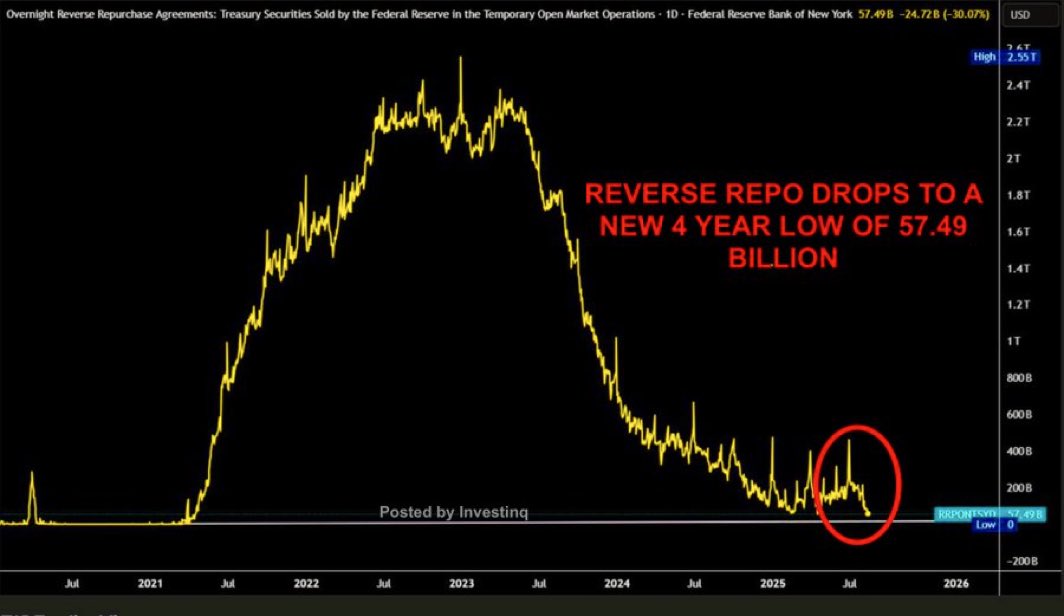

The Federal Reserve’s Reverse Repo Facility (RRP), a magical wellspring of liquidity, has dipped to its lowest level in 1,596 days, hinting at a crack in the financial dam that’s been holding back the flood of market chaos.

This turn of events, which suggests that financial conditions are about to get tighter than a drum, has sent ripples of panic through Wall Street and the crypto underworld, where people usually only panic when they can’t find their NFTs.

Experts Warn as Federal Reserve Reverse Repo Plummets to a 5-Year Low

Kevin Malone, the wizard of Malone Wealth, pointed out the decline, warning that the “excess cushion” in financial markets is vanishing faster than a unicorn in a budget meeting.

BREAKING NEWS: Federal Reserve Reverse Repo drops to the lowest level in 1,596 days. What happens tomorrow? 🚨🚨🚨

– Kevin Malone (@Malone_Wealth) August 19, 2025

He explained that once the RRP is empty, every new Treasury issuance must be absorbed directly by private buyers, rather than being offset by the cash that was previously parked at the Fed, like a car in a garage that’s suddenly a parking lot.

That shift, he said, will likely push bond yields higher while forcing banks, hedge funds, and money market funds to compete harder for funding, like a bunch of cats fighting over the last mouse in the house.

“The bottom line is that liquidity flowing from RRP into markets has been supportive until now. But when it reaches near zero, there’s no cushion left. That’s when financial conditions tighten significantly, and everyone starts to feel like they’re walking on eggshells,” wrote Malone, adding a wry smiley emoji 😄.

Others hold that the Fed’s failure to intervene will lead to problems in markets, banks, and possibly even government funding, which is like saying if you don’t water your plant, it might just decide to become a cactus.

Bruce, Co-Founder of Schwarzberg, tied the RRP decline to broader risks for stocks, bonds, and Bitcoin. He explained that the $2 trillion in excess liquidity built up during the pandemic had acted like a magical elixir, sustaining markets even as interest rates rose like the sun on a hot summer day.

However, with that liquidity nearly exhausted, the underlying fragility is exposed, much like when you finally look under the bed and realize it’s a mess down there.

“This is bad in the short term for stocks, bonds, and Bitcoin…The US bond market is the most important market in the world. If the RRP now drops out as a buyer, bond yields will continue to rise. The Fed will likely have to step in and save the bond market by providing new liquidity, or else we might all end up trading in our dollars for goats,” Bruce warned, with a touch of dramatic flair.

Meanwhile, Joseph Brown of Heresy Financial highlights how the Treasury continues to ramp up short-term borrowing despite the RRP running dry, like a gambler doubling down on a losing hand.

He estimated that an additional $1.5 trillion in bills could hit the market by year’s end, which is about as much as the GDP of a small country, or the debt of a large one.

“Treasury is betting that rate cuts will come soon and provide a band-aid, but we all know what happens when you put a band-aid on a gushing wound,” Brown said, shaking his head in disbelief.

Meanwhile, some see the liquidity crunch as a prelude to the next phase of monetary easing. Crypto analyst Quinten argued that quantitative easing (QE) and fresh money printing will become unavoidable once the RRP balance hits zero, like a printer that never runs out of ink because it’s actually printing more ink.

“Federal Reserve’s Reverse Repo Facility is plummeting. QE & money printing will start aggressively when this drains to 0. Bitcoin will explode, and we’ll all be living in a digital utopia, or something,” he predicted, with a hint of sarcasm.

As the liquidity engine that quietly propped up markets for years sputters and coughs, the Fed faces a narrowing path between rising funding costs, surging Treasury supply, and market stability, like a tightrope walker with a blindfold and a strong wind.

The next act may involve bond market turmoil, emergency easing, or a Bitcoin rally, all of which hinge on how quickly the last drops of the RRP dry up, and whether anyone remembers where they put the fire extinguisher.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- All Brawl Stars Brawliday Rewards For 2025

2025-08-21 09:25