In a most audacious display of bravado, Bitwise’s esteemed Chief Investment Officer, Matt Hougan, has taken a rather pointed jab at the venerable JPMorgan, the titan of American banking. It appears that the grand institutions of finance are attempting to persuade our lawmakers to impose restrictions on the yields of stablecoins, a move that has ignited a veritable firestorm in the hallowed halls of Washington.

As the clash between the digital currency realm and the staid world of Wall Street intensifies, we find ourselves at the precipice of one of the most explosive lobbying skirmishes in recent memory. Who knew finance could be so entertaining?

Bitwise’s Bold Rebuke of JPMorgan in the Great Wall Street-Crypto Showdown

With a flourish, Hougan has publicly chastised JPMorgan, following the rather curious remarks from members of the Bank Policy Institute and their banking compatriots. One might wonder if they’ve been sipping too much of their own Kool-Aid.

“I think JPMorgan Chase is confused. Can someone tell them that the 0% interest rule is only for stablecoins, not bank accounts?” quipped Hougan, with a wit sharper than a banker’s pencil.

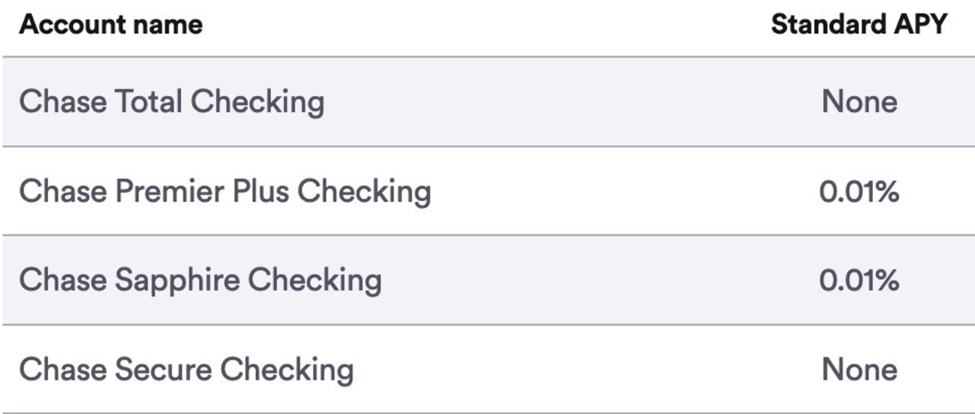

Indeed, Hougan pointed out the paltry interest rates offered by JPMorgan Chase on checking accounts, a meager 0% to 0.01% APY. One might as well keep their money under the mattress!

This stands in stark contrast to the recently passed GENIUS Act, which permits interest-bearing stablecoins, suggesting that perhaps the banks are lagging behind in the race for financial innovation. Oh, the irony!

According to the TradFi media, JPMorgan’s most enticing Certificate of Deposit (CD) rates require a staggering $100,000 deposit and a checking account relationship. A strategic barrier, indeed, designed to keep the average Joe at bay while the elite bask in their financial glory. Meanwhile, stablecoins are offering yields of up to 5%. Who wouldn’t want a piece of that pie?

In this grand theater of finance, banks are lamenting a supposed loophole that allows exchanges like Coinbase and Binance to reward stablecoin holders. How dare they!

Lobbyists are now clamoring for Congress to amend the GENIUS Act, which, in a fit of legislative wisdom, banned issuers like Circle (USDC) and Tether (USDT) from directly paying interest. A classic case of “you can’t have your cake and eat it too.”

In a similar vein to Hougan’s remarks, Ryan Sean Adams, the host of the Bankless podcast, has accused banks of engaging in a rather unsavory practice known as rent-seeking.

“The banks are trying to stop American citizens from getting yield on their savings. They want to keep it for themselves…Stablecoin yield belongs to the people, not the banks,” he observed, with a flair for the dramatic.

The Growing Weight of Stablecoins Amid Washington’s Lobbying “Civil War”

Traditional finance players, such as the American Bankers Association and the Consumer Bankers Association, are warning that allowing stablecoin yields could trigger an unprecedented exodus of deposits, potentially amounting to a staggering $6.6 trillion. Can you imagine the chaos?

Such a shift, they argue, would raise borrowing costs, diminish lending capacity, and wreak havoc on small businesses and households. Oh, the humanity!

“It feels like there’s a move to replace us,” lamented a TradFi media source, quoting Christopher Williston, CEO of the Independent Bankers Association of Texas. One can almost hear the violins playing in the background.

Yet, crypto advocates scoff at this panic. Coinbase’s Chief Legal Officer, Paul Grewal, asserts that the banks’ warnings are merely a desperate attempt to shield themselves from competition.

This was no loophole and you know it. 376 Democrats and Republicans in the House and Senate rejected your unrestrained effort to avoid competition. So did one President. It’s time to move on.

– paulgrewal.eth (@iampaulgrewal) August 13, 2025

As the stakes rise, stablecoins are evolving from mere niche payment tokens into potential macroeconomic juggernauts. Coinbase’s Head of Research, David Duong, recently projected that stablecoins could swell to a remarkable $1.2 trillion by 2028. Who knew digital coins could be so ambitious?

TradFi views this battle as a lobbying civil war, with Republicans gearing up to advance a more comprehensive crypto market structure bill this fall, which could enshrine stablecoin yield as a cornerstone of US digital asset policy. Meanwhile, Wall Street is mobilizing to thwart this endeavor.

Banks are fighting tooth and nail to preserve their deposit base, while the crypto world is on a mission to democratize yield. It’s a classic tale of David versus Goliath, with a twist of humor and a dash of sarcasm.

As stablecoins become increasingly entwined in the intricate web of US fiscal mechanics, the struggle over who controls interest in America may very well shape the future of financial policy. And who said finance was boring?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-26 13:34