Bitcoin (BTC) traders are watching this year’s Jackson Hole Economic Symposium with an intensity that’s borderline obsessive. 🤯

Like, I get it, it’s important. But do we really need to treat every Fed meeting like it’s the Super Bowl of finance? 🏈

Jackson Hole to Influence Bitcoin and Liquidity Markets… Or Not?

The Jackson Hole symposium has a history of making waves in global markets. But let’s be real, this year it’s like everyone’s waiting for the Fed to either give us the golden ticket to Bitcoin heaven or drop the nuclear bomb on our portfolios. 🚀💥

Remember when Ben Bernanke used it in 2010 to hint at quantitative easing (QE)? Great for the markets, but can you imagine the chaos if he did that today? And then there was Jerome Powell’s 2022 speech, which was about as fun as a root canal. 🦷

Analysts say these past events mean we should be glued to our screens. But honestly, it feels like we’re just setting ourselves up for disappointment. 😒

“Jackson Hole has been the venue for critical statements that have shifted the direction of markets. The signals given by the Fed at the end of August shape liquidity flows and risk appetite. The fact that BTC is a ‘liquidity barometer’ makes Jackson Hole quite critical for it,” CryptoQuant’s Kerem explained. But seriously, can’t we just enjoy the summer without worrying about the Fed? 🌞

In a follow-up analysis, Kerem added that Powell’s speech on August 22 will be pivotal in determining how close the Fed is to a September rate cut. Like, who doesn’t love a good suspense story, right? 📚

Combine this with the release of core PCE data later in the month, and you’ve got yourself a perfect storm of market anxiety. 🌪️

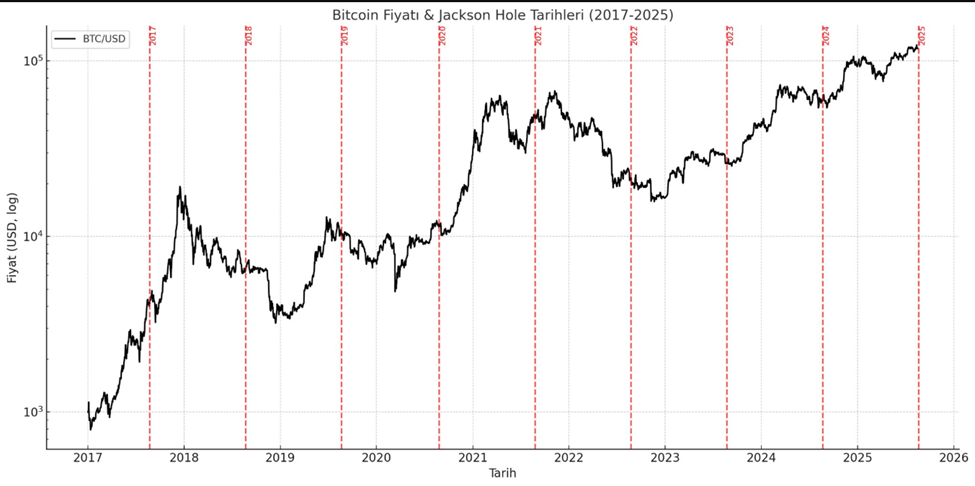

Historical patterns around Jackson Hole add to the drama. Oraclum Capital noted that almost every Jackson Hole meeting in the past seven years has been followed by a correction, except for 2023, when Powell declared victory over inflation and hinted at rate cuts, which actually lifted the markets. 🎉

“Reiterating July FOMC and a somewhat hawkish message is NOT priced in the market. It could be a catalyst for a regular Aug-Sep selloff. However, if Powell turns dovish, it could be a major boost to equities; another ATH is certain in such a case,” they wrote. But let’s be honest, predicting the market is like trying to guess what’s in a mystery box. 🎁

The Case for a Bullish Outcome… Maybe?

Not everyone is bracing for impact. Some analysts think this year’s Jackson Hole could actually be a boon for Bitcoin. 🍀

Capital Flows pointed out that the three-month Nonfarm Payrolls (NFP) trend is still positive, indicating steady job creation. Meanwhile, inflation indicators like PCE, CPI, and PPI have all surprised to the upside, and inflation swaps are sitting above 3%. 📈

Credit spreads have also narrowed to their lowest point of the cycle, suggesting that markets aren’t exactly bracing for a crisis. 🏦

“Growth and inflation are accelerating… the Fed has allowed 50 basis points of rate cuts to remain priced into forward markets,” wrote Capital Flows. So, maybe the Fed is just being a bit too cautious? 🤔

Capital Flows argues that this represents a policy error that could create a positive liquidity impulse, pushing asset prices higher. Which means, if the Fed doesn’t go full hawk mode, Bitcoin and equities might just keep soaring. 🚀

The Fed chair will have to walk a tightrope between reassuring markets and maintaining credibility on inflation. Too dovish, and long-end rates might rise as investors question whether the Fed is being too easy. Too hawkish, and we could see a rapid repricing of risk, leading to volatility across the board. 🤹♂️

The outcome could really come down to Powell’s tone. A repeat of the July FOMC’s hawkishness might trigger the “regular Aug-Sep selloff,” but a dovish surprise could send risk assets skyrocketing. 🌠

So, in the end, Bitcoin’s near-term direction might depend less on its own merits and more on what Powell says in Wyoming on Friday. Here’s hoping he brings the good news! 🙏

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-19 10:42