Ah, Ethereum! The noble warrior of the digital realm, poised to embark on yet another week of tumultuous adventures. Just last week, it danced upon the heights of glory, reaching price levels unseen since the fabled year of 2021. But lo! A dark cloud looms on the horizon, as the once-mighty Spot Ethereum ETFs, which had summoned forth billions in inflows, have now recorded their first daily outflow in over a week. Talk about a plot twist! 🎭

ETF Inflows Break: Is the Party Over? 🍾

As the week drew to a close, the jubilant cheers surrounding Ethereum’s rally began to fade, much like the last slice of pizza at a party. The US-based Spot ETH ETFs reported a net outflow of $59.34 million on August 15, effectively putting an end to an eight-day streak that had seen a whopping $3.7 billion in inflows. Ouch! 😱

And just when Ethereum thought it could break free from the shackles of $4,788-oh, the sweet taste of victory!-it slipped back down to around $4,450. BlackRock’s ETHA may have stood tall with $338.09 million in daily inflows, but Grayscale’s ETHE and Fidelity’s FETH were not so fortunate, suffering withdrawals of $101.74 million and $272.23 million, respectively. It’s like watching a game of musical chairs, and guess who’s left standing? Not the ETFs! 🎶

Total Ethereum Spot ETF Net Inflow: SoSoValue

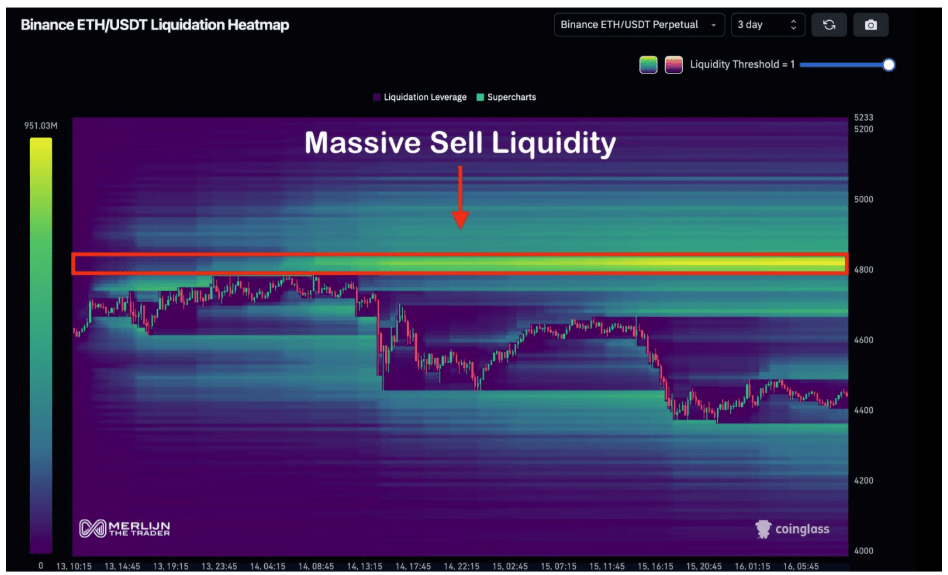

Now, let us speak of the fabled $4,800, a level that has been dubbed Ethereum’s “final boss.” Merlijn The Trader, a sage of the charts, has pointed out that a mountain of sell orders looms at this level on Binance’s ETH/USDT pair. A liquidity heatmap reveals a veritable fortress of asks, and should Ethereum manage to breach this stronghold, it could unleash a torrent of bullish energy, propelling it to heights unknown! But beware, dear traders, for as long as this level remains fortified, it may act as a formidable barrier to any upward ascent. 🏰

Image From X: Merlijn The Trader

Bearish Retracement Scenario: The Dark Side Awaits 🌑

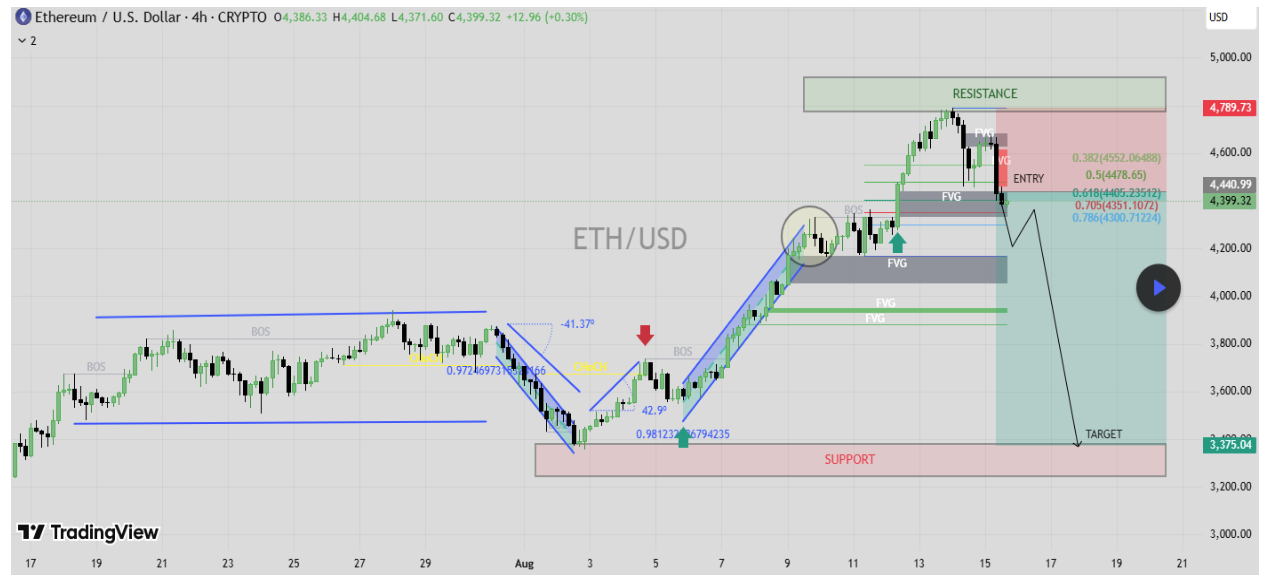

While the winds of liquidity seem to favor a bullish breakout, another oracle from TradingView offers a more cautious tale. Their analysis, drawn from the mystical 4-hour candlestick chart, identifies the $4,700 to $4,800 region as a treacherous zone of supply, where Ethereum has already shown signs of fatigue after its aggressive rally from early August. Exhaustion, it seems, is a cruel mistress! 😴

However, the stars align with multiple technical signals-Break of Structure, fair value gaps (FVG), and Fibonacci retracements-hinting that Ethereum may be due for a retracement. The trade plan suggests an entry around $4,440, with a stop loss above $4,790 and a downside target of $3,375 at a strong support area. If this bearish prophecy unfolds, we could witness a corrective move of over 20%. Buckle up, folks! 🎢

Chart Image From TradingView

As the ink dries on this tale, Ethereum finds itself trading at $4,465. Will it rise to glory or tumble into the abyss? Only time will tell! ⏳

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-18 03:09