Oh, the drama of central banking! After Jerome Powell’s Jackson Hole performance-part monetary policy, part Shakespearean soliloquy-markets are now gripped by the tantalizing possibility of a September rate cut. Cue the violins… or perhaps a kazoo ensemble? 🎭🎶

Ah, the CME’s Fedwatch tool, that oracle of economic tea leaves, whispers to us of probabilities: a 75% chance of a modest 25-basis-point cut as of August 23, 2025. But wait, there’s more! A stubborn 25% insists the Fed might just sit on its hands like a cat ignoring a laser pointer. 🐱✨

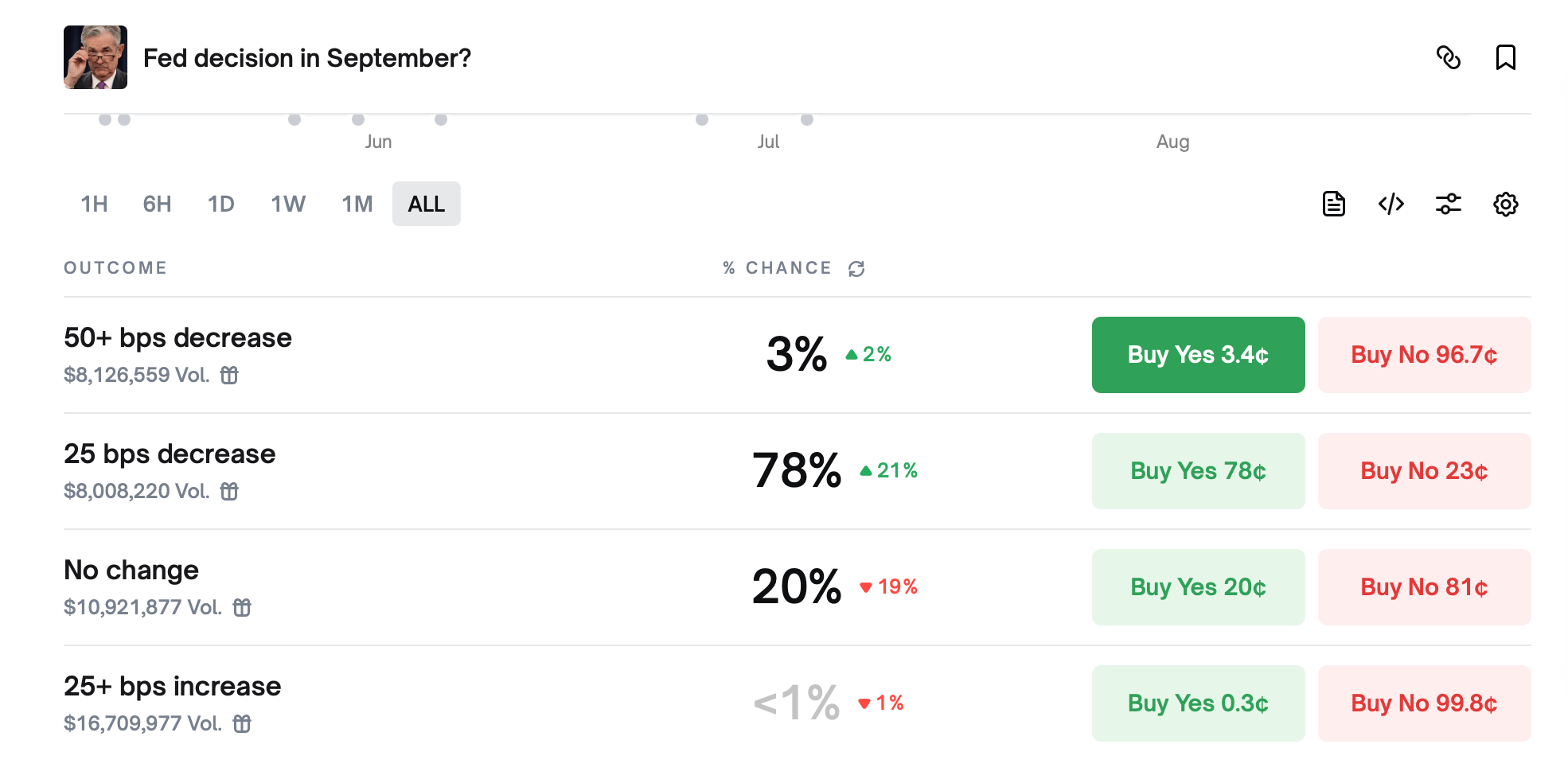

Over on Polymarket, traders are practically throwing confetti at the prospect of a September rate trim. Odds for a quarter-point cut have surged to 78%, up 21 points recently. Truly, these are the circus acts of our modern financial age. 🎪📉

The prediction markets paint a picture so clear it could be a Soviet propaganda poster: an 80% likelihood of *some* kind of rate cut by September, and a whopping 93% chance of easing before year’s end. Only 3% dare dream of a bold 50-basis-point move, while less than 1% cling to the fantasy of a rate hike. Poor souls-they must enjoy tilting at windmills. 🎯📈

Meanwhile, the odds of “no change” have collapsed faster than a house of cards in a hurricane, tumbling to 20%. Money is pouring into the 25-basis-point option, while bets on a pause or surprise hike evaporate quicker than vodka at a Siberian winter fest. Even Kalshi agrees, showing the same cautious consensus as Polymarket. It’s almost as if they consulted each other-or maybe just read the same fortune cookie. 🥠📊

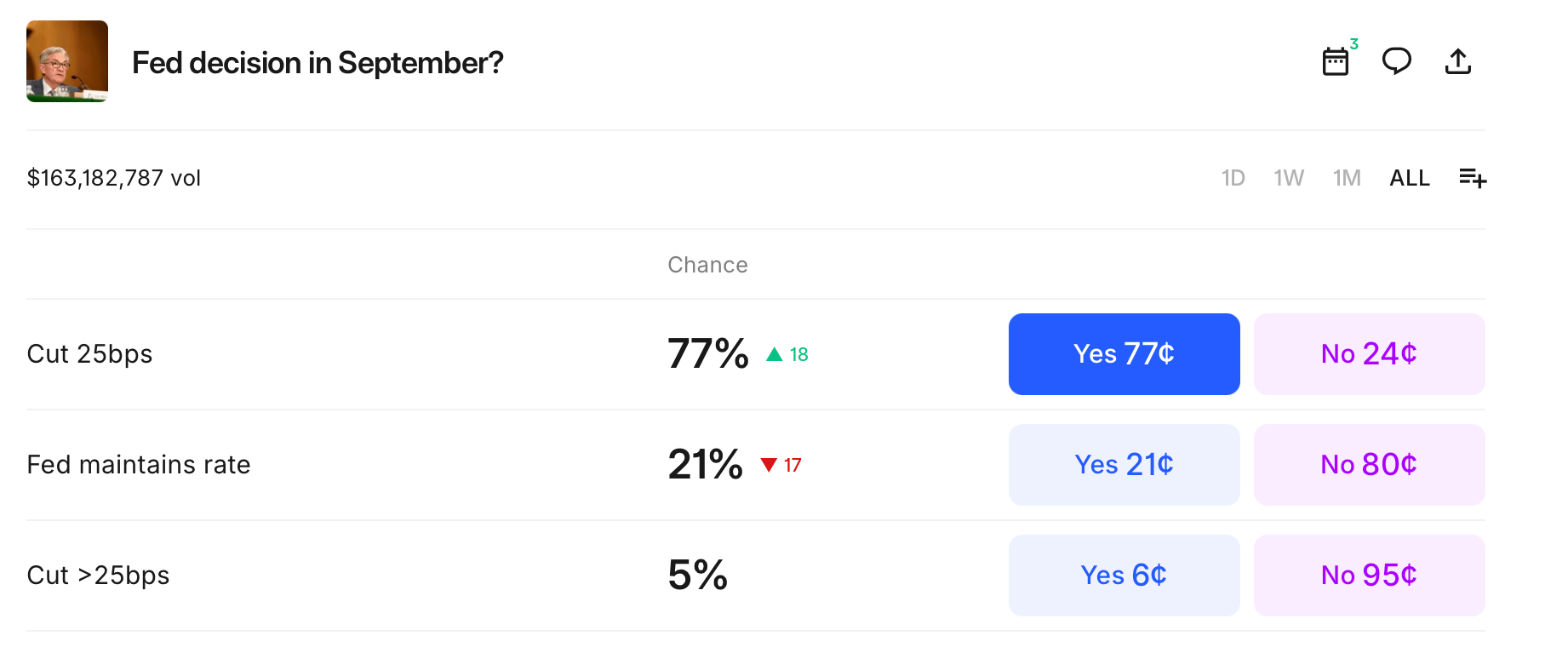

On Kalshi, the crowd has spoken with all the subtlety of a sledgehammer: a 77% probability of a 25-basis-point cut, up 18 points recently. The odds of standing pat? Down to 21%. And the idea of anything more aggressive? A mere 5%. It seems the market believes in baby steps, not moonwalks. 🚶♂️🌕

With over $163 million wagered, Kalshi reflects a near-unanimous belief that the Fed will opt for prudence over panache. In conclusion, dear reader, CME futures, Polymarket, and Kalshi harmonize like a barbershop quartet: September heralds the start of easing, a gentle nudge rather than a seismic shift. Let us toast to moderation-or mourn its absence. 🍷📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-08-23 20:28