In the grand theater of finance, where fortunes are made and lost with the flick of a wrist, Bitcoin finds itself in a most precarious position, trading at the lofty height of $115,000. This figure, however, is but a shadow of its recent glory, having plummeted from an all-time high of nearly $124,000. The market, much like a tempestuous sea, has returned to its familiar volatility, igniting fervent discussions among analysts and investors alike. Are we on the brink of a deeper abyss, or is the phoenix of Bitcoin poised to rise once more? The current price action, a veritable dance of indecision, reveals a fierce struggle between buyers and sellers, each vying for dominance at these pivotal junctures.

Some analysts, with the gravitas of seasoned prophets, caution that Bitcoin may soon face a deluge of selling pressure should it fail to regain its lost momentum. Others, however, posit that this retracement is merely a healthy pause, a moment of reflection before the next audacious ascent. What is indisputable, dear reader, is that investors are bracing themselves for a tempest of market fluctuations in the weeks to come.

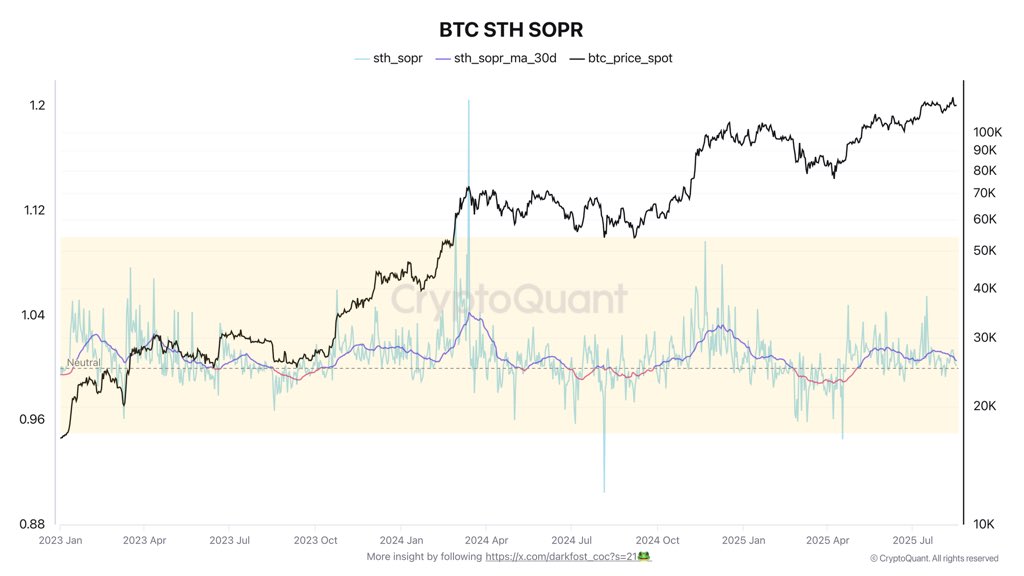

Upon examining the sacred texts of on-chain data, it becomes evident that our short-term holders (STHs) are under considerable duress. Since the waning days of November and December in the year 2024, the average profit realized by this beleaguered group has scarcely exceeded 5%. Their Spent Output Profit Ratio (SOPR), a measure of their fleeting triumphs, languishes below 1.05, indicating that many of the recent entrants into this digital gold rush have found themselves ensnared in a web of stagnation, unable to secure meaningful gains. Historically, such stagnation has heralded significant directional shifts, suggesting that Bitcoin may soon embark upon its next decisive chapter.

The Plight of Short-Term Holders

Our esteemed analyst, Darkfost, has offered a fresh perspective on the current market landscape, illuminating the plight of short-term holders through the lens of the Spent Output Profit Ratio (SOPR). This metric, akin to a barometer of investor sentiment, measures the average profit or loss realized when a UTxO is spent, serving as a reliable gauge of profitability and selling behavior.

At this juncture, the STH SOPR remains ensnared at the neutral ratio of 1. This indicates that, on average, recent market entrants are merely breaking even on their transactions, rather than basking in the glow of profit or wallowing in the depths of loss. Darkfost suggests that many of these STHs entered the fray during Bitcoin’s meteoric rise above $100,000 in the past six months, and now find themselves in a state of limbo, awaiting the elusive price appreciation that would grant them meaningful returns.

Darkfost further elucidates that in the ebbs and flows of bull markets, these dynamics often follow a predictable script. When STHs are shaken from their positions, their SOPR typically dips below 1, reflecting a sell-off at a loss. Historically, such phases have created ripe opportunities for dollar-cost averaging (DCA), as the capitulation of weaker hands clears the path for stronger upward trends.

Bitcoin Price Analysis: The Crucial Levels

As we gaze upon the current trading landscape, Bitcoin hovers near $115,133, having sharply retreated from its recent zenith of $124,000. The charts reveal that BTC has broken free from its mid-summer slumber, yet momentum has waned, with the price now testing the critical support of the 50-day moving average ($115,712). This level, dear reader, is of utmost importance; a sustained breakdown could usher in a descent toward the 100-day moving average, lurking ominously at $110,833.

Despite the recent decline, the broader structure remains, in a word, constructive. Bitcoin has spent a considerable portion of the past six months above the psychological barrier of $100,000, establishing a robust long-term support. The rejection near $123,217, marked by the yellow resistance line, suggests that the bulls will require a greater conviction to propel BTC into new heights. A clean breakout above that threshold could swiftly catapult the price toward the $130,000-$135,000 region.

On the flip side, the 200-day moving average ($100,339) stands as the ultimate bastion of defense. As long as BTC remains above this sacred line, the broader bull trend shall endure, much like the enduring spirit of humanity in the face of adversity.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

2025-08-18 18:12