Anyone with a keyboard can shout “Crypto signals!” but only a foolhardy few offer a steady raft across the treacherous waters of profit.

Making a buck in crypto? Easy as pie. Keeping it? That’s the hard grind. Most crews of signal-peddlers can land a lucky shot here and there during a market boom, but long-term? Nah. Only a brave handful stick to a real plan that preserves your stash rather than blowing it all on a whim. The best crypto signals-well, they’re built on an honest, systematic approach, not smoke and mirrors, and certainly not the pipe dreams of turning a dime into a fortune overnight. 🚀

How Can You Tell If a Trader’s Just Cowboying or Actually Knows the Rodeo?

With a million & one groups shouting “Buy now!” from every corner of Telegram, Discord, and social media, figuring out who’s a real trader and who’s just gotten fortunate once or twice is like finding a needle in a haystack. That’s why MyCryptoParadise, a firm with a reputation for riding the long trail and knowing their onions, whipped up this straightforward checklist to cut through the bull and the hogwash.

This here guide will help you spot the charlatans from the pros, the weekend gamblers from the patient traders who keep their eyes on the long-term prize-most of whom don’t trade by feelings or hype but use a solid system, risk controls, and patience.

In the End, the Market Reveals Everything: Who’s Just Lucky and Who’s the Real Deal

Time is the great truth-teller. Most signal groups are like a crooked card dealer-playing the short game, winning a few rounds, then losing everything in the long haul, like sheep in wolves’ clothing. They run schemes built on pump-and-dump tricks, or else they’re just giving you a song and dance, hoping you don’t notice their skills are as thin as a dime. When the market’s calm, they look like experts; but the true traders? They test their mettle through repeated, disciplined efforts, always thinking of the long game.

You’ll learn what to watch out for, what to avoid, and how real pros think-whether they’re big institutional traders or hedge fund managers. These folks don’t go trading on wild whim or sensational headlines-they rely on systematized risk management, a clear edge, and a steady hand.

✅ The Reliable Trader’s Checklist

Here’s what separates the real guns from the con artists; some traders manipulate, pump their followers full of false hope, or simply lack the skill, the strategy, or the nerve to survive the full cycle of the market’s ups and downs.

Write this down; it’s a shield against years of folly:

- Knowing when to be bold and when to fold-like a prudent poker player 🃏

- Winning rate? Nah-It’s about risk and reward, my friend ✅

- Say no to sneaky multiple entries and fake profits-the big losses hide behind small wins

1. When to Play Big and When to Hold Back – The Mark of a Trader

Real traders change their game with the weather. Sometimes, a promising setup calls for a full-on assault. Other times, prudence counsels a light touch or sitting tight. Think of it like poker-you don’t go all-in on a weak hand in a rigged casino. When the cards are poor, you fold; when they’re promising, you press your luck. If you always gamble with the same monsters’ risk, you’re just playing the fool’s game.

🃏 Remember: Bluffing your way through trades is only a step above throwing dice. True skill lies in knowing when to bet big and when to test your luck with a small stake.

2. Win Rate? Bah! It’s the Risk-Reward Ratio that Counts

A high percentage of wins don’t mean a thing if the losses are big enough to wipe out your winnings faster than you can say “bankruptcy.” Long story short: it’s not how often you get lucky; it’s how much you make when you’re right versus what you lose when you’re wrong. A trader with a 90% win rate who loses twice as much on the bad trades as they gain on the good ones? Chasing your own tail.

Watch out for those who boast about a “90%+ win rate”-they be selling a pig in a poke without explaining their risk/reward strategy. 🐷

3. The Power of a Single, Honest Entry-No Fooling Around

Professional traders don’t sprinkle their bets like fairy dust-no multiple DCA thimbles, no tricks. They commit fully once they’ve identified a promising trade, based on solid analysis. If they’re dilly-dallying with tiny entry points or pretending to be big shots with multiple small entries, beware: they might be hiding something.

One trick is to enter with a fraction-say 25%-then pretend the win is glorious. But come a loss, they’ve already long gone all-in. It’s like the wolf dressed as grandma-looks sweet, but it’s all a sham.

4. Quality Over Quantity-The Patient Gambler’s Motto

Lots of trades? Nope. That’s just gambling with your hard-earned coin. The best traders wait patiently for the best setups, only jumping in when the odds are in their favor. Less is more-less rashness, more discipline. They deliberately pick their battles, and over time, that’s what wins the war.

5. Context Matters, or You’re Just Trading Blind

If your trader isn’t looking at all the angles-macro data, market indexes, sentiment, liquidity-they’re as blind as a bat in a coal mine. Successful trading is about knowing what the big players are up to, what the flow of money indicates, and reading the macro landscape. Without this, you’re just guessing-like trying to hit a barn with a pea shooter in the dark.

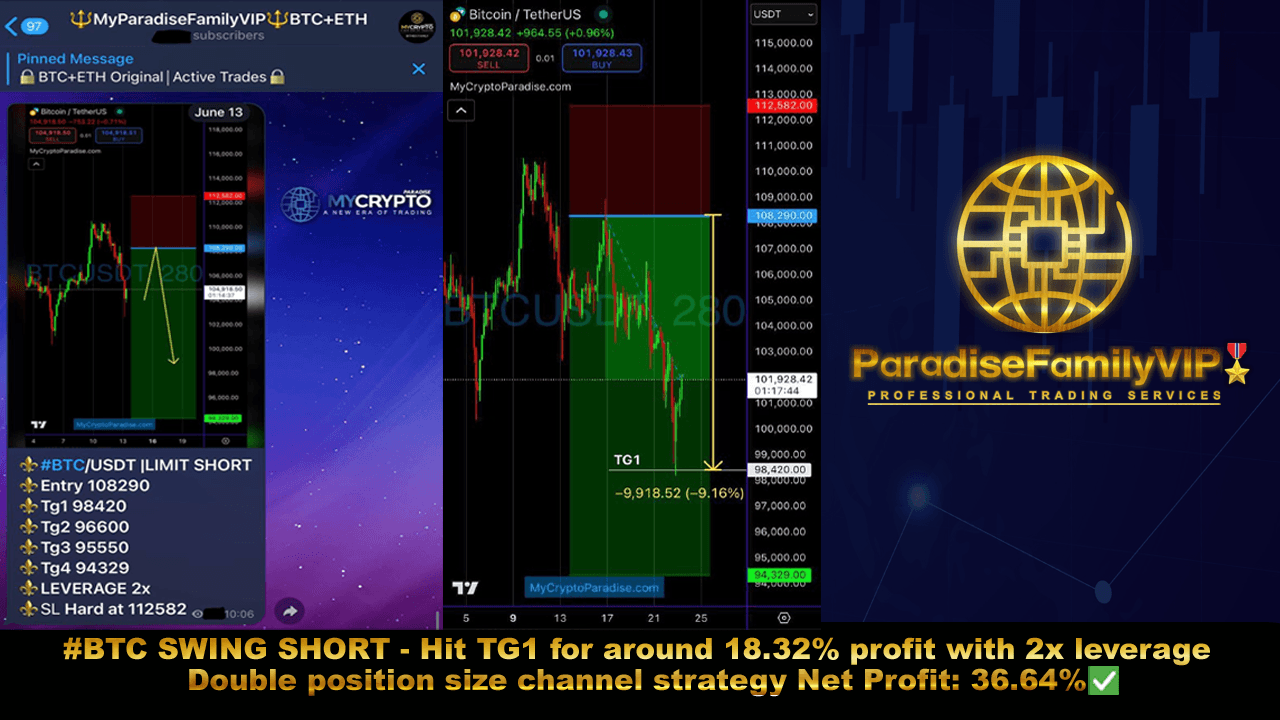

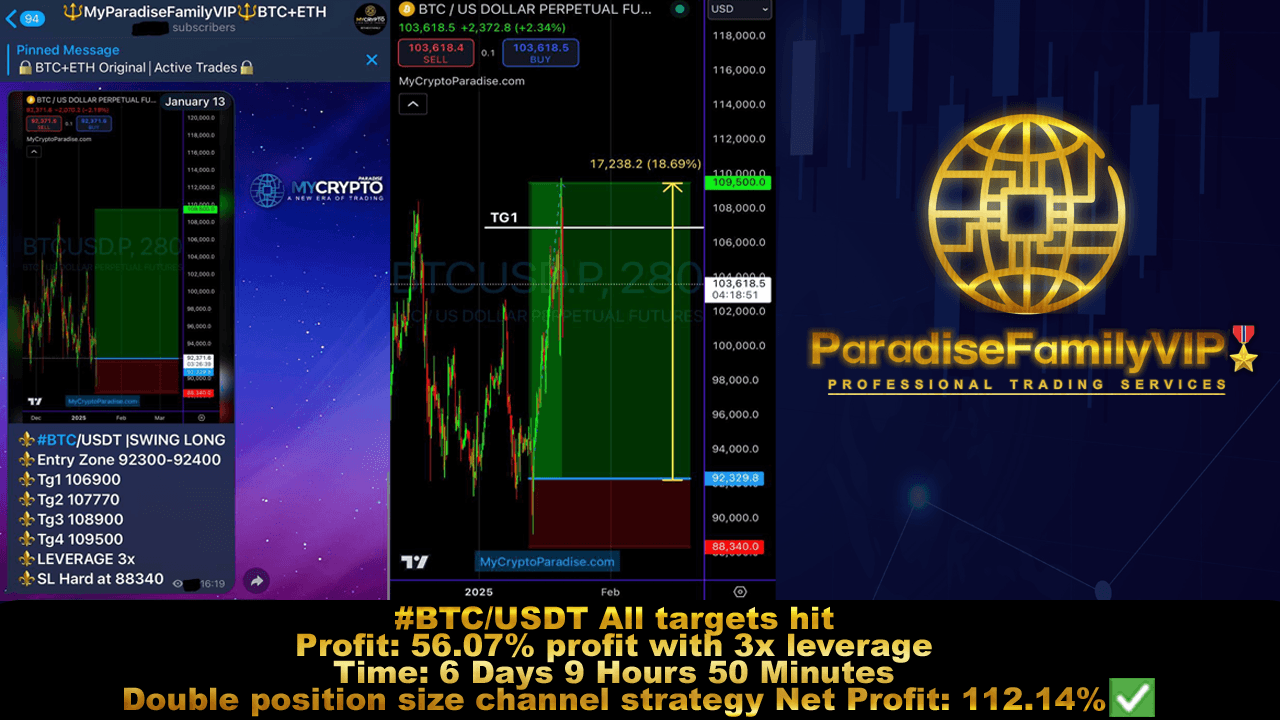

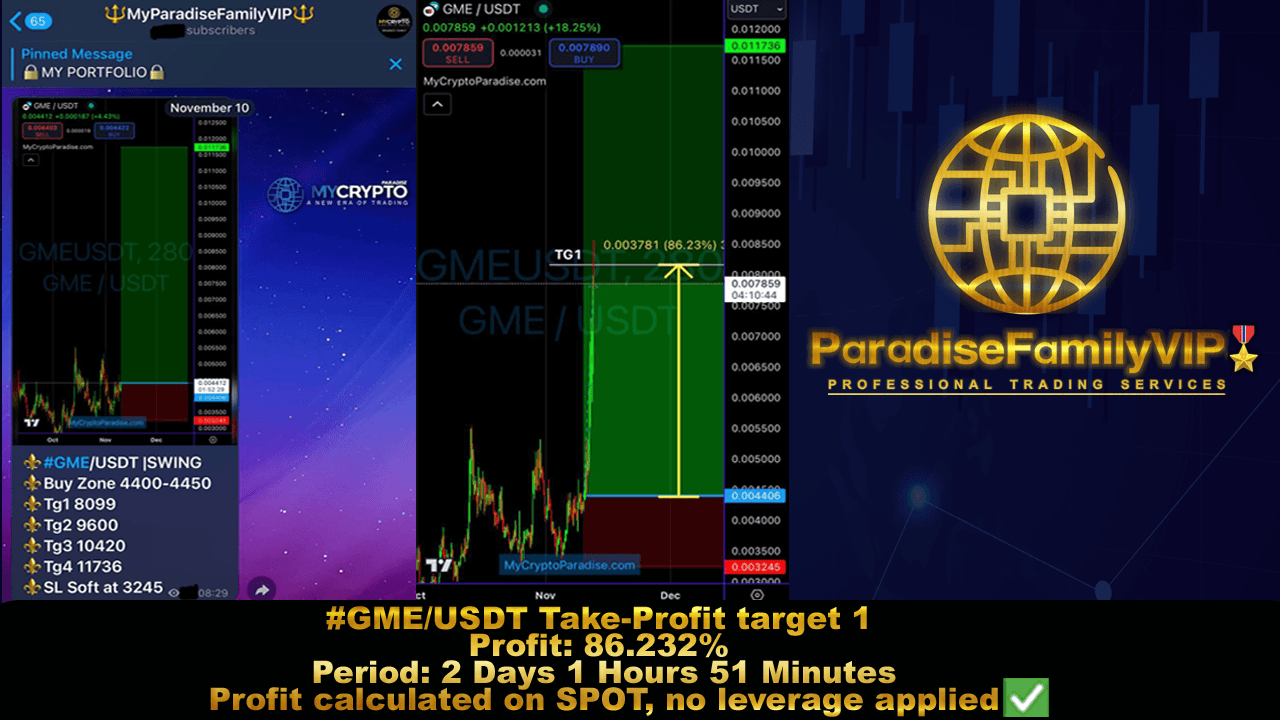

6. Show Me the Chart, or I Don’t Believe It

Every good trade must be documented visually. No screenshots, no proof. It’s that simple. Charts, entries, stop-losses, take-profits-every detail. Without them, it’s just hot air, and you might as well be betting on a coin toss.

7. Twice the Reward at Least-The Golden Rule of Risk

Most pros shoot for a 2:1 reward-to-risk ratio. That means their take-profit is at least twice the distance from their entry as their stop-loss. If it’s less-say 1:1 or worse-they’re playing with fire. A single big loss can erase a bunch of winning trades, and none of us want that kind of cake.

- Small wins? Early and often. Big wins? Let ’em run. That’s how the wise keep building wealth.

8. Explain Your System, or It’s Just Fool’s Gold

A true professional doesn’t hide their method-they explain it, lay it out like a map. If they can’t walk you through their logic, they’re just guessing. That’s not trading, that’s gambling. A system is a system, and without one, your chance of long-term success is slim as a willow in a flood.

9. Keep Your Emotions in the Stable

Good traders are like calm cowboys-they don’t get hot under the collar or overly excited. When they win, they tip their hat; when they lose, they tip it lower and stick to their plan. No celebrating like a fool or panicking like a chicken. Discipline, my friend, that’s the secret.

10. Know How Much to Bet

Your position size must match your confidence and your risk appetite. No wild guessing-be methodical. A well-structured system enforces consistent sizing, avoiding the temptation to bet the farm just because you got lucky once. Otherwise, you’re courting disaster.

11. One Price to Enter, and That’s All

Vague entry zones are a red flag. The pros give you one solid number or a tight zone. No wide lurches where you might get played. Trust their precision, or risk being outplayed by the wolves disguised as shepherds.

12. Play the Big Wins, Not the Small Noise

If your trader is throwing darts at every little market move, they’re just noisy. Real pros wait for big, high-probability setups. They’re patient, not chasing shiny objects or trying to scalp every tick. That’s how you catch the really big fish, not pennies in a jar.

13. Keep Your Risks Tight and Clear

If they don’t explain how they control their risk-how much they risk per trade, how they measure R/R-run like hell. Without good risk management, their system’s as shaky as a barn in a hurricane.

14. Reward at Least Double or More

Any less than 2:1 on the reward-to-risk quotient is a gamble. Smart traders aim to make at least twice what they risk. That way, a few bad trades won’t wipe out the good ones. That’s why wise traders keep their stop-losses close and let their winners breathe.

15. Patience-the Virtue of the Trader

Good traders sit still until all the signs point in their favor. Rushing into trades just because you’re bored is like jumping into quicksand. The best signals come when patience and preparation meet, not when your finger presses the buy button in a panic.

16. Risk Control-Or It’s All Smoke and Mirrors

If they don’t explain how they size or diversify their trades, they’re just throwing darts. True professionals plan, balance, and don’t overreach. Without that, your bankroll might turn into old shoes-worn out and worthless.

17. Keep Track and Grow

Smart traders keep a ledger-tracking every trade’s ROI, whether it’s spot or leverage, to see their true progress. They understand streaks, gains, and losses-not just the big wins they can brag about.

They also sometimes lock profits early on a streak-like a wise farmer harvesting before a rain-so they don’t give it all back. No fantasy of infinite wealth here.

18. They Don’t Keep Secrets-They Teach

Real pros don’t hoard their knowledge; they share it-talking through their trades, answering questions, and helping others learn the ropes. They want everyone in their circle to grow stronger, not be kept in the dark like a secret society.

19. Change With the Wind (or the Market)

If your trader isn’t adjusting their sails to the wind-meaning they change tactics as the market shifts-they’re just a fool with a stick. Markets change, strategies have to change too, or you’ll be left standing out in the rain.

20. Same Size, Every Time-Consistency Is King

Unless their plan involves scaling, good traders stick to a set position size, no matter how tempting it is to go bigger when the market sings a siren song. Consistency keeps your risk predictable and your head clear.

21. A Little of Everything-Diversify or Perish

A professional’s portfolio isn’t all one trick pony. They mix and match scalping, swing, spot, futures-as nature intended-adapted for the season. That way, they’re not ruined when one style falls flat in a different cycle.

22. Show Me the Whole Log-No Secrets Here

If they only flaunt their wins and hide their losses, they’re up to no good. True professionals log everything for all to see-entry, exit, and even the big boo-boos to stay honest. Transparency is their badge of honor.

23. Every Trade Has a Carrot and a Stick

No broken bits and no vague promises-each trade should have a clear plan: entry, exit, stops, and profit targets. A plan that’s all over the place? That’s just gambling, plain and simple.

24. Don’t Rush, Wait for It

Expert signals come early, clear, and with enough time for a busy trader to get in. Signals that pop up in the middle of the chaos? That’s just chasing shadows and risking being left holding the bag.

Deep Secrets of the Master Traders

Beyond good signals, real professionals analyze multiple timeframes-monthly down to 15 minutes-so they see the full picture. They use a system with set rules, grounds for confirmation, and know how to counteract manipulations by whales, influencers, and market shysters.

They keep their ear to the ground about what the big money’s doing-watching for footprints and signals that reveal the whales’ plans-and then carefully tiptoe around those traps.

Final Thoughts for the Wise

Look behind the curtain: know who’s really running the show, whether by real name and face or by teaching free and openly. Beware of the loudmouths hiding behind paywalls or shady groups that delete their bad trades.

And always-always-demand visual proof. No charts? No trust. Keep your eyes wide, your mind sharp, and your wallet even sharper.

Thanks again to the crack team of seasoned traders at MyCryptoParadise for puttin’ this together. They’ve shown us what real, consistent trading looks like, and how to keep your hard-earned cash safe in this wild market.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

2025-08-20 14:38