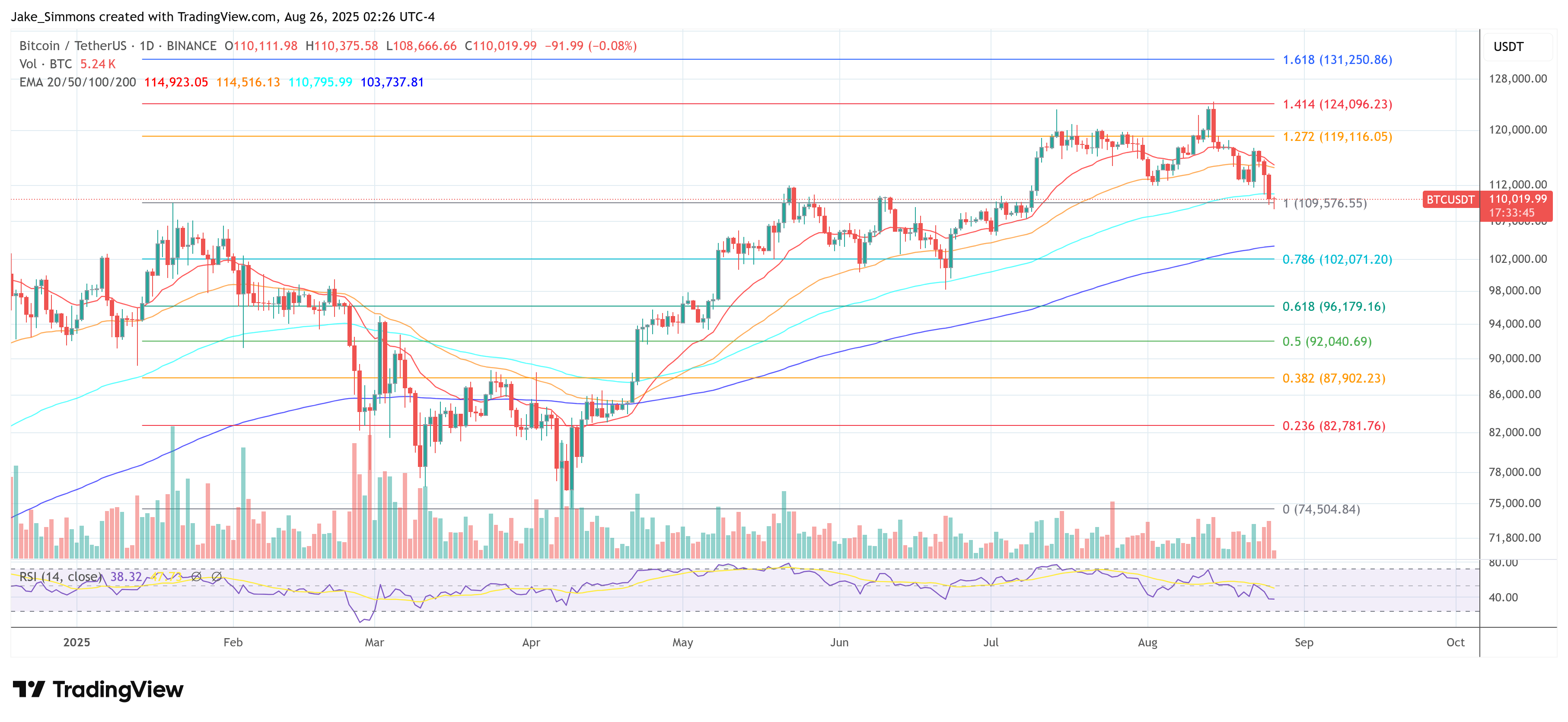

In a subsequent communiqué, he reiterated his peculiar obsession with the zone between one-hundred-seven and one-hundred-ten thousand dollars, a stretch of numerical real estate he has apparently deemed “the MOST pivotal point on the BTC chart…” This, he breathlessly declared, is “the most likely zone for a full on reversal-it doesn’t mean it is guaranteed of course but this is the last place it makes sense to start flipping bearish.” One imagines a lone, dramatic palm tree in a desert of numbers.

A Descent into the Numerical Abyss

The man’s posts point backward, like a Proustian madeleine, to a video performance from a fortnight prior. There, he choreographed three potential ballets for Bitcoin’s next act. Two envision a graceful *pirouette* skyward from our current, tawdry price box, while a third, more tragicomic number, allows for a deeper, more humiliating stumble into the orchestra pit-all without, mind you, tearing the fundamental costume of the secular uptrend.

He is most explicit that the final, absolute invalidation for this entire circus resides much lower, nestled in the “mid-$70,000s.” This, you see, is where the prior high-time-frame impulse was first conceived, and where the market would, in the arcane tongue of Elliott-wave, perform a most unforgivable act: erasing the larger five-wave structure. A true tragedy of classical proportions! Thus, losing $105,000 would merely signify a deterioration in momentum, a slight limp in the step, not a fatal gunshot to the choreography.

His “Scenario 1”-the quaint notion that the price was merely pausing for a compact fourth-wave cigarette-has, by his own admission, grown as unlikely as a well-mannered troll. The corrective chop has lasted too long and retraced too deep; its proportions are all wrong, a grotesque caricature of a fourth wave. Its technical red line was $110,000; once reclaimed and then vomited forth during the correction, the count’s precious symmetry shattered like a dropped vial of perfume.

“Scenario 2,” his current paramour, casts the recent rally as the first completed five-wave impulse of a new advance. In this romantic reading, the market is now tracing a wave-two pullback, a shy retreat with its invalidation squarely at that fateful $105k. The implication is as arithmetic as it is structural: if wave one spanned a neat $20,000, a standard third wave would be larger, lunging toward the mid-$130,000s before a fourth-wave pause and a terminal, breathless fifth carry the affair into the $150,000-plus region. This is why he characterizes $107,000-110,000 as “the best R:R for longs,” the last high-probability cotillion before the ballroom closes.

And then we have “Scenario 3,” the *memento mori* of the trio. This keeps the broader May-to-present correction intact. Here, the pop above range highs was not a true impulse but a corrective feint-a three-leg rise with overlap, a technical term as charming as ‘moist’-and the market still owes a deeper, more penitent sweep into demand. He differentiates two sub-species of this gloom: a ‘running flat’ that defends the June/July lows, and an ‘expanded flat’ that undercuts them, testing a daily demand block that “started at basically 98k,” which price “front-ran… at 98.2k” before bouncing. In both cases, the higher-time-frame thesis remains, for the structural invalidation remains, like a distant, unblinking star, at $74k-$75k.

At the moment of this writing, the fickle beast BTC traded at approximately $110,019, having just hours prior touched its intraday low at $108,666-a drama of thousands played out in the space of a mere thousand. A most tedious puppet show.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

2025-08-26 14:12